Tax Dilemma (MALAYSIA)

The income of any person, including a company, accruing in or derived from Malaysia or received in Malaysia from outside Malaysia is subject to income tax or in other words all individuals are liable to tax on income accrued in, derived from or remitted to Malaysia. April 30th is the deadline for the submission of income tax returns for the individual taxpayer without a business income in Malaysia, while June 30th is for those with business income in Malaysia.

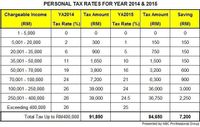

While reading the newspaper on tax issue reminded Lokman Hakim that he has not filled in his income tax form as yet. Tax computation has been a burden on Lokman’s shoulder and Siti Sarah has been talking and reminding Lokman to fill in his BE form before the deadline expires at the end of April. Lokman Hakim, age 32 years is currently working as a government officer in Sabah and brings home an income of RM4500 monthly. He is married to Siti Sarah, age 28 years, who is currently working as a lecturer in one of the public universities in that state. Lokman Hakim and Siti Sarah have been married for 5 years and they have two children, Siti Khadijah and Muhammad Yusof, age 3 and 4 years old respectively. Lokman’ mother is currently living with them. His mother is sick and being the only son, he has the responsibility to look after his mother. His mother makes frequent visits to the hospital due her illness and unfortunately Lokman has to pay for all her medical expenses since she does not buy any medical insurance to cover for her illness. Lokman spent around RM500 a month for her medical expenses.

Understanding the importance of having an insurance policy, Lokman had subscribed to two insurance policies, namely life insurance and medical card for critical illness. He pays RM205.42 monthly for his life insurance and RM189.32 for his medical card. Lokman also contributes monthly to Skim Simpanan Pendidikan Nasional for an amount of RM200 monthly equally divided for his two children and did not make any withdrawal. He also contributed to Employee Provident Funds (EPF) for an amount of RM281.60 monthly. In addition, last June, Lokman has applied for ASB loan and it was approved for an amount of RM100, 000 and the dividend payout of the ASB loan was 6% last year. He also pays zakat and fitrah for a monthly amount of RM40. The couple loves to read in their spare times and wanting to cultivate and encourage the reading habit in their two children. During the weekend, Lokman will bring his family to the nearby bookstore to search for new reading materials. They spend an average of RM850 per annum on reading materials each year.

Lokman is currently pursuing his study on a Master Degree on a part-time basis at the local university. Being a part-time student requires him to juggle between work and assignment at the same time. Due to time and work constraint, Lokman normally has to study and do his assignment at home. Based on that limitation, he purchased a personal laptop at the price of RM2259 last year. The couple has also agreed to assess their taxes separately.

QUESTION

1. What are Lokman's major financial concerns in his current situation?

Step by stepSolved in 4 steps with 1 images

- a) Explain, in three sentences or less, ‘cross-credit’ in relation to the foreign tax credit. Make sure to identify the problem, and how cross-crediting solves the problem. b) Treadwell, Inc. had $2,500,000 taxable income, $250,000 of which was generated by business activities in foreign jurisdictions. If Treadwell paid $55,500 foreign tax to Utopia. Compute the following: US tax paid______________________ Worldwide tax paid_______________arrow_forwardCalculation of Foreign Tax Credit (here is the answer for A&F. You need to complete Basket B&D and Basket Earrow_forwardYour Group has formed a tax advisory firm. One of your clients in considering investing in the country assigned to your Group. The company has requested general tax advice in respect of the VAT regime in the assigned country. Your Group is required to provide this advice. Additionally, the company has requested high -level tax advice on the other taxes in that country that they may need to consider. Each group will be assigned to conduct research one of the Caribbean Country below: 1.Bahamasarrow_forward

- 4. A, non-resident citizen, has the following income within and without the Philippines for 2018: Abroad Within the Phil 70,000 Interest income from depository bank under expanded foreign currency deposit system in Philippines Dividend income Royalty income-others Business income-net of expenses Interest income-bank deposits 90,000 50,000 200,000 30,000 60,000 40,000 300,000 40,000 What is the total final income tax due of A?arrow_forwardFederal income taxes have a significant effect on businesses and investors, and affect the personal decisions of every taxpayer in the United States. If we consider that the tax rates of corporations and individuals can reach up to 37% of contributions, certainly, all transactions have their tax impact. Argument about Internal Revenue Services of USA. Do you think the tax filing requirements that the IRS demands of taxpayers is fair? Why?arrow_forwardWhat are the most common violations of the taxpayers in the Philippines that cause tax penalties? Enumerate at least 3 and how can you avoid such violations.arrow_forward

- Determine the taxable income for the year. (PHILIPPINES)arrow_forwardWhen is the taxation year in Canada? What is the determining factor of establishing what income is subject to taxation in Canada? Why is Elections Canada question on Tl? Why is the Foreign Tax question on the Tl?arrow_forwardUS Tax law contains a two-pronged system for taxing the US source income of foreign persons. Briefly explain this system.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education