FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

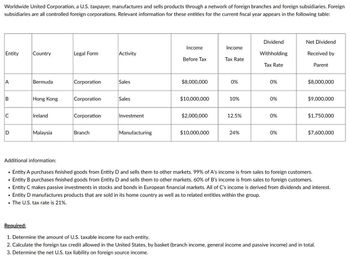

Transcribed Image Text:Worldwide United Corporation, a U.S. taxpayer, manufactures and sells products through a network of foreign branches and foreign subsidiaries. Foreign

subsidiaries are all controlled foreign corporations. Relevant information for these entities for the current fiscal year appears in the following table:

Entity

A

B

C

D

.

●

●

Country

.

Bermuda

|Hong Kong

Ireland

Malaysia

Legal Form

Corporation

Corporation

Corporation

Branch

Activity

Sales

Sales

Investment

Manufacturing

Income

Before Tax

$8,000,000

$10,000,000

$2,000,000

$10,000,000

Income

Tax Rate

0%

10%

12.5%

24%

Dividend

Withholding

Tax Rate

0%

0%

0%

0%

Net Dividend

Received by

Parent

$8,000,000

Additional information:

Entity A purchases finished goods from Entity D and sells them to other markets. 99% of A's income is from sales to foreign customers.

Entity B purchases finished goods from Entity D and sells them to other markets. 60% of B's income is from sales to foreign customers.

Entity C makes passive investments in stocks and bonds in European financial markets. All of C's income is derived from dividends and interest.

Entity D manufactures products that are sold in its home country as well as to related entities within the group.

• The U.S. tax rate is 21%.

$9,000,000

$1,750,000

$7,600,000

Required:

1. Determine the amount of U.S. taxable income for each entity.

2. Calculate the foreign tax credit allowed in the United States, by basket (branch income, general income and passive income) and in total.

3. Determine the net U.S. tax liability on foreign source income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- US Tax law contains a two-pronged system for taxing the US source income of foreign persons. Briefly explain this system.arrow_forwardHow can a country’s tax system affect the manner in which an operation in that country is financed by a foreign investor?arrow_forwardIt is talking about Hong Kong Tax, Special Business, Profit Tax Comuptaion of Financila instituition, please explain the DIPN 21 "Initiation" and "funding".arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education