FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

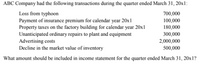

Transcribed Image Text:ABC Company had the following transactions during the quarter ended March 31, 20x1:

Loss from typhoon

Payment of insurance premium for calendar year 20x1

Property taxes on the factory building for calendar year 20x1

Unanticipated ordinary repairs to plant and equipment

Advertising costs

Decline in the market value of inventory

700,000

100,000

180,000

300,000

2,000,000

500,000

What amount should be included in income statement for the quarter ended March 31, 20x1?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For 20Y2, Macklin Inc. reported a significant decrease in net income. At the end of the year, John Mayer, the president, is presented with the following condensed comparative income statement: Macklin Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Υ2 20Y1 Sales $483,672 $408,000 Cost of goods sold (358,800) (260,000) Gross profit $124,872 $148,000 Selling expenses $(50,150) $(34,000) Administrative expenses (29,520) (22,000) Total operating expenses $(79,670) $(56,000) Operating income $45,202 $92,000 Other revenue 2,166 1,700 Income before income tax expense $47,368 $93,700 Income tax expense (13,300) (28,100) Net income $34,068 $65,600 Required:arrow_forwardIn its income statement for the year ended December 31, 2022, Pharoah Company reported the following condensed data. Operating expenses Cost of goods sold Interest expense (a) (b) Prepare a single-step income statement. Revenues $776,000 1,236,000 72,000 Net Sales Interest revenue Loss on disposal of plant assets Net sales Pharoah Company Income Statement For the Year Ended December 31, 2022 69 $ 29,000 17,000 2,218,000 KNUTarrow_forwardRevenue and expense data for Innovation Quarter Inc. for two recent years are as follows: Current Year Previous YearSales $4,000,000 $3,600,000Cost of goods sold 2,280,000 1,872,000Selling expenses 600,000 648,000Administrative expenses 520,000 360,000Income tax expense 240,000 216,000a. Prepare an income statement in comparative form, stating each item for both years as a percent of sales. Round to the nearest whole percentage.b. Comment on the significant changes disclosed by the comparative income statement.arrow_forward

- The company recorded a net loss of P175,000 for the year just ended. Total operating expenses was P3,792,000, cost of sales was P1,822,300 and sales discount was P89,890. How much is the gross sales that the company generated during the year?arrow_forwardBlossom Manufacturing Ltd.'s sales for the year ended December 31, 2022 are $1.00 million. The expenses for 2022 are as follows: Cost of goods sold Selling expenses Administrative expenses Variable $320,000 56,000 27,920 Fixed $180,000 26,400 36,000 Prepare a detailed CVP income statement for the year ended December 31, 2022. Blossom Manufacturing Ltd. CVP Income Statement $ $arrow_forwardProvide Answer please providearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education