FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

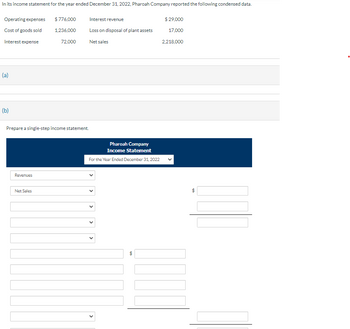

Transcribed Image Text:In its income statement for the year ended December 31, 2022, Pharoah Company reported the following condensed data.

Operating expenses

Cost of goods sold

Interest expense

(a)

(b)

Prepare a single-step income statement.

Revenues

$776,000

1,236,000

72,000

Net Sales

Interest revenue

Loss on disposal of plant assets

Net sales

Pharoah Company

Income Statement

For the Year Ended December 31, 2022

69

$ 29,000

17,000

2,218,000

KNUT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume Martinez Company has the following reported amounts: Sales revenue $ 610,000, Sales returns and allowances $ 30,000, Cost of goods sold $ 396,500, and Operating expenses $ 84,000. (a) Compute net sales. Net sales (b) Compute gross profit. Gross profit (c) Compute income from operations. Income from operations (d) Compute the gross profit rate. (Round answer to 1 decimal place, e.g. 25.2%.) Gross profit rate %24arrow_forwardThe income statement of Tavis Corporation and selected additional data are presented below: Tavis Corporation Income Statement for the Year Ended December 31, 2020 Net sales $220,000 Cost of goods sold __109,000 Gross profit 111,000 Selling and general expenses _98,000 Income from operations 13,000 Interest expense __2,500 Income before income tax 10,500 Income tax expense __3,000 Net income $ 7,500 Additional data: Total assets $214,000 Common stockholders’ equity $116,000 Preferred dividends…arrow_forwardMac Donald company reported the following on its comparative income statement: 2017 2018 2019 Revenue 9,000 10,000 14,000 Cost of goods sold 6,000 4,000 9,000 Prepare a horizontal analysis of revenue , cost of goods sold and gross profitarrow_forward

- In its income statement for the year ended December 31, 2022, Crane Company reported the following condensed data. Salaries and wages expenses $381,300 Loss on disposal of plant assets $ 68,470 Cost of goods sold 809,340 Sales revenue 1,812,200 Interest expense 58,220 Income tax expense 20,500 Interest revenue 53,300 Sales discounts 131,200 Depreciation expense 254,200 Utilities expense 90,200 Prepare a multiple-step income statement. (List other revenues before other expenses.)arrow_forwardIn its income statement for the year ended December 31, 2022, Blue Company reported the following condensed data. Operating expenses $760,210 Interest revenue $31,740 Cost of goods sold Interest expense 1,301,200 Loss on disposal of plant assets 15,430 72,400 Net sales 2,413,300 (a) Prepare a multiple-step income statement. (List other revenues before other expenses. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) BLUE COMPANY Income Statement For the Year Ended December 31, 2022arrow_forwardRetail Corporation reported the following Income Statement for the past two years: Retail Corporation Comparative Income Statement For the Years Ended December 31, 2021 and 2020 2021 2020 Amount Amount Sales $ 30,100,100 $ 26,210,200 Cost of goods sold 22,425,500 18,950,800 Gross profit 7,674,600 7,259,400 Selling expenses 1,525,500 1,480,600 Administrative expenses 1,425,300 1,325,000 Total operating expenses 2,950,800 2,805,600 Income from operations 4,723,800 4,453,800 Interest Expense 190,500 210,600 Other income 62,500 55,500 Income before income tax 4,595,800 4,298,700 Income tax expense 1,608,500 1,312,400 Net income $ 2,987,300 $ 2,986,300 a. What was Retail…arrow_forward

- Here are comparative financial statement data for Bramble Company and Debra Company, two competitors. All data are as of December 31, 2022, and December 31, 2021. Bramble Company Debra Company 2022 2021 2022 2021 Net sales $1,896,000 $561,000 Cost of goods sold 1,020,048 297,330 Operating expenses 257,856 79,662 Interest expense 7,584 3,927 Income tax expense 54,984 6,171 Current assets 322,500 $310,000 83,500 $78,000 Plant assets (net) 520,800 500,300 139,800 123,000 Current liabilities 64,200 75,600 34,400 29,600 Long-term liabilities 108,400 90,400 28,400 26,000 Common stock, $10 par 498,000 498,000 122,500 122,500 Retained earnings 172,700 146,300 38,000 22,900 Compute the 2022 return on assets and the return on common stockholders’ equity ratios for both companies. (Round answers to 1 decimal…arrow_forwardHere are comparative financial statement data for Bramble Company and Debra Company, two competitors. All data are as of December 31, 2022, and December 31, 2021. Net sales Cost of goods sold Operating expenses Interest expense Income tax expense Current assets Plant assets (net) Current liabilities Bramble Company 2022 $1,896,000 1.020,048 257,856 Return on assets 7,584 54,984 322,500 520,800 O 64,200 Plant assets (net) Current liabilities Long-term liabilities Common stock, $10 par Retained earnings 2021 Return on common stockholders' equity 520,800 64,200 Debra Company $561,000 297,330 79,662 3,927 6,171 $310,000 83,500 $78,000 500,300 139,800 123,000 75,600 29,600 108,400 498,000 172,700 2022 34,400 500,300 2021 498,000 146,300 Bramble Company 75,600 90,400 67.2 % % 139,800 34,400 28,400 122,500 Compute the 2022 return on assets and the return on common stockholders' equity ratios for both companies. (Round answers to 1 decimal place, eg. 12.1%) 38,000 123,000 Debra Company 29,600…arrow_forward[The following information applies to the questions displayed below.] Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31 Sales. Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income Assets Current assets Long-term investments. Plant assets, net Total assets Liabilities and Equity Current liabilities KORBIN COMPANY Comparative Balance Sheets 2020 2021 $548,688 $ 420,340 330,310 263,974 218,378 156,366 77,914 58,007 49,382 36,990 127,296 94,997 91,082 61,369 16,941 12,581 $ 74,141 $ 48,788 Common stock Other paid-in capital Retained earnings Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income December 31 2021 $ 62,574 % 0 % $ 41,881 $ 55,985 1,200 3,920 114,438 103,962 61,920 $177,012 $ 147,043 $ 121,825 $ 25,844 65,000 8,125…arrow_forward

- In its income statement for the year ended December 31, 2022, Splish Brothers Inc. reported the following condensed data. Prepare a multiple step income statement , and then calculate the profit margin and gross profit rate. Salaries and wages expenses $576,600 Loss on disposal of plant assets $103,540 Cost of goods sold 1,223,880 Sales revenue 2,740,400 Interest expense 89,460 Income tax expense 31,000 Interest revenue 80,600 Sales discounts 198,400 Depreciation expense 384,400 Utilities expense 136,400arrow_forwardNASH'S LTD. Statement of Income For the year ended June 30, 2024 Sales revenue Cost of goods sold Gross profit Expenses Wages expense Depreciation expense Rent expense Income tax expense Operation income Gain on sale of equipment Net income Additional information: 1. $63,000 18,500 16,000 15,500 $400,000 210,000 190,000 113,000 77,000 5,000 $82,000 The following information is for Nash Ltd. for the year ended June 30, 2024. Assets Current assets: Cash NASH'S LTD. Statement of Financial Position As at June 30 Accounts receivable Inventory Total current assets Equipment Accumulated depreciation, equipment Land Liabilities and shareholders' equity Current liabilities Accounts payable Dividends payable Total current liabilities Bank loan payable Common shares Retained earnings 2024 $63,000 94,800 82,500 240,300 153,000 (33,500) 163,000 $522,800 $45,000 15,000 60,000 114,500 163,000 185,300 2023 $43,000 63,000 98,500 204,500 113,000 (29,000) 200,000 $488,500 $70,000 5,000 75,000 163,000…arrow_forwardView Policies Current Attempt in Progress Assume Sunland Company has the following reported amounts: Sales revenue $1,000,000, Sales returns and allowances $29,000, Cost of goods sold $649.599, and Operating expenses $215,600. (a) Compute net sales. Net sales $ (b) Compute gross profit. Gross profit S (c) Compute income from operations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education