FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

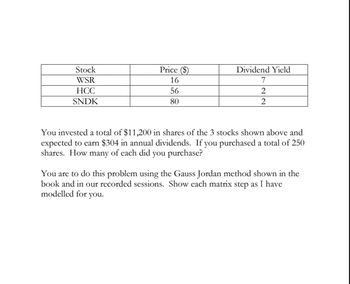

Transcribed Image Text:Stock

Price ($)

Dividend Yield

WSR

16

7

HCC

56

2

SNDK

80

2

You invested a total of $11,200 in shares of the 3 stocks shown above and

expected to earn $304 in annual dividends. If you purchased a total of 250

shares. How many of each did you purchase?

You are to do this problem using the Gauss Jordan method shown in the

book and in our recorded sessions. Show each matrix step as I have

modelled for you.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- pm.4arrow_forwardEXCEL PROJECT AND EXCEL SOLUTION Consider the following stocks, all of which will pay a liquidating dividend in a year and nothing in the interim: Stock A Stock B Stock с Stock D Market Capitalization (5 million) 800 750 950 900 Expected Liquidating Dividend ($ million) 1000 1000 1000 1000 Beta PLEASE SHOW SOLUTIONS IN EXCEL 0.77 1.46 1.25 1.07 a. Calculate the expected return of each stock. b. What is the sign of correlation between the expected return and market capitalization of the stocks? In Problem 20, assume the risk-free rate is 3% and the market risk premium is 7%. a. What does the CAPM predict the expected return for each stock should be? b. Clearly, the CAPM predictions are not equal to the actual expected returns, so the CAPM does not hold. You decide to investigate this further. To see what kind of mistakes the CAPM is making, you decide to regress the actual expected return onto the expected return predicted by the CAPM.49 What is the intercept and slope coefficient of…arrow_forwardDonald Gilmore has $100,000 invested in a 2-stock portfolio. $70,000 is invested in Stock X and the remainder is invested in Stock Y. X's beta is 1.50 and Y's beta is 0.70. What is the portfolio's beta? Select the correct answer. a. 1.31 b. 1.36 c. 1.41 d. 1.46 e. 1.26arrow_forward

- You are evaluating a company's stock. The stock just paid a dividend of $1.75. Dividends are expected to grow at a constant rate of 5 percent for a long time into the future. The required rate of return (Rs) on the stock is 12 percent. What is the fair present value? Multiple Choice O O E $26.25 $22.50 $35.26 $50.25 Q Search $ 4 R is do F % 5 164- T 8 N 10 DII K M O O ENG Darrow_forwardUsing the data in the table to the right, calculate the return for investing in the stock from January 1 to December 31. Prices are after the dividend has been paid. (Click on the following icon in order to copy its contents into a spreadsheet.) Return for the entire period is %. (Round to two decimal places.) Date Jan 1 Feb 5 May 14 Aug 13 Nov 12 Dec 31 Price $33.88 $30.67 $29.49 $32.38 $39.07 $41.99 Dividend $0.17 $0.17 $0.17 $0.17arrow_forwardSuppose a market consists of four stocks. The number of shares outstanding for each stock as well as the stock prices in two consecutive days are as follows: Stock A Stock B Stock C Stock D Shares outstanding 200 1000 400 3000 I $5 $30 $100 $40 Ро $15 $25 $80 $50 a) Compute the percentage increase in the price-weighted index for this market. b) Compute the percentage increase in the value-weighted index for this market. P₁arrow_forward

- Research 3 stocks of your choice and answer the following questions. 1. What is the name of the stock? 2. What is the stock symbol? 3. What is its current price per share? 4. What was the 52 week high price for the stock? 5. What was the 52 week low price for the stock? 6. Why did you pick these stocks?arrow_forwardI need both answersarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education