FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

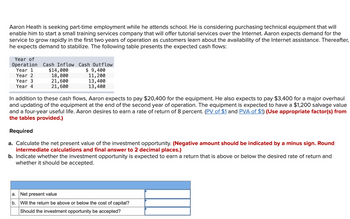

Transcribed Image Text:Aaron Heath is seeking part-time employment while he attends school. He is considering purchasing technical equipment that will

enable him to start a small training services company that will offer tutorial services over the Internet. Aaron expects demand for the

service to grow rapidly in the first two years of operation as customers learn about the availability of the Internet assistance. Thereafter,

he expects demand to stabilize. The following table presents the expected cash flows:

Year of

Operation

Year 1

Year 2

Year 3

Year 4

Cash Inflow Cash Outflow

$ 9,400

11, 200

$14,000

18,800

21,600

21,600

13,400

13,400

In addition to these cash flows, Aaron expects to pay $20,400 for the equipment. He also expects to pay $3,400 for a major overhaul

and updating of the equipment at the end of the second year of operation. The equipment is expected to have a $1,200 salvage value

and a four-year useful life. Aaron desires to earn a rate of return of 8 percent. (PV of $1 and PVA of $1) (Use appropriate factor(s) from

the tables provided.)

Required

a. Calculate the net present value of the investment opportunity. (Negative amount should be indicated by a minus sign. Round

intermediate calculations and final answer to 2 decimal places.)

b. Indicate whether the investment opportunity is expected to earn a return that is above or below the desired rate of return and

whether it should be accepted.

a.

Net present value

b. Will the return be above or below the cost of capital?

Should the investment opportunity be accepted?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hanshabenarrow_forwardThe dean of the School of Fine Arts is trying to decide whether to purchase a copy machine to place in the lobby of the building. The machine would add to student convenience, but the dean feels compelled to earn an 8 percent return on the investment of funds. Estimates of cash inflows from copy machines that have been placed in other university buildings indicate that the copy machine would probably produce incremental cash inflows of approximately $19,500 per year. The machine is expected to have a three-year useful life with a zero salvage value. (Use appropriate factor(s) from the tables provided.) Required a. Use Present Value Appendix PV of $1, to determine the maximum amount of cash the dean should be willing to pay for a copy machine. (Round your intermediate calculations and final answer to 2 decimal places.) b. Use Present Value Appendix PVA of $1, to determine the maximum amount of cash the dean should be willing to pay for a copy machine. (Round your final answer to 2…arrow_forwardThe financial manager at Starbuck Industries is considering an investment that requires an initial outlay of $25,000 and is expected to produce cash inflows of $3,000 at the end of year 1, $6,000 at the end of years 2 and 3, $10,000 at the end of year 4, $8,000 at the end of year 5, and $7,000 at the end of year 6. Draw and label a timeline depicting the cash flows associated with Starbuck Industries’ proposed investment. Use arrows to demonstrate, on the timeline in part a,how compounding to find future value can be used to measure all cash flows at the end of year 6. Use arrows to demonstrate, on the timeline in part b,how discounting to find present value can be used to measure all cash flows at time zero. Which of the approaches—future value or present value—do financial managers rely on most often for decision making?arrow_forward

- The dean of the School of Fine Arts is trying to decide whether to purchase a copy machine to place in the lobby of the building. The machine would add to student convenience, but the dean feels compelled to earn an 6 percent return on the investment of funds. Estimates of cash inflows from copy machines that have been placed in other university buildings indicate that the copy machine would probably produce incremental cash inflows of approximately $13,500 per year. The machine is expected to have a three-year useful life with a zero salvage value. Note: Use appropriate factor(s) from the tables provided. Required a. Use Present Value Appendix PV of $1, to determine the maximum amount of cash the dean should be willing to pay for a copy machine. Note: Round your intermediate calculations and final answer to 2 decimal places. b. Use Present Value Appendix PVA of $1, to determine the maximum amount of cash the dean should be willing to pay for a copy machine. Note: Round your final…arrow_forwardThe dean of the School of Fine Arts is trying to decide whether to purchase a copy machine to place in the lobby of the building. The machine would add to student convenience, but the dean feels compelled to earn an 8 percent return on the investment of funds. Estimates of cash inflows from copy machines that have been placed in other university buildings indicate that the copy machine would probably produce incremental cash inflows of approximately $25,000 per year. The machine is expected to have a three-year useful life with a zero salvage value. (Use appropriate factor(s) from the tables provided.) Required a. Use Present Value Appendix PV of $1, to determine the maximum amount of cash the dean should be willing to pay for a copy machine. (Round your intermediate calculations and final answer to 2 decimal places.) b. Use Present Value Appendix PVA of $1, to determine the maximum amount of cash the dean should be willing to pay for a copy machine. (Round your final answer to 2…arrow_forwardYour barkada is planning to set up a food stall in your village. You plan to sell items such as fish balls, squid balls, instant noodles, soft drinks, etc. Based on your research you will be needing an initial capital of P50,000. Your estimate of net cash flow for the next four years ( your investment horizon) are as follows: Year 1: P20,000 Year 2: P25,000 Year 3: P25,000 Year 4: P30,000 Compute the Net Present Value of the project. The OPPORTUNITY COST OF CAPITAL IS 9%. Will you pursue this business?arrow_forward

- The dean of the School of Fine Arts is trying to decide whether to purchase a copy machine to place in the lobby of the building. The machine would add to student convenience, but the dean feels compelled to earn an 10 percent return on the investment of funds. Estimates of cash inflows from copy machines that have been placed in other university buildings indicate that the copy machine would probably produce incremental cash inflows of approximately $19,000 per year. The machine is expected to have a three-year useful life with a zero salvage value. (Use appropriate factor(s) from the tables provided.) Required a. Use Present Value Appendix PV of $1, to determine the maximum amount of cash the dean should be willing to pay for a copy machine. (Round your intermediate calculations and final answer to 2 decimal places.) b. Use Present Value Appendix PVA of $1, to determine the maximum amount of cash the dean should be willing to pay for a copy machine. (Round your final answer to 2…arrow_forwardHarley worked for many years to save enough money to start his own residential landscape design business. The net cash flows shown are those he recorded for the first 6 years as his own boss. Find the external rate of return using the modified rate of return approach with a reinvestment rate of 15% per year and a borrowing rate of 8%. Additionally, after using the procedure, use the MIRR function to confirm your answer. Year 0 1 NCF, $ -9,000 4,100 2 -4,000 The external rate of return is 3 -7,000 % per year. The spreadsheet function is =RATE(6,-17986,,25972) 4 5 12,000 700 6 1,050arrow_forwardYou have recently been hired to improve the performance of Multiplex Corporation, which has been experiencing a severe cash shortage. As one part of your analysis, you want to determine the firm’s cash conversion cycle. Using the following information and a 365-day year,(a) what is your estimate of the firm’s current cash conversion cycle? Current inventory = $241,000.00 • Annual sales = $1,200,000.00 • Accounts receivable = $300,000.00 • Accounts payable = $245,000.00 • Total annual purchases = $600,000.00 • Purchases credit terms: net 30 days. • Receivables credit terms: net 50 days.arrow_forward

- Lana Powell is seeking part-time employment while she teaches school. She is considering purchasing technical equipment that will enable her to start a small training services company that will offer tutorial services over the internet. Lana expects demand for the service to grow rapidly in the first two years of operation as customers learn about the availability of the Internet assistance. Thereafter, she expects demand to stabilize. The following table presents the expected cash flows. Year of Operation Cash Inflow 2010 $6,500 4,500 7,000 7,000 In addition to these cash flows, Ms Powell expects to pay $7,300 for the equipment. She also expects to pay $1,200 for a major overhaul and updating of the equipment at the end of the second year of operation. The equipment is expected to have a $750 salvage value and a four-year useful life. Ms Powell desires to earn a rate of return of 10 percent. What is the Net Present Value of the investment opportunity? (Round computations to the…arrow_forwardTiger Trucking Company is considering a project that will produce cash inflows of $18,000 at the end of Year 1, $32,000 in Year 2, and $45,000 in Year 3. What is the present value of these cash inflows at a discount rate of 9 percent? Can the excel and calculator solution be provided?arrow_forwardA financial adviser is reviewing one of her client's accounts. The client has been investing $1,000 at the end of every quarter for the past Il years in a fund that has averaged 7.3% compounded quarterly. How much money does the client have in his account? Construct a cash flow diagram and use a formula.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education