Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

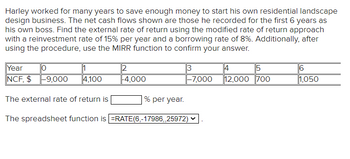

Transcribed Image Text:Harley worked for many years to save enough money to start his own residential landscape design business. The net cash flows shown are those he recorded for the first 6 years as his own boss. Find the external rate of return using the modified rate of return approach with a reinvestment rate of 15% per year and a borrowing rate of 8%. Additionally, after using the procedure, use the MIRR function to confirm your answer.

| Year | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

|------|-------|-------|-------|-------|-------|-------|-------|

| NCF, $ | -9,000 | 4,100 | -4,000 | -7,000 | 12,000 | 700 | 1,050 |

- The external rate of return is \_\_\_\_ % per year.

- The spreadsheet function is `=RATE(6,-17986,,25972)`.

The table consists of two rows:

1. **Year**: Represents each year from 0 to 6.

2. **NCF, $**: Lists the net cash flow for each corresponding year.

The process involves using the given reinvestment and borrowing rates to calculate the external rate of return, which can then be confirmed using the MIRR (Modified Internal Rate of Return) function in spreadsheet software.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- .arrow_forwardCan someone please help me to solve the following question showing all work and formulas neatly. And please show the cash flow diagram as well. PLEASE ANS THANK YOU!!!!!arrow_forwardAssume that at the beginning of the year, you purchase an investment for $2,500 that pays $67 annual income. Also assume that the investment's value has decreased to $2,350 at the end of the year. a. What is the rate of return for this investment? b. Is the rate of return a positive or a negative number? Complete this question by entering your answers in the tabs below. Req 1 Req 2 What is the rate of return for this investment? Note: Enter your answer as a percent rounded to 2 decimal places. Input the amount as a positive value. Rate of return % Req 1 Req 2 >arrow_forward

- What is the excel function and formula for this question? Off-The-Books Investment Firm, LLC, has offered you an investment it says will return to you $20,000 in 2 years. To get in, you'll need to make a $10,000 deposit to their receivables account and promise not to tell anyone about it. What is the annual return on this investment?arrow_forwardYou were saving your money in an account that requires interest continuou at a rate of 6.25%. You invested $12,000. part A: identify the values for the variables, in write an equation that can be used to find the amount of money and they count after a certain number of years, T. part B: approximately how much money will be in the account after two years, show your work. part C:arrow_forwardDogwood Company is considering a capital investment in machinery: (Click the icon to view the data.) 8. Calculate the payback. 9. Calculate the ARR. Round the percentage to two decimal places. 10. Based on your answers to the above questions, should Dogwood invest in the machinery? 8. Calculate the payback. Amount invested Expected annual net cash inflow Payback 1,500,000 24 500,000 3 years 9. Calculate the ARR. Round the percentage to two decimal places. Average annual operating income Average amount invested ARR Data Table Initial investment $ 1,500,000 Residual value 350,000 Expected annual net cash inflows 500,000 Expected useful life 4 years Required rate of return 15%arrow_forward

- Use the present value and future value tables to answer the following questions. Time Value of Money - Principles of Accounting, Volume 2: Managerial Accounting | OpenStax A. If you would like to accumulate $2,400 over the next 5 years when the interest rate is 15%, how much do you need to deposit in the account? $_____ B. If you place $6,200 in a savings account, how much will you have at the end of 6 years with a 12% interest rate? $_____ C. You invest $7,000 per year for 11 years at 12% interest, how much will you have at the end of 11 years? $_____ D. You win the lottery and can either receive $760,000 as a lump sum or $60,000 per year for 19 years. Assuming you can earn 8% interest, which do you recommend and why? _____arrow_forwardAnswer the given question with a proper explanation and step-by-step solution. Please provide the answer using the math tool otherwise I give the downvote.arrow_forwardFill in the blank to answer the below. You invested $20,000 at the beginning of the year. At the end of the year, you received cash flows of $400 from the investment and you cashed out entirely, receiving $21,600. What is your return for the year? %arrow_forward

- In the provided scenario, you address the time value of money also known as discounted cash flow analysis. This type of analysis is crucial to being able to viably analyze financial statements. The start - up firm you founded is trying to save $10, 000 in order to buy a parcel of land for a proposed small warehouse expansion. In order to do so, your finance manager is authorized to make deposits of S 1250 per year into the company account that is paying 12% annual interest. The last deposit will be less than $1250 if less is needed to reach $10,000. How many years will it take to reach the $10,000 goal and how large will the last deposit be? Show your workarrow_forwardSolve the following problem. Use Excel, financial calculator, or PV and FV Tables. Show your work with the formulas and figures inserted in them. Hamad is saving to establish a small business. He deposits a fixed amount of money every month in a bank account that pays a nominal interest rate of 12 percent. If this account pays interest every month, then how much he should save at the end of every month to have AED 50,000 in his account after 5 years.arrow_forwardPlease help me with show all calculation thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning