FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

The following is an independent error made by a company that uses the periodic inventory system:

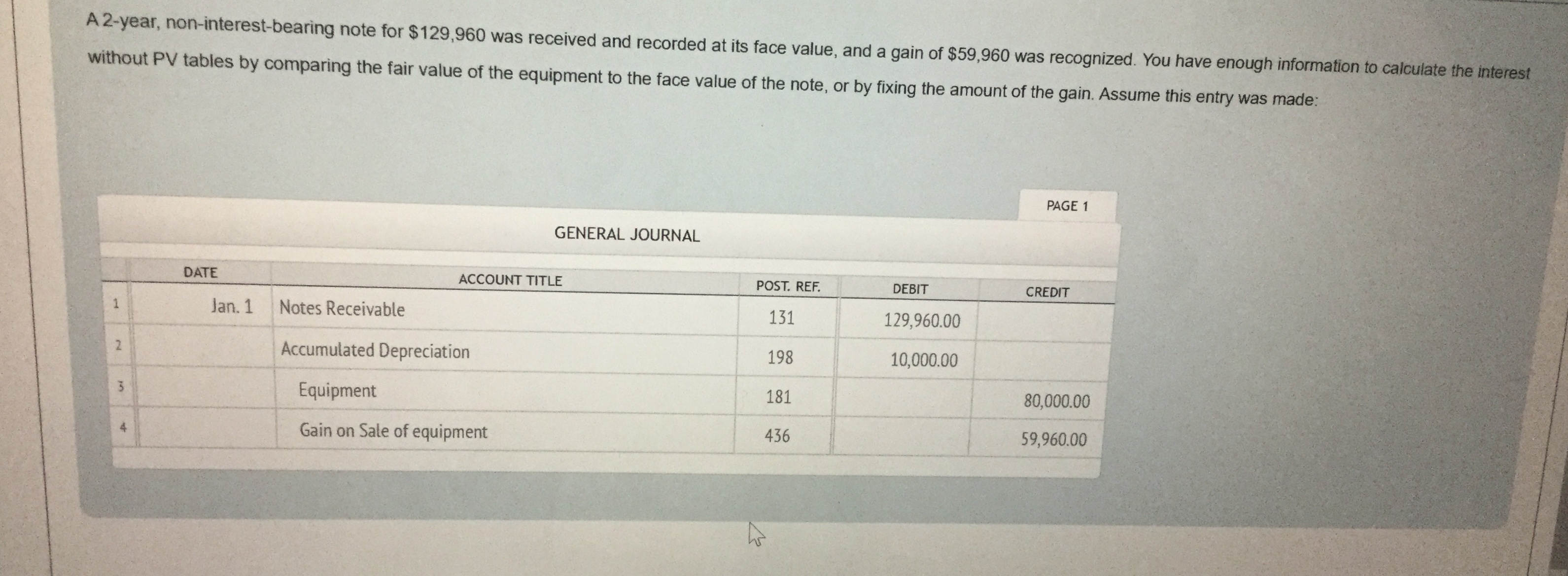

Equipment with a book value of $70,000 and a fair value of $100,000 was sold at the beginning of the year. A 2-year, non-interest-bearing note for $129,960 was received and recorded at its face value, and a gain of $59,960 was recognized. No interest revenue was recorded and 14% is a fair rate of interest.

What is the

What is the journal entry adjustment needed to correct interest related to the note?

Transcribed Image Text:A2-year, non-interest-bearing note for $129,960 was received and recorded at its face value, and a gain of $59,960 was recognized. You have enough information to calculate the interest

without PV tables by comparing the fair value of the equipment to the face value of the note, or by fixing the amount of the gain. Assume this entry was made:

PAGE 1

GENERAL JOURNAL

DATE

ACCOUNT TITLE

POST. REF.

DEBIT

CREDIT

Notes Receivable

Jan. 1

131

129,960.00

Accumulated Depreciation

198

10,000.00

181

80,000.00

Equipment

59,960.00

436

Gain on Sale of equipment

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In your audit of James Smith Company, you find that a physical inventory on December 31, 2020, showed merchandise with a cost of $449,390 was on hand at that date. You also discover the following items were all excluded from the $449,390. 1. 2. 3. 4. 5. Merchandise of $61,150 which is held by Smith on consignment. The consignor is the Max Suzuki Company. Merchandise costing $36,420 which was shipped by Smith f.o.b. destination to a customer on December 31, 2020. The customer was expected to receive the merchandise on January 6, 2021. Merchandise costing $47,720 which was shipped by Smith f.o.b. shipping point to a customer on December 29, 2020. The customer was scheduled to receive the merchandise on January 2, 2021. Merchandise costing $83,030 shipped by a vendor f.o.b. destination on December 30, 2020, and received by Smith on January 4, 2021. Merchandise costing $49,200 shipped by a vendor f.o.b. shipping point on December 31, 2020, and received by Smith on January 5, 2021. Based on…arrow_forwardDuring 2011, Paul discovered that the ending inventories reported on its financial statements were incorrect by the following amounts: 2009 P60,000 understated; 2010 P75,000 overstated. Paul uses the periodic inventory system to ascertain year-end quantities that are converted to peso amounts using the FIFO cost method. Prior to any adjustments for these errors and ignoring income tax, Paul’s retained earnings at January 1, 2011 would be Choices; Correct 15,000 overstated 75,000 overstated 135,000 overstatedarrow_forwardIn fiscal year 2020, the company had accumulated inventory impairment of 2000. In fiscal year 2021, the company considered that the required amount of accumulated impairment amounted to 1300 and thus reversed the difference in results. However, according to the Auditor, the required amount of accumulated impairment in the year 2021 amounted to 2500. If the amount of net profit of the income statement in 2021 is 20000, how much is the actual profit of the business?arrow_forward

- During the year ended December 31, 2021, Angel Company revealed the following events: a) A counting error relating to inventory on December 31, 2020 was discovered. This required an increase in the carrying amount of inventory on that date of P500,000. b)It was also decided to write off P50,000 from inventory which was over two years old as it was obsolete. c) The provision for uncollectible accounts on December 31, 2020 was P200,000. During 2021, an amount of P300,000 was written off on the December 31, 2020 accounts receivable. What pretax adjustment is required to restate retained earnings on January 1, 2021? Your answerarrow_forwardKari Downs, an auditor with Wheeler CPAS, is performing a review of Waterway Company's inventory account. Waterway did not have a good year, and top management is under pressure to boost reported income. According to its records, the inventory balance at year- end was $747,000. However, the following information was not considered when determining that amount. (a1) Prepare a schedule to determine the correct inventory amount. (If an amount reduces the account balance then enter with a negative sign preceding the number, e.g. -15,000, or parenthesis e.g. (15,000). Enter O if there is no effect.) 1. 2. 3. 4. 5. 6. Ending inventory-as reported Included in the company's count were goods with a cost of $257,000 that the company is holding on consignment. The goods belong to Kroeger Corporation. The physical count did not include goods purchased by Waterway with a cost of $35,000 that were shipped FOB destination on December 28 and did not arrive at Waterway warehouse until January 3.…arrow_forwardSheridan Inc. reported total assets of $2395000 and net income of $322000 for the current year. Sheridan determined that inventory was overstated by $23500 at the beginning of the year (this was not corrected). Ignoring income taxes, what is the corrected amount for total assets and net income for the year? $2371500 and $298500. $2395000 and $345500. $2418500 and $345500. $2395000 and $322000.arrow_forward

- Willamill Company showed pre-tax income of P2,500,000 for the year ended December 31, 2025. On your year-end verification of the transactions of the Company, you discovered the following errors: P1,000,000 worth of merchandise was purchased in 2025 and included in the ending inventory. However, the purchase was recorded only in 2026. A merchandise shipment valued at P1,500,000 was properly recorded as purchases at year-end. The merchandise was inadvertently omitted from the physical count, since it has not arrived by December 31, 2025. Value added tax for the fourth quarter of 2025, amounting to P500,000 was included in the Sales account. Rental of P300,000 on an equipment, applicable for six months, was received on November 1, 2025. The entire amount was reported as revenue upon receipt. Rent paid on building covering the period from July 1, 2025 to July 1, 2026, amounting to P1,200,000, was paid and recorded as expense on July 1, 2025. The company did not make any adjustment at the…arrow_forwardOffice Outfitters Inc. which uses a perpetual inventory system, experienced an inventory shrinkage of $3,750. What accounts would be increased and decreased to record the adjustment for the inventory shrinkage at the end of the accounting period?arrow_forwardIn your audit of Chris Anderson Company, you find that a physical inventory on December 31, 2020, showed merchandise with a cost of $439,750 was on hand at that date. You also discover the following items were all excluded from the $439,750. 1. Merchandise of $63,260 which is held by Anderson on consignment. The consignor is the Max Suzuki Company. Merchandise costing $34,870 which was shipped by Anderson f.o.b. destination to a customer on December 31, 2020. The customer was expected to receive the merchandise on January 6, 2021. 2. 3. Merchandise costing $44,590 which was shipped by Anderson f.o.b. shipping point to a customer on December 29, 2020. The customer was scheduled to receive the merchandise on January 2, 2021. 4. Merchandise costing $76,380 shipped by a vendor f.o.b. destination on December 30, 2020, and received by Anderson on January 4, 2021. 5. Merchandise costing $54,450 shipped by a vendor f.o.b. shipping point on December 31, 2020, and received by Anderson on January…arrow_forward

- During the taking of its physical inventory on December 31, 20Y3, Zula Company incorrectly counted its inventory as $116,985 instead of the correct amount of $131,025. Indicate the effect of the misstatement on Zula's December 31, 20Y3, balance sheet or income statement for the year ended December 31, 20Y3. For each, select if the amount is overstated or understated. Then, input the over or under amount, entered as a positive value. Line Item Description Financial Statement Understated or Overstated Amount Current assets $fill in the blank 3 Gross profit $fill in the blank 6 Inventory $fill in the blank 9 Net income $fill in the blank 12 Stockholders' equity $fill in the blank 15 Total assets $fill in the blank 18arrow_forwardanswer in text form please (without image)arrow_forwardNavajo Company's year-end financial statements show the following. The company recently discovered that in making physical counts of inventory, it had made the following errors: Year 1 ending inventory is understated by $60,000 and Year 2 ending inventory is overstated by $30,000. Year 2 965,000 $ 285,000 1,370,000 1,590,000 Year 3 800,000 260,000 1,240,000 1,255,000 For Year Ended December 31 Year 1 (a) Cost of goods sold (b) Net income (c) Total current assets (d) Total equity 24 735,000 $ 278,000 1,257,000 1,397,000 Required: 1. For each key financial statement figure-(a), (b), (C), and (d) above-prepare a table to show the adjustments necessary to correct the reported amounts. 2. What is the total error in combined net income for the three-year period resulting from the inventory errors? Complete this question by entering your answers in the tabs below. Required 1 Required 2 For each key financial statement figure-(a), (b), (c), and (d) above-prepare a table to show the adjustments…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education