FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

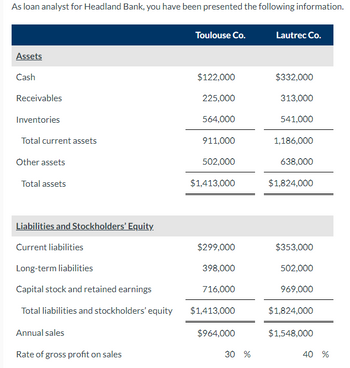

Transcribed Image Text:As loan analyst for Headland Bank, you have been presented the following information.

Assets

Cash

Receivables

Inventories

Total current assets

Other assets

Total assets

Liabilities and Stockholders' Equity.

Current liabilities

Long-term liabilities

Capital stock and retained earnings

Total liabilities and stockholders' equity

Annual sales

Rate of gross profit on sales

Toulouse Co.

$122,000

225,000

564,000

911,000

502,000

$1,413,000

$299,000

398,000

716,000

$1,413,000

$964,000

30 %

Lautrec Co.

$332,000

313,000

541,000

1,186,000

638,000

$1,824,000

$353,000

502,000

969,000

$1,824,000

$1,548,000

40 %

Transcribed Image Text:Each of these companies has requested a loan of $50,000 for 6 months with no collateral offered. Because your bank has reached its quota for loans of this type, only one of these requests is to be granted.

(a1) Compute the various ratios for each company. Assume that the ending account balances are representative of the entire year. (Round answer to 2 decimal places, e.g. 2.25.)

Current ratio

Acid-test ratio

Accounts receivable turnover

Inventory turnover

Cash to current liabilities

Toulouse Co.

:1

:1

times

times

:1

Lautrec Co.

:1

:1

times

times

:1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 4. The following select financial statement information from Hogge Computing. Compute the accounts receivable turnover ratios and the number of days' sales in receivables ratios for 2021 and 2022 (round answers to two decimal places). Year 2020 2021 2022 2021: Net Credit Sales 2022: $1,557,200 $1,755,310 $1,965,170 Accounts Receivable Turnover Ratio: • Days' Sales: days Accounts Receivable Turnover Ratio: Days' Sales: days times times Ending Accounts Receivable $397,000 $465,200 $505,780arrow_forwardcalculate these (d) Current ratio :1 (e) Accounts receivable turnover times (f) Average collection period daysarrow_forwardPlease answers parts 4,5, and 6. I have the first three alreadyarrow_forward

- Please Do not Give image formatarrow_forwardI could use a hand with thisarrow_forwardBased on the financial statements provided, compute the following financial ratios. Show your workings and round your figures to 2 decimal places. Ratio 2020 2019 Current Ratio Quick Ratio Debt Ratio (%)arrow_forward

- A company reports the following: Sales Average accounts receivable (net) Determine (a) the accounts receivable turnover and (b) the days' sales in receivables. When required, round your answers to one decimal place. Assume a 365-day a. Accounts receivable turnover b. Days' Sales in Receivables Time Remaining: 1:48:20 $284,700 54,750 days Il Proctorio is sharing your screen. Stop sharing Hidearrow_forwardCrane Corp.currently has accounts receivable of $1,093,000 on net sales of $7,334,000. What are its accounts receivable turnover ratio and days' sales outstanding (DSO)? (Round accounts receivable turnover ratio answer to 2 decimal places, e.g. 12.25 and days' sales outstanding answer to 1 decimal place, e.g. 12.2. Use 365 days for calculation.)arrow_forwardFollowing is some financial information of 250R Corp: 250 CORP Statement of Income For the years ended December 31, 2020 and 2021 Year Ended 31.12.2021 Sales Revenues Cost of Goods Sold Gross Margin Salaries expense Depreciation expense Interest expense Net income Long-term borrowings Accounts receivable Property, plant & equipment (PPE): Cost Accumulated Depreciation $750,000 (300,000) $450,000 (75,000) (70,000) (30,000) $275,000 Some Selected Balance Sheet Data As at 31.12.2021 $300.000 $525,000 $350,000 210,000 Year Ended 31.12.2020 $500,000 (200,000) $300,000 (50,000) (70,000) (30,000) $150,000 As at 31.12.2020 $300.000 $250.000 $350,000 140,000arrow_forward

- The following data (in millions) were adapted from recent financial statements of CVS Health Corporation (CVS). Year 2 Year 1 Sales $256,776 $194,579 Operating income 12,467 10,170 Average accounts receivable 18,624 15,406 1. Compute the accounts receivable turnover for Years 1 and 2. Round to one decimal place. Accounts Receivable Turnover Year 2 fill in the blank 1 Year 1 fill in the blank 2 2. Compute the days' sales in receivables for Years 1 and 2. Assume there are 365 days in the year, and round to the nearest day. Number of Days' Salesin Receivables Year 2 fill in the blank 3 days Year 1 fill in the blank 4 days 3. Compute the return on sales for Years 1 and 2. Round to one decimal place. Return on Sales Year 2 fill in the blank 5 % Year 1 fill in the blank 6 % 4. Based on the results in parts 1, 2, and 3, all the following are true except: The change in accounts receivable turnover from Year 1 to…arrow_forwardPlease do not give image format and explanationarrow_forwardBelow are amounts (in millions) from three companies' annual reports. Beginning Accounts Receivable Ending Accounts Receivable Net Sales WalCo TarMart $1,815 $2,762 $322,427 6,166 6,694 67,878 CostGet 629 665 68,963 Required: 1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. 2. Which company appears most efficient in collecting cash from sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. (Enter your rounded to 1 decimal place.) WalCo TarMart CostGet Choose Numerator Receivables Turnover Ratio Choose Denominator Average Collection Period Choose Numerator Choose Denominator = Receivables turnover ratio times times times = Average collection periodarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education