Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:c. Which constraint shows extra capacity? How much? constraint shows no extra capacity, enter 0 as number of

units. If required, round your answers to the nearest whole number.

Constraints

Fan motors

Cooling coils

Manufacturing time

The optimal solution

solution changing.

d. If the profit for the deluxe model were increased to $152 per unit, would the optimal solution change?

change because the profit of the deluxe model can vary from

$152 is

this range without the optimal

The optimal solution

Extra capacity

$0

$12

$125

$137

$149

Yes

†No

d. If the profit for the deluxe model were increased to $152 per unit, would the optimal sc

change because the profit of the deluxe mo

$152 is

this rang

solution changing.

would

would not

to

d. If the profit for the deluxe model were increased to $152 per unit, would the optimal sol

The optimal solution

change because the profit of the deluxe mod

$152 is

this range

solution changing.

Number of units

to

$12

$125

$137

$149

linfinitv

d. If the profit for the deluxe model were increased to $152 per unit, would the optimal solution change?

The optimal solution

change because the profit of the deluxe model can vary from

$152 is (

this range without the optimal

to

in

not in

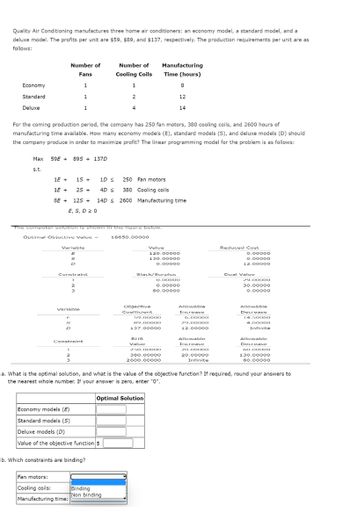

Transcribed Image Text:Quality Air Conditioning manufactures three home air conditioners: an economy model, a standard model, and a

deluxe model. The profits per unit are $59, $89, and $137, respectively. The production requirements per unit are as

follows:

Economy

Standard

Deluxe

Max

s.t.

Number of

Fans

1

1

1

59E+ 895 + 137D

1E +

1E +

For the coming production period, the company has 250 fan motors, 380 cooling coils, and 2600 hours of

manufacturing time available. How many economy models (E), standard models (S), and deluxe models (D) should

the company produce in order to maximize profit? The linear programming model for the problem is as follows:

15 +

25 +

Optimal Objective Value =

Variable

E

S

D

250 Fan motors

380 Cooling coils

8E + 125 + 14D ≤ 2600 Manufacturing time

E, S, D 20

Constrainal

1

2

3

The computer solution is shown in the figure below.

Variable

D

Constraint

1D S

4D S

Fan motors:

Cooling coils:

Manufacturing time:

Number of

Cooling Coils

b. Which constraints are binding?

1

2

4

Economy models (E)

Standard models (S)

Deluxe models (D)

Value of the objective function $

Binding

Non binding

18650.00000

Manufacturing

Time (hours)

Slack/Surplus

Objective

Coefficient

RIIS

Value

Value

120.00000

130.00000

0.00000

59.00000

89.00000

137.00000

Optimal Solution

8

12

14

0.00000

0.00000

80.00000

250.00000

380.00000

2600.00000

Allowable

Increase

6.00000

29.00000

12.00000

Allowable

Increase

20.00000

20.00000

Infinite

Reduced Cost

0.00000

0.00000

12.00000

Dual Value

29.00000

30.00000

0.00000

a. What is the optimal solution, and what is the value of the objective function? If required, round your answers to

the nearest whole number. If your answer is zero, enter "0".

Allowable

Decrease

14.50000

4.00000

Infinite

Allowable

Decrease

60.00000

130.00000

80.00000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 5 images

Knowledge Booster

Similar questions

- In one fiscal year, firm B has ROA (return on asset) of 5%, and they borrow a substantial amount of money from banks to finance their operations. Except for that, the firm has no debt. Suppose the interest rate for the loans is 6%. What will this firm's ROE (return on equity) be? Group of answer choices More than 5% Less than 5% Less than 4% More than 4% Please ANSWER ASAParrow_forwardPlease do not give solution in image format thankuarrow_forwardNeed help only with finding the optimal solutionarrow_forward

- I need solution of 2.34 as possible as pleasearrow_forwardblank one options: increases OR decreases OR remains unchanged Blank two options: increases OR decreases OR remains unchanged Blank three options: increases OR decreases OR remains unchangedarrow_forwardPLEASE USE SIMPLEX METHOD. Thank you! Suppose a company manufactures different electronic components for computers. Component A requires 2 hours of fabrication and an hour of assembly. Component B requires 3 hours of fabrication and an hour of assembly, and component C requires 2 hours of fabrication and 2 hours of assembly. The company has upto 1,000 labor-hours for fabrication, 800 labor-hours of assembly time each work. If the profit on each component A, B, and C is $7, $8, and $10 respectively, how many of each should be produced to maximize profit?arrow_forward

- John is travelling from home in Sydney to a hotel in Perth. Three stopovers on the way a number of choices of towns for each stop only one hotel to choose from in each town, except for Perth, where there are three hotels (J, K, and L) to choose from Each trip has a different distance resulting in a different cost (petrol) (cost is marked by each arc) Hotels have different costs (cost is marked by each node (town)) ● ● ● The goal is to select a route to and a hotel in Perth so that the overall cost of the trip is minimized. Use dynamic programming (forward recursion) to solve this problem by constructing the usual tables for each stage. Stage: 0 (Sydney) 1 Petrol cost start 22 8 12 Hotel cost 70 80 B 80 25 10 2 50 A E 70 30 10 18 8 7 3 50 F 70 70 H 60 8 10 10 4 (Perth) 50 13 K 10 15 L 60 70arrow_forwardProblem 7-41 Southern Oil Company produces two grades of gasoline: regular and premium. The profit contributions are $0.30 per gallon for regular gasoline and $0.50 per gallon for premium gasoline. Each gallon of regular gasoline contains 0.3 gallons of grade A crude oil and each gallon of premium gasoline contains 0.6 gallons of grade A crude oil. For the next production period, Southern has 18,000 gallons of grade A crude oil available. The refinery used to produce the gasolines has a production capacity of 50,000 gallons for the next production period. Southern Oil's distributors have indicated that demand for the premium gasoline for the next production period will be at most 20,000 gallons. a. Formulate linear programming model that can be used to determine the number of gallons of regular gasoline and the number of gallons of premium gasoline that should be produced in order to maximize tota profit contribution. If required, round your answers to two decimal places. L Let R = P =…arrow_forward19. Solve for n, C(n, 4) = 210 Solve it accurate solve it correct complete solutionsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.