Understanding Business

12th Edition

ISBN: 9781259929434

Author: William Nickels

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

Pls help ASAP for both

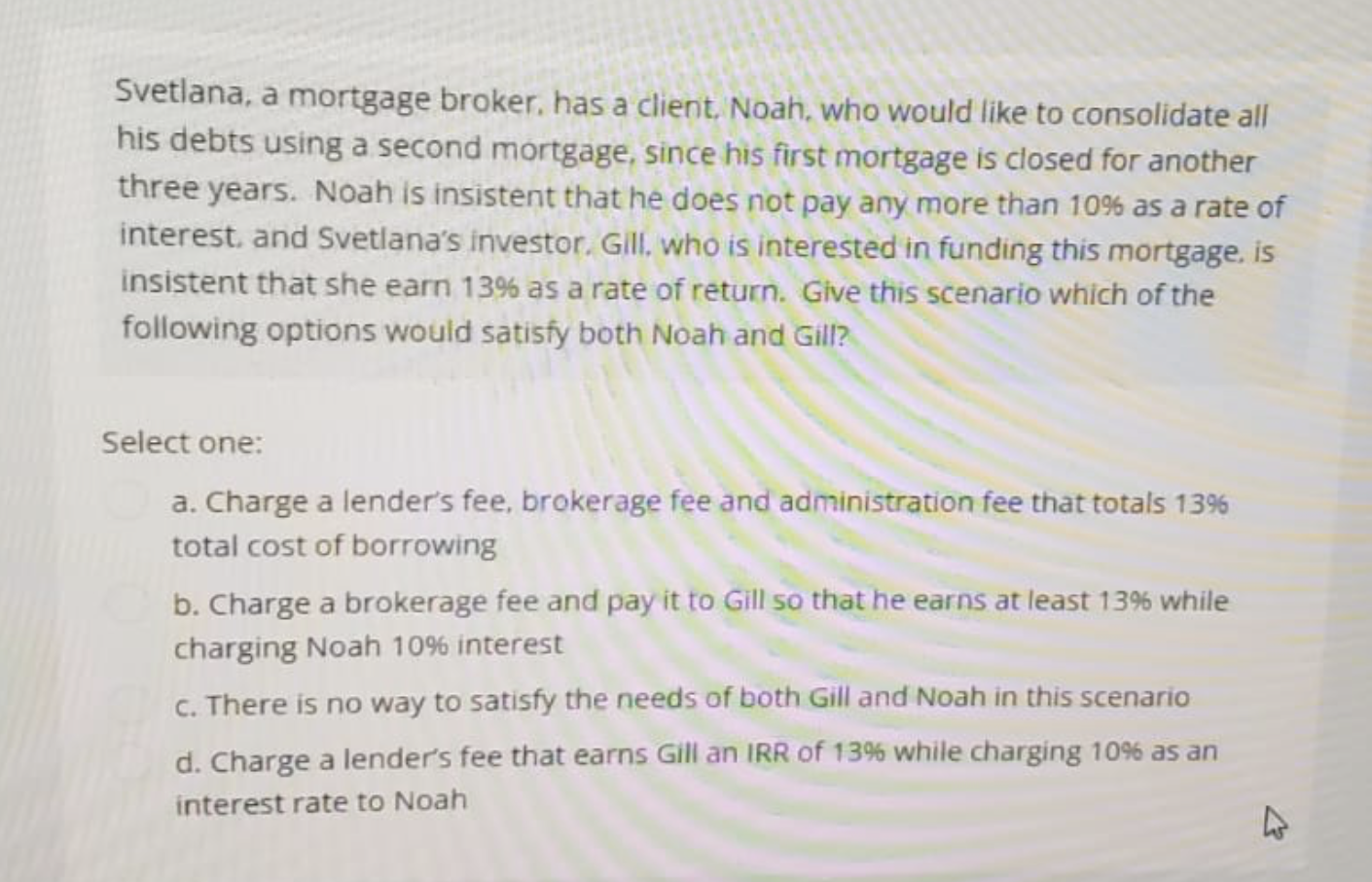

Transcribed Image Text:Svetlana, a mortgage broker, has a client, Noah, who would like to consolidate all

his debts using a second mortgage, since his first mortgage is closed for another

three years. Noah is insistent that he does not pay any more than 10% as a rate of

interest, and Svetlana's investor, Gill, who is interested in funding this mortgage, is

insistent that she earn 13% as a rate of return. Give this scenario which of the

following options would satisfy both Noah and Gill?

Select one:

a. Charge a lender's fee, brokerage fee and administration fee that totals 13%

total cost of borrowing

b. Charge a brokerage fee and pay it to Gill so that he earns at least 13% while

charging Noah 10% interest

c. There is no way to satisfy the needs of both Gill and Noah in this scenario

d. Charge a lender's fee that earns Gill an IRR of 13% while charging 10% as an

interest rate to Noah

4

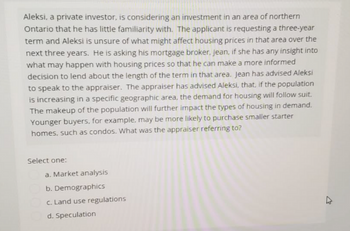

Transcribed Image Text:Aleksi, a private investor, is considering an investment in an area of northern

Ontario that he has little familiarity with. The applicant is requesting a three-year

term and Aleksi is unsure of what might affect housing prices in that area over the

next three years. He is asking his mortgage broker, jean, if she has any insight into

what may happen with housing prices so that he can make a more informed

decision to lend about the length of the term in that area. Jean has advised Aleksi

to speak to the appraiser. The appraiser has advised Aleksi, that, if the population

is increasing in a specific geographic area, the demand for housing will follow suit.

The makeup of the population will further impact the types of housing in demand.

Younger buyers, for example, may be more likely to purchase smaller starter

homes, such as condos. What was the appraiser referring to?

Select one:

a. Market analysis

b. Demographics

c. Land use regulations

d. Speculation

D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON