ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

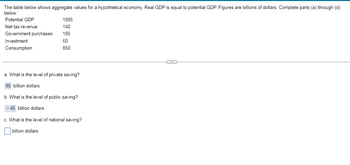

Transcribed Image Text:The table below shows aggregate values for a hypothetical economy. Real GDP is equal to potential GDP. Figures are billions of dollars. Complete parts (a) through (d)

below.

Potential GDP

Net tax revenue

Government purchases

Investment

Consumption

1085

140

185

50

850

a. What is the level of private saving?

95 billion dollars

b. What is the level of public saving?

-45 billion dollars

c. What is the level of national saving?

billion dollars

C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question 1 Suppose the information below shows aggregate values for a hypothetical economy. Real GDP is equal to potential GDP. All figures are billions of dollars. Potential GDP Net tax revenue Government purchases = = = 950 = 125 140 Desired Investment Desired consumption (a) What is the level of private saving? (b) What is the level of public saving? (c) What is the level of national saving? (d) Is the interest rate at its equilibrium level? Provide a justification. 10 800arrow_forwardA country has national saving of $50 billion, government expenditures of $40 billion, domestic investment of $15 billion, and net capital outflow of $65 billion. What is its supply of loanable funds? A. $115 billion B. $50 billion C. $40 billion D. $90 billionarrow_forwardOnly typed answerarrow_forward

- QUESTION 9 Use the following diagram to answer this question The accompanying graph shows the market for loanable funds in equilibrium. Interest rate (%) 12 10 8 6 4 0 XH 2 3 E 4 6 5 Quantity of loanable funds (trillions of dollars) S Which of the following might produce a new equilibrium interest rate of 2% and a new equilibrium quantity of loanable funds of $5 trillion? OA. Firms become pessimistic about the future and, as a result, they cut back on their plans to buy new equipment and build new factories. ⒸB. Congress decreases the tax rate on interest income. C. Capital inflows from foreign citizens are declining. D. The U.S. government offers a tax credit for firms that built new factories in the U.S.arrow_forwardOne of the benefits financial capital markets offer savers is the opportunity to earn income. a. Savers earn income in the form of purchasing b. Savers earn income in the form of through partial ownership of a corporations that they acquire by by lending money to corporations when they purchasearrow_forward3. The meaning of saving and investment Classify each of the following based on the macroeconomic definitions of saving and investment. Saving Investment Caroline purchases new ovens for her cupcake-baking business. Antonio buys a government bond. Dmitri takes out a loan and uses it to build a new cabin in Montana. Frances purchases stock in Pherk, a pharmaceutical company.arrow_forward

- 1. Investment is a determining factor of GDP. A decrease in the supply of available funds (i.e. a decrease in the supply of savings) is predicted to? a. Decrease interest rates, decrease investment towards physical capital and hence decrease GDP. b. Increase interest rates, increase investment towards physical capital and hence decrease GDP. c. Decrease interest rates, decrease investment towards physical capital and hence increase GDP. d. Increase interest rates, decrease investment towards physical capital and hence decrease GDP.arrow_forwardGDP is $5 billion this year in a closed economy. Consumption is $3 billion, and government spending is $0.5 billion and taxes are $0.5 billion. How much is private saving? Select one: Oo $4.5 billion Ob 50 billions OC -50.5 billion Od $1.5 billion.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- 2. Compared to a balanced budget or a budget surplus, what is the effect of a government budget deficit on national saving in the economy? A. National saving is unchanged. OB. National saving decreases. OC. National saving increases. D. National saving could increase or decrease. 3. What is the effect of a budget deficit created by an increase in governmentarrow_forwardDescribe the investment decisions made in the private sector?arrow_forwardcountry has domestic investment of $200 billion. Its citizens purchase $600 billion of foreign assets and foreign citizens purchase $300 billion of its assets. What is national saving? a. $500 billion b. $400 billion c. $800 billion d. $600 billtionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education