ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

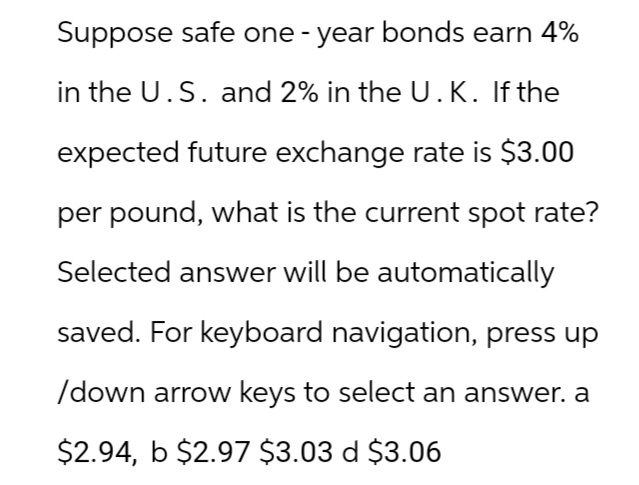

Transcribed Image Text:Suppose safe one-year bonds earn 4%

in the U.S. and 2% in the U.K. If the

expected future exchange rate is $3.00

per pound, what is the current spot rate?

Selected answer will be automatically

saved. For keyboard navigation, press up

/down arrow keys to select an answer. a

$2.94, b $2.97 $3.03 d $3.06

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A Sri Lankan MNC that is an importer has a $3,750,000 payable due in one year. Spot exchange rates 1-year Forward Rates Contract size $ 1.00 Rs. 100 $ 1.00 = Rs. 120 Rs. 12,500,000 What is a strategy that will hedge this Sri Lankan firm's exchange rate risk? A. Go short in 36 rupee forward contracts. B. Go long in 36 rupee forward contracts. C. Go short in 30 rupee forward contracts. D. Go long in 30 rupee forward contracts. E. None of the optionsarrow_forwardA UK-manufactured car sells for GBP 14.000. A french-manufactured car sells for EUR 15.750. If the EUR/GBP exchange rate is 1.17, how much does the french-made car cost in GBP? a. 13.467 b. 14.500 c. 16.380 d. 18.427arrow_forward3. In which country would you save if the nominal interest rate equals 4% in the U.S. and 1% in Germany, the current dollar-Euro exchange rate (E$/ €) is equal to 1.2 and your expected exchange rate one year from now (Ee$/ €) equals 1.25.arrow_forward

- 5/variants/950245/take/10/ On a supply and demand graph with the quantity of dollars on the horizontal axis and the price of pesos in dollars on the vertical axis, what happens to the exchange rate if the demand for dollars decreases? Press the hotspot that shows the exchange rate if the demand for dollars decreases, and then press the answer box to save your selection. Price of pesos in dollars Y 21 Total Questions Answered ********* QUE HAGE LANGE MOET DOLE ARE DO ******** MAE ARE NOE DUDELAUT DE QUE ELE hapa kwa JE ME NE DRE DEELNEMENDE NUK DENETLE GARALAM TENDE DIE WE ARE PAR ******** D1 Previous exchange rate Quantity of dollars S DO 8035560000000000001 anges Saved < V ✰ ✰ Continue 6/6arrow_forwardWhat is the correct option for this question?arrow_forwarda) Using the following information, determine each one of the theoretical Exchange Rates (E.R.) according to International Fisher Effect. b) Show how Money Market Arbitrage could be done assuming that the loan is 1,000 units of the currency of the country where the loan is contracted. Determine the profit in the currency in which the loan was contracted. ΜARKET ΜARKET E.R. E.R. COUNTRY CURRENCY INTEREST Dec-01 Dec-02 Dec-02 Mexico MXP 12 % 19.56 20.15 Turkey TRY (Lira) 6 % 5.9419 6.07673 Australia AUD 4 % 1.7759 1.81183 Jаpan JPY 8 % 105.866 113.978 United GBP 5 % 0.5991 0.617849 Kingdom (UK) South Korea KRW (Won) 9% 1,658.62 1,793.37 Canada CAD 5 % 1.3736 1.4942 U.S.A.. USD 3%arrow_forward

- Suppose that a U.S. company wishes to purchase goods from a German producer. The U.S. firm agrees to take the delivery of the goods in three months and to pay €1 million Euros at that time. This company wishes to avoid this exchange rate risk by buying Euros at the 3-month forward rate, f = 0.95 (€/$). Then, how much this company would have to pay in US dollars in exchange for €1 million Euros? a. $1 million dollars. b. $1,052,632 dollars. c. $950,000 dollars.arrow_forwardAssume an American firm takes a long position on British Pound call options. The premium is $0.05, and the strike price is $1.45. When the firm executed the option, they were able to save $150,000 total. If the total contracts were enough to buy 560,000 pounds, what was the asking price of the pound in US dollars?arrow_forwardExplain partially convertible currencyarrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward6arrow_forwardGiven the following data R = $1/¥105 F = $1/¥140 i(u.s.) = 10% What is the interest rates in Japan if the interest parity condition holdsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education