Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

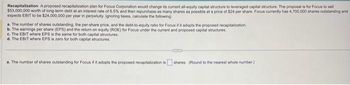

Transcribed Image Text:Recapitalization A proposed recapitalization plan for Focus Corporation would change its current all-equity capital structure to leveraged capital structure. The proposal is for Focus to sell

$53,000,000 worth of long-term debt at an interest rate of 6.5% and then repurchase as many shares as possible at a price of $24 per share. Focus currently has 4,700,000 shares outstanding and

expects EBIT to be $24,000,000 per year in perpetuity. Ignoring taxes, calculate the following:

a. The number of shares outstanding, the per-share price, and the debt-to-equity ratio for Focus if it adopts the proposed recapitalization.

b. The earnings per share (EPS) and the return on equity (ROE) for Focus under the current and proposed capital structures.

c. The EBIT where EPS is the same for both capital structures.

d. The EBIT where EPS is zero for both capital structures.

a. The number of shares outstanding for Focus if it adopts the proposed recapitalization is shares. (Round to the nearest whole number)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 7 images

Knowledge Booster

Similar questions

- (please correct answer and question information)arrow_forwardWoeBeTide's chief objective is to meet its investment needs and maintain its target debt-equity ratio before paying dividends. WoeBeTide is following a dividend approach. Select one: a. cyclical b. stable C. compromise d. residual e. stochasticarrow_forwardEstimate the costs of different capital components—debt, preferred stock, retained earnings, and common stock.arrow_forward

- The distribution of a dividend that represents a partial return of the original investment made by the shareholders is known as a. participating dividend. b. liquidating dividend. c. property dividend.arrow_forwardUse the following information to answer the following question(s). a) What is the percentage of common stock in Sumitomo's weighted average cost of capital? b) What is the percentage of debt in Sumitomo's weighted average cost of capital? c) What is the percentage of preferred stock in Sumitomo's weighted average cost of capital? d) What is the total capital that should be used in computing the weights for Sumitomo's WACC?arrow_forwardThe financial manager of a firm determines the following schedules of cost of debt and cost of equity for various combinations of debt financing: Debt/Assets After-Tax Cost of Debt Cost of Equity 0 % 4 % 8 % 10 4 8 20 4 8 30 5 9 40 6 10 50 8 12 60 10 14 70 12 16 Find the optimal capital structure (that is, optimal combination of debt and equity financing). Round your answers for the capital structure to the nearest whole number and for the cost of capital to one decimal place. The optimal capital structure: % debt and % equity with a cost of capital of % Why does the cost of capital initially decline as the firm substitutes debt for equity financing? The cost of capital initially declines because the firm cost of debt is than the cost of equity. Why will the cost of funds eventually rise as the firm becomes more financially leveraged? As the firm becomes more financially leveraged and riskier, the cost of…arrow_forward

- Select the best answer that addresses the source(s) of capital that firms use. Group of answer choices Debt Preferred stock Common Equity All options mentioned are sources of capital that firms usearrow_forwardWith its earnings, a firm has a decision to make about whether to pay common dividends or a. pay depreciation expense on its fixed assets b. pay preferred dividends c. pay interest to bondholders d. reinvest for future growth On the income statement, interest expense is a. after-tax b. tax-deductible preferred dividents are a. tax-deductible b. after-tax and common dividends are a. after-tax b. tax-deductible Wages are considered a(n) a. an interest expense b. a depreciation expense c. a cost of good sold d. a research and development expense e. an operating expense A company usually expenses ( ) when it incurs them, because the future benefits that this spending is expected to bring are very uncertain and difficult to time. a. a depreciation expense b. an interest expense c. a cost of goods sold d. an operating expense e. a research and development expensearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education