Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

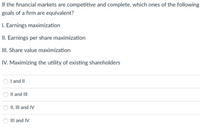

Transcribed Image Text:If the financial markets are competitive and complete, which ones of the following

goals of a firm are equivalent?

I. Earnings maximization

II. Earnings per share maximization

III. Share value maximization

IV. Maximizing the utility of existing shareholders

I and II

Il and III

II, II and IV

IIlI and IV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- How do you calculate investment growth based off the stock price record for a company?arrow_forward37. Lis/are a way to raise capital by selling ownership or equity: A. Issuing Stock B. Seeking Early-stage capital C. Issuing Bonds D. Developing profits E. Seeking a Bank Loan 38. is/are a way to raise capital through borrowing: A. Issuing Stock B. Seeking Early-stage capital C. Issuing Bonds D. Developing profits E. Mutual Funds 39. If a firm's revenues are greater than costs, then the business would be considered:arrow_forwardHow financial synergy impact the firm's valuearrow_forward

- What are the real-world factors that would encourage firms to follow a high dividend policy.arrow_forwardThe idea that changes in dividend policy reflects managers' views about the firm's future earnings is known as: a) Modigliani and Miller Theory b) Payoff Theory c) Dividend Signaling Hypothesis d) Pecking Order Hypothesisarrow_forwardWhy do firms pay dividends? International evidence on the determinants of dividend policy.arrow_forward

- The dividend policy of a company is a key focus for potential investors. This is because dividends are the main contribution to the assumed investment objective. Hence, it is important that management monitor and review the various factors that influence the company's dividend policy. Critically analyse this statement.arrow_forwardWhat is the most appropriate goal for a publicly-traded company? O Maximize stock price O Maximize sales O Maximize market share O Maximize earnings O Maximize cash flowsarrow_forwardFinance multiple choice question. 9. Which of the following is the primary goal of financial management for all for-profit companies? Maximize value of owners' equity. Maximize net cash flows. Maximize profitability. Minimize risk. Maximize market share.arrow_forward

- 8. Each of the following is sometimes listed as a reasonable objective for a firm: (a) maximize profit (accounting income), (b) maximize sales (or share of the market), (c) maximize the value of a share of common stock t time periods from now, (d) ensure continuity of existence, (e) maximize the rate of growth, (f) maximize future dividends. Discuss each item and the extent of its relevance to the making of investment decisions.arrow_forwardM-M theroy with perfect market suggests that divident payment: A.It dependes on the company's capital structure and retained earnings B.Has a positive impact on the value of a firm C.Has a negative impact on the value of a firm D.Has no impact on the value of a firmarrow_forwardIf the management of a company would like to improve the company's return on equity, what should the management of the company do?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education