FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

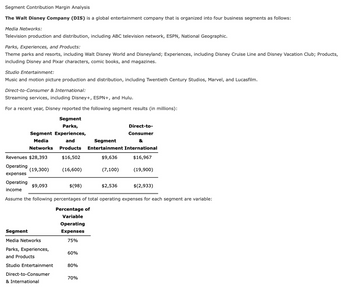

Transcribed Image Text:Segment Contribution Margin Analysis

The Walt Disney Company (DIS) is a global entertainment company that is organized into four business segments as follows:

Media Networks:

Television production and distribution, including ABC television network, ESPN, National Geographic.

Parks, Experiences, and Products:

Theme parks and resorts, including Walt Disney World and Disneyland; Experiences, including Disney Cruise Line and Disney Vacation Club; Products,

including Disney and Pixar characters, comic books, and magazines.

Studio Entertainment:

Music and motion picture production and distribution, including Twentieth Century Studios, Marvel, and Lucasfilm.

Direct-to-Consumer & International:

Streaming services, including Disney+, ESPN+, and Hulu.

For a recent year, Disney reported the following segment results (in millions):

Segment

Parks,

Segment Experiences,

Media

and

Networks

Revenues $28,393

Operating

expenses

(19,300)

Operating

income

Assume the following percentages of total operating expenses for each segment are variable:

$9,093

Direct-to-

Consumer

Segment

&

Products Entertainment International

$16,502

$9,636

$16,967

(16,600)

(7,100)

(19,900)

Segment

Media Networks

Parks, Experiences,

and Products

Studio Entertainment

Direct-to-Consumer

& International

$(98)

Percentage of

Variable

Operating

Expenses

75%

60%

80%

70%

$2,536

$(2,933)

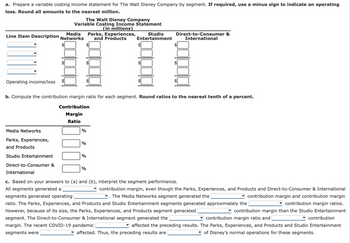

Transcribed Image Text:a. Prepare a variable costing income statement for The Walt Disney Company by segment. If required, use a minus sign to indicate an operating

loss. Round all amounts to the nearest million.

The Walt Disney Company

Variable Costing Income Statement

(in millions)

Line Item Description

Operating income/loss $

Media

Networks

Media Networks

Parks, Experiences,

and Products

Studio Entertainment

Direct-to-Consumer &

%

b. Compute the contribution margin ratio for each segment. Round ratios to the nearest tenth of a percent.

Contribution

Margin

Ratio

%

%

Parks, Experiences,

and Products

%

$

Studio

Entertainment

Direct-to-Consumer &

International

International

c. Based on your answers to (a) and (b), interpret the segment performance.

All segments generated a

contribution margin, even though the Parks, Experiences, and Products and Direct-to-Consumer & International

. The Media Networks segment generated the

contribution margin and contribution margin

segments generated operating

ratio. The Parks, Experiences, and Products and Studio Entertainment segments generated approximately the

contribution margin ratios.

However, because of its size, the Parks, Experiences, and Products segment generated

contribution margin than the Studio Entertainment

segment. The Direct-to-Consumer & International segment generated the

contribution margin ratio and

contribution

margin. The recent COVID-19 pandemic

affected the preceding results. The Parks, Experiences, and Products and Studio Entertainment

segments were

affected. Thus, the preceding results are

of Disney's normal operations for these segments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Party Supply is trying to decide whether or not to continue its costume segment. The information shown is available for Party Supply's business segments. Assume that neither the Direct fixed costs nor the Allocated common fixed costs may be eliminated, but will be allocated to the two remaining segments. Sales Variable costs Contribution margin Direct fixed costs Allocated common fixed costs Net income Party Supply segment data Costumes Party Supplies $160,000 84,000 76,000 50,000 30,000 $110,000 50,000 60,000 20,000 25,000 Floral Decorations $210,000 120,000 90,000 25,000 30,000 $(4,000) $15,000 $35,000 If costumes are dropped, what change will occur to profit? If the effect is negative, use a dash - not parentheses ().arrow_forwardV. Prepare a CONTRIBUTION MARGIN (also known as variable costing) income statement given a traditional (also known as absorption costing) income statement Bruno Industries manufactures and sells a single product. The controller has prepared the following income statement for the most recent year: B C D 1 2 3 Bruno Industries Traditional Income Statement (Absorption Costing) For the Year Ended December 31 4 5 Sales revenue 6 Less: Cost of goods sold 7 Gross profit 8 Less: Operating expenses 9 Operating income $ 406,000 329,000 $ 77,000 73,000 $ 4,000 10 The company produced 8,000 units and sold 7,000 units during the year ending December 31. Fixed manufacturing overhead (MOH) for the year was $152,000, while fixed operating expenses were $62,000. The company had no beginning inventory. Requirements 1. Will the company's operating income under variable costing be higher, lower, or the same as its operating income under absorption costing? Why? 2. Prepare a variable costing income…arrow_forwardAPPLY THE CONCEPTS: Prepare a contribution margin income statement Assume that you are part of the accounting team for Starr Productions. The company has only one product that sells for $40 per unit. Starr estimates total fixed costs to be $3,700. Starr estimates direct materials cost of $12.00 per unit, direct labor costs of $15.00 per unit, and variable overhead costs of $3.00 per unit. The CEO would like to see what the gross margin and operating income will be if 600 units are sold in the next period. Prepare a contribution margin income statement. Starr Productions Contribution Margin Income Statement Sales Less: Variable costs Contribution margin Less: Fixed costs Operating incomearrow_forward

- Contribution Margin Ratio a. Imelda Company budgets sales of $810,000, fixed costs of $62,000, and variable costs of $275,400. What is the contribution margin ratio for Imelda Company? (Enter your answer as a whole number.) % b. If the contribution margin ratio for Peppa Company is 62%, sales were $596,000, and fixed costs were $273,440, what was the income from operations?arrow_forwardShirley Incorporated has three divisions, King, West and Gold. All common fixed costs are unavoidable. Following is the segmented income statement for the previous year: Sales revenue Variable costs Contribution margin Direct fixed costs Segment margin Common fixed costs (allocated) Net operating income (loss) King $ 1,040,000 312,000 $ 728,000 104,000 $ 624,000 391,000 $ 233,000 Required: a. What would Shirley's net income (loss) be if the West Division were dropped? b. What would Shirley's net income (loss) be if the Gold Division were dropped? Complete this question by entering your answers in the tabs below. Required A Required B What would Shirley's net income (loss) be if the West Division were dropped? Gold $426,000 251,340 $ 174,660 48.000 $ 126,660 159,375 $ (32,715) Total $ 2,048,000 889,260 $ 1,158,740 192,000 $ 966,740 763,000 $ 203,740arrow_forwardRequired information [The following information applies to the questions displayed below] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): $ 10,000 5,500 4,500 2,250 Sales Variable expenses Contribution margin Fixed expenses Net operating income 2,250 2. What is the contribution margin ratio? Contribution margin ratioarrow_forward

- Waterman's WaterWorld Tourist Park has collected the following data for operations for the year. Total revenues Total fixed costs Total variable costs Total tickets sold $ 2,300,000 $ 671,375 1,275,000 50,000 $ Required: a. What is the average selling price for a ticket? b. What is the average variable cost per ticket? a Average selling price b. Average variable cost c. Average contribution margin d. Break-even point e. Number of tickets c. What is the average contribution margin per ticket? Note: Do not round Intermediate calculations. d. What is the break-even point? Note: Do not round Intermediate calculations. e. Waterman's management has decided that unless the operation can earn at least $164,000 in operating profits, they will close it down. What number of tickets must be sold for Waterman's to make a $164,000 operating profit for the year on ticket sales? Note: Do not round Intermediate calculations. per ticket per ticket per ticket tickets ticketsarrow_forwardpls helparrow_forwardContribution margin ratio a. Coastal Company budgets sales of $1,080,000, fixed costs of $38,900, and variable costs of $172,800. What is the contribution margin ratio for Coastal Company?fill in the blank 1 of 1 % b. If the contribution margin ratio for Bushner Company is 42%, sales were $848,000, and fixed costs were $277,800, what was the operating income?fill in the blank 1 of 1$arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education