FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

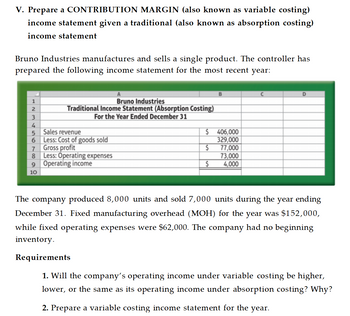

Transcribed Image Text:V. Prepare a CONTRIBUTION MARGIN (also known as variable costing)

income statement given a traditional (also known as absorption costing)

income statement

Bruno Industries manufactures and sells a single product. The controller has

prepared the following income statement for the most recent year:

B

C

D

1

2

3

Bruno Industries

Traditional Income Statement (Absorption Costing)

For the Year Ended December 31

4

5

Sales revenue

6

Less: Cost of goods sold

7

Gross profit

8

Less: Operating expenses

9 Operating income

$ 406,000

329,000

$

77,000

73,000

$

4,000

10

The company produced 8,000 units and sold 7,000 units during the year ending

December 31. Fixed manufacturing overhead (MOH) for the year was $152,000,

while fixed operating expenses were $62,000. The company had no beginning

inventory.

Requirements

1. Will the company's operating income under variable costing be higher,

lower, or the same as its operating income under absorption costing? Why?

2. Prepare a variable costing income statement for the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- On November 30, the end of the first month of operations, Weatherford Company prepared the following income statement, based on the absorption costing concept: Weatherford Company Absorption Costing Income Statement For the Month Ended November 30 Sales (6,100 units) Cost of goods sold: Cost of goods manufactured (7,000 units) Inventory, November 30 (1,000 units) Total cost of goods sold Gross profit $161,000 Sales Variable cost of goods sold: Variable cost of goods manufactured Inventory, November 30 (23,000) $201,300 138,000 $63,300 Selling and administrative expenses 35,910 Income from operations $27,390 Assume the fixed manufacturing costs were $38,640 and the fixed selling and administrative expenses were $17,590 Prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. Weatherford Company Variable Costing Income Statement For the Month Ended November 30 201,300arrow_forwardVariable Costing Income Statement On April 30, the end of the first month of operations, Joplin Company prepared the following income statement, based on the absorption costing concept: Joplin Company Absorption Costing Income Statement For the Month Ended April 30 Sales (5,600 units) Cost of goods sold: Cost of goods manufactured (6,600 units) Inventory, April 30 (900 units) Total cost of goods sold Gross profit Selling and administrative expenses Operating income Variable cost of goods sold: $138,600 (18,900) Fixed costs: $162,400 If the fixed manufacturing costs were $30,492 and the fixed selling and administrative expenses were $12,600, prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. Joplin Company Variable Costing Income Statement For the Month Ended April 30 (119,700) $42,700 (25,720) $16,980arrow_forwardRequired information [The following information applies to the questions displayed below] Hudson Company reports the following contribution margin income statement. HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (9,700 units at $280 each) Variable costs (9,700 units at $210 each) Contribution margin Fixed costs Income 1. Amount of sales 2. Margin of safety 1. Assume Hudson has a target income of $163,000. What amount of sales (in dollars) is needed to produce this target income? 2. If Hudson achieves its target income, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.) $ 2,716,000 2,037,000 679,000 441,000 $ 238,000 %arrow_forward

- Income Statements under Absorption Costing and Variable Costing Fresno Industries Inc. manufactures and sells high-quality camping tents. The company began operations on January 1 and operated at 100% of capacity (70,400 units) during the first month, creating an ending inventory of 6,400 units. During February, the company produced 64,000 units during the month but sold 70,400 units at $90 per unit. The February manufacturing costs and selling and administrative expenses were as follows: Manufacturing costs in February 1 beginning inventory: Variable Fixed Total Manufacturing costs in February: Variable Fixed Total Selling and administrative expenses in February: Variable Fixed Total Number of Units Cost of goods sold: 6,400 $36.00 6,400 14.00 64,000 64,000 Unit Cost 70,400 70,400 Total Cost $230,400 89,600 $50.00 $320,000 $36.00 $2,304,000 15.40 985,600 $51.40 $3,289,600 $18.20 $1,281,280 7.00 492,800 $25.20 $1,774,080 a. Prepare an income statement according to the absorption…arrow_forwardA. Manufacturing margin? b. Contribution margin? C. Operating income for PhiladelPho's company ?arrow_forwardSubject : Accountingarrow_forward

- Use the information given below to prepare the Income Statement for March 2022 according to theabsorption costing method.arrow_forwardam. 132.arrow_forwardplease answer completely and correctly in text form with all working describe each and every step with explanation computation formulaarrow_forward

- Absorption Statement Absorption costing does not distinguish between variable and fixed costs. All manufacturing costs are included in the cost of goods sold. Saxon, Inc.Absorption Costing Income StatementFor the Year Ended December 31 Sales $1,200,000 Cost of goods sold: Cost of goods manufactured $840,000 Ending inventory (168,000) Total cost of goods sold (672,000) Gross profit $528,000 Selling and administrative expenses (289,000) Operating income $239,000 Variable Statement Under variable costing, the cost of goods manufactured includes only variable manufacturing costs. This type of income statement includes a computation of manufacturing margin. Saxon, Inc.Variable Costing Income StatementFor the Year Ended December 31 Sales $1,200,000 Variable cost of goods sold: Variable cost of goods manufactured $600,000 Ending inventory (120,000) Total variable cost of goods sold (480,000) Manufacturing…arrow_forwardPhiladelphia Company has the following information for March: Sales $484,795 Variable cost of goods sold 205,574 Fixed manufacturing costs 76,273 Variable selling and administrative expenses 52,568 Fixed selling and administrating expenses 35,254 a. Determine the March manufacturing margin.$fill in the blank 1 b. Determine the March contribution margin.$fill in the blank 2 c. Determine the March income from operations for Philadelphia Company.$fill in the blank 3arrow_forwardMorning Company reports the following information for March: E (Click the icon to view the data.) Read the requirements. Requirement 1. Calculate the gross profit and operating income for March using absorption costing. Morning Company Income Statement (Absorption Costing) For the Month Ended March 31 Data Table Net Sales Revenue 67,850 Variable Cost of Goods Solłd 19,300 Operating income Fixed Cost of Goods Sold 8,400 Variable Selfing and Administrative Costs 16,500 Requirements Fixed Selling and Administrative Costs 3,800 1. Calculate the gross profit and operating income for March using absorption costing. 2. Calculate the contribution margin and operating income for March using variable costing. Print Donearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education