MACROECONOMICS

14th Edition

ISBN: 9781337794985

Author: Baumol

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Please give each parts answer and take a like

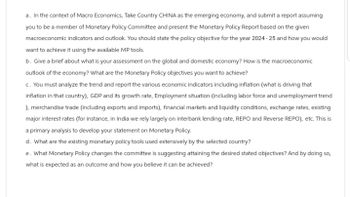

Transcribed Image Text:a. In the context of Macro Economics, Take Country CHINA as the emerging economy, and submit a report assuming

you to be a member of Monetary Policy Committee and present the Monetary Policy Report based on the given

macroeconomic indicators and outlook. You should state the policy objective for the year 2024-25 and how you would

want to achieve it using the available MP tools.

b. Give a brief about what is your assessment on the global and domestic economy? How is the macroeconomic

outlook of the economy? What are the Monetary Policy objectives you want to achieve?

c. You must analyze the trend and report the various economic indicators including inflation (what is driving that

inflation in that country), GDP and its growth rate, Employment situation (including labor force and unemployment trend

), merchandise trade (including exports and imports), financial markets and liquidity conditions, exchange rates, existing

major interest rates (for instance, in India we rely largely on interbank lending rate, REPO and Reverse REPO), etc. This is

a primary analysis to develop your statement on Monetary Policy.

d. What are the existing monetary policy tools used extensively by the selected country?

e. What Monetary Policy changes the committee is suggesting attaining the desired stated objectives? And by doing so,

what is expected as an outcome and how you believe it can be achieved?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- b. How do fiscal and monetary policies differ in their approaches to managing the economy during periods of recession? Provide examples of each policy tool.arrow_forwardOn June 5, 2003, the European Central Bank acted to decreasethe short-term interest rate in Europe by half a percentagepoint, to 2 percent. The bank’s president at the time, WillemDuisenberg, suggested that, in the future, the bank could reducerates further. The rate cut was made because European coun-tries were growing very slowly or were in recession. What effectdid the bank hope the action would have on the economy? Bespecific. What was the hoped-for result on C, I, and Y?arrow_forwardWhich of the following would be classed as an expansionary monetary policy? Ο Α. A decrease in the quantity of money. ОВ. A decrease in interest rates. C. An increase in government taxation. O D. An increase in government expenditure. O E. An increase in VAT.arrow_forward

- Imagine that you run the central bank in a large open economy.Your goal is to stabilizeincome, and you adjust the money supply accordingly. Under your policy, what happens tothe money supply, the interest rate, the exchange rate, and the trade balance in response toeach of the following shocks?a. The president raises taxes to reduce the budget deficit.b. The president restricts the import of Japanese cars.arrow_forwarddo question e d f thank youarrow_forwardSelect all that are true given an acceleration of economic growth in the Brazilian economy: A. Long term investors would invest in the Brazilian economy, but only if the structural aspects of its economy support it (e.g. fiscal policy & the rule of law) and this would depreciate the currency B. The domestic currency (the Real) would depreciate as foreign investors seek higher returns at lower risk in Brazil. C. Contractionary monetary policy would appreciate the domestic currency due to the lower risk, ceteris paribus. D. The domestic interest rate would increase as the demand for loanable funds is pro-cyclical Detailedly Explanation Please, Thank you!arrow_forward

- Select all that are true given an acceleration of economic growth in the Brazilian economy: A.Long term investors would invest in the Brazilian economy, but only if the structural aspects of its economy support it (e.g. fiscal policy & the rule of law) and this would depreciate the currency B.The domestic currency (the Real) would depreciate as foreign investors seek higher returns at lower risk in Brazil. C.Contractionary monetary policy would appreciate the domestic currency due to the lower risk, ceteris paribus. D.The domestic interest rate would increase as the demand for loanable funds is pro-cyclicalarrow_forwardHi, can I please get help with the picture in the attachements its true and false. I’m not so good at reading and comprehension and understanding the meaning. Here’s the link 2 incase: https://sites.google.com/a/macmillan.com/news-analysis/japan-recession-europe-stagnation-cast-pall-over-global-economic-outlookarrow_forwardPlease help me with this macroeconomic question 4!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax