Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:5:42

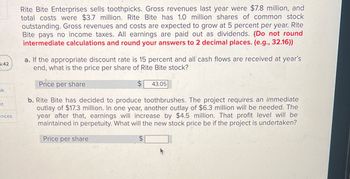

Rite Bite Enterprises sells toothpicks. Gross revenues last year were $7.8 million, and

total costs were $3.7 million. Rite Bite has 1.0 million shares of common stock

outstanding. Gross revenues and costs are expected to grow at 5 percent per year. Rite

Bite pays no income taxes. All earnings are paid out as dividends. (Do not round

intermediate calculations and round your answers to 2 decimal places. (e.g., 32.16))

a. If the appropriate discount rate is 15 percent and all cash flows are received at year's

end, what is the price per share of Rite Bite stock?

Price per share

$ 43.05

ok

ht

ences

b. Rite Bite has decided to produce toothbrushes. The project requires an immediate

outlay of $17.3 million. In one year, another outlay of $6.3 million will be needed. The

year after that, earnings will increase by $4.5 million. That profit level will be

maintained in perpetuity. What will the new stock price be if the project is undertaken?

Price per share

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You have found an investment opportunity that will provide annual cash flows of $1,234 for 5 years and costs $6789 today. If the required return is 12%, what is the profitability index for this opportunity?arrow_forwardDevelopment costs of a new product are estimated to be $100,000 per year for five years. Annual profits from the sale of the product, estimated to be $75,000, will begin in the fourth year and each year they will increase by ($10,000 + $10,000*4) through year 15. Compute the present value using an interest rate of 10%. Draw a cashflow diagram.arrow_forwardIncognito Company is contemplating the purchase of a machine that provides it with cash savings of $93,000 per year for five years. Interest is 11%. Assume the cash savings.occur at the end of each year. Required: Calculate the present value of the cash savings. Note: Use tables, Excel, or a financial calculator. Round your final answer to the nearest whole dollar. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Present valuearrow_forward

- Pendleton Products has a project requiring an initial cash investment of $3,100. The project is expected to return $1,000 each period for the next 5 periods, and it has a discount rate of 4%.1. Determine how long it will take, if at all, for the project to have a positive payback.Present value formula:arrow_forwardNPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 33,000, with an annual growth rate of 4.00% over the next ten years. The sales price per unit will start at $41.00 and will grow at 2.00% per year. The production costs are expected to be 55% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,100,000. It will be depreciated using MACRS, and has a seven-year MACRS life classification. Fixed costs will be $360,000 per year. Miglietti Restaurants has a tax rate of 40%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $140,000 at the end of the ten-year project and the cost of capital for this project is 8%. MACRS Fixed Annual Expense Percentages by Recovery Class Year 3-Year…arrow_forwardVishanoarrow_forward

- A firm is considering a new inventory system that will cost $120,000. The system is expected to generate positive cash flows over the next four years in the amounts of $35,000 in year 1, $55,000 in year 2, $65,000 in year 3, and $40,000 in year 4. The firm’s required rate of return is 9%. What is the payback period of this project? 1.95 years 2.46 years 2.99 years 3.10 years Based on the information from Question 47. What is the net present value (NPV) of the project? $28,830.29 $30,929.26 $36,931.43 $39,905.28 Based on the information from Question 47, what is the internal rate of return (IRR) of this project? 14.03% 17.56% 19.26% 21.78% Based on the information from Question 47, what is the profitability index (PI) of this project? 0.87 1.11 1.31 1.83.arrow_forwardNPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 34,000 , with an annual growth rate of 4.00% over the next ten years. The sales price per unit will start at $45.00 and will grow at 2.00% per year. The production costs are expected to be 55% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,400,000. It will be depreciated using MACRS, 囲, and has a seven-year MACRS life classification. Fixed costs will be $360,000 per year. Miglietti Restaurants has a tax rate of 359 /hat is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $140,000 at the end of the ten-year project and the cost of capital for this project is 7%. What is the operating cash flow for this project in year 1 ? (Round to the nearest dollar.) Data table MACRS…arrow_forwardNikularrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education