Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

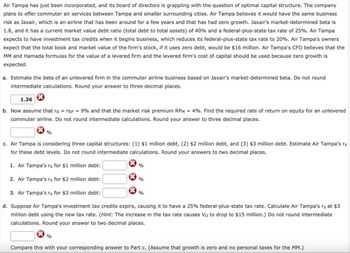

Transcribed Image Text:Air Tampa has just been incorporated, and its board of directors is grappling with the question of optimal capital structure. The company

plans to offer commuter air services between Tampa and smaller surrounding cities. Air Tampa believes it would have the same business

risk as Jaxair, which is an airline that has been around for a few years and that has had zero growth. Jaxair's market-determined beta is

1.8, and it has a current market value debt ratio (total debt to total assets) of 40% and a federal-plus-state tax rate of 25%. Air Tampa

expects to have investment tax credits when it begins business, which reduces its federal-plus-state tax rate to 20%. Air Tampa's owners

expect that the total book and market value of the firm's stock, if it uses zero debt, would be $16 million. Air Tampa's CFO believes that the

MM and Hamada formulas for the value of a levered firm and the levered firm's cost of capital should be used because zero growth is

expected.

a. Estimate the beta of an unlevered firm in the commuter airline business based on Jaxair's market-determined beta. Do not round.

intermediate calculations. Round your answer to three decimal places.

1.36

b. Now assume that rd = TRF = 9% and that the market risk premium RPM = 4%. Find the required rate of return on equity for an unlevered

commuter airline. Do not round intermediate calculations. Round your answer to three decimal places.

%

c. Air Tampa is considering three capital structures: (1) $1 million debt, (2) $2 million debt, and (3) $3 million debt. Estimate Air Tampa's rs

for these debt levels. Do not round intermediate calculations. Round your answers to two decimal places.

1. Air Tampa's rs for $1 million debt:

2. Air Tampa's rs for $2 million debt:

3. Air Tampa's rs for $3 million debt:

d. Suppose Air Tampa's investment tax credits expire, causing it to have a 25% federal-plus-state tax rate. Calculate Air Tampa's rs at $3

million debt using the new tax rate. (Hint: The increase in the tax rate causes Vu to drop to $15 million.) Do not round intermediate

calculations. Round your answer to two decimal places.

%

%

%

%

Compare this with your corresponding answer to Part c. (Assume that growth is zero and no personal taxes for the MM.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- if a firm has had sales which have been extremely variable, the firm should Question 1 options: project COGS instead. begin by projecting cash. forgo projections. forecast dividends first. create multiple forecasts.arrow_forwardQuantitative Problem: You are given the following probability distribution for CHC Enterprises: State of Economy Probability Rate of return Strong 0.15 20 % Normal 0.55 9 % Weak 0.30 -5 % What is the stock's expected return? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwarda. Fill in the missing values in the table. (Leave no cells blank - be certain to enter O wherever required. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Security Firm A Expected Return Standard Deviation Correlation Beta 0.119 0.22 0.95 Firm B 0.131 0.41 1.50 Firm C 0.112 0.75 0.26 The market portfolio 0.12 0.19 The risk-free asset 0.05 * With the market portfolio b-1. What is the expected return of Firm A? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected return %arrow_forward

- 6) An investor holds a portfolio of stocks and is considering investing in the DBB Company. The firm's prospects look neutral, and you estimate the following probability distribution of possible returns: Conditions Recession P Returns on DBB Returns on DVI 0.12 -33% -12% Below Average 0.15 -18% 7% Average 0.46 12% 11% Above Average 0.15 25% 23% Boom 0.12 37% 25% a) How much is the expected return for DBB? b) How much is the coefficient of variation for DBB? c) Now let's say you want to add another asset, DVI, to your portfolio. You sell 35% of DBB to purchase DVI. How much is your expected return for this portfolio? d) How much is the coefficient of variation for the new portfolio?arrow_forwardSuppose the market portfolio has an expected return of 10% and a volatility of 20%, while Microsoft’s stock has a volatility of 30%. Microsoft’s equity cost of capital is 10%. Based on this information, which statement is most likely to be correct? (assume that all assumptions of CAPM are satisfied) Group of answer choices Microsoft’s beta is lower than 1. There is not enough information to determine Microsoft’s beta. Microsoft’s beta is 1. Microsoft’s beta is higher than 1.arrow_forwardDogarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education