FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

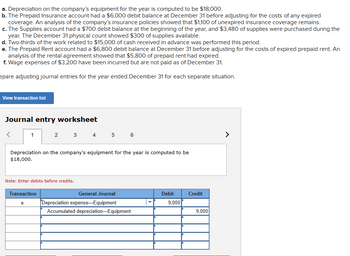

Transcribed Image Text:a. Depreciation on the company's equipment for the year is computed to be $18,000.

b. The Prepaid Insurance account had a $6,000 debit balance at December 31 before adjusting for the costs of any expired

coverage. An analysis of the company's insurance policies showed that $1,100 of unexpired insurance coverage remains.

c. The Supplies account had a $700 debit balance at the beginning of the year, and $3,480 of supplies were purchased during the

year. The December 31 physical count showed $300 of supplies available.

d. Two-thirds of the work related to $15,000 of cash received in advance was performed this period.

e. The Prepaid Rent account had a $6,800 debit balance at December 31 before adjusting for the costs of expired prepaid rent. An

analysis of the rental agreement showed that $5,800 of prepaid rent had expired.

f. Wage expenses of $3,200 have been incurred but are not paid as of December 31.

epare adjusting journal entries for the year ended December 31 for each separate situation.

View transaction list

Journal entry worksheet

3

1

2

Depreciation on the company's equipment for the year is computed to be

$18,000.

Note: Enter debits before credits.

Transaction

a.

4 5 6

General Journal

Depreciation expense-Equipment

Accumulated depreciation-Equipment

Debit

9,000

Credit

9,000

>

Expert Solution

arrow_forward

Step 1

Adjusting entries are the kind of journal entries prepared at year-end to adjust the accounts. These entries are mostly made to recognize expenses and revenue at the end of the year.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Chuck Company purchases performs a major inspection on its machinery on 1 January 20X4 for $137,000. The company uses the straight-line method of depreciation. The company performs major inspections every 5 years. The bookkeeper erroneously expenses the entire amount to repairs and maintenance. The error is discovered at the end of 20X5. Required: Prepare the journal entry required in 20X5arrow_forwardAllyn Company purchased equipment costing $55,000 on January 1, Year 1. The equipment is estimated to have a salvage value of $5,000 and an estimated useful life of 5 years. Double-declining-depreciation is used, and all depreciation has been recorded as of December 31, Year 2. If the equipment is sold on December 31, Year 2 for $15,000, the journal entry to record the sale is: A.Debit Cash, $15,000; Debit Accumulated Depreciation, $22,000; Debit Loss on Sale, $18,000; Credit Equipment, $55,000. B. Debit Cash, $15,000; Debit Accumulated Depreciation, $13,200; Debit Loss on Sale, $26,800; Credit Equipment, $55,000. C. Debit Cash, $15,000; Debit Accumulated Depreciation, $35,200; Debit Loss on Sale, $4,800; Credit Equipment, $55,000. D. Debit Cash, $15,000; Debit Accumulated Depreciation, $40,000; Credit Equipment, $55,000. E. Debit Cash, $15,000; Debit Loss on Sale, $40,000; Credit Equipment, $55,000.arrow_forwardOn January 1, Year 2, Webb Construction Company overhauled four cranes resulting in a slight increase in the life of the cranes. Such overhauls occur regularly at two-year intervals and have been treated as maintenance expense in the past. Management is considering whether to capitalize this year's $28,310 cash cost expense. Assume that the cranes have a remaining useful life of two years and no expected salvage value. Assume straight-line depreciation. the Cranes asset account or to expense it as a maintenance Required a. Determine the amount of additional depreciation expense Webb would recognize in Year 2 and Year 3 if the cost were capitalized in the Cranes account. b. Determine the amount of expense Webb would recognize in Year 2 and Year 3 if the cost were recognized as maintenance expense. c. Determine the effect of the overhaul on cash flow from operating activities for Year 2 and Year 3 if the cost were capitalized and expensed through depreciation charges. (Cash outflows…arrow_forward

- On January 2, Bering Company disposes of a machine costing $47,800 with accumulated depreciation of $25,749. Prepare the entries to record the disposal under each separate situation. The machine is sold for $18,494 cash. The machine is traded in for a new machine having a $64,300 cash price. A $22,762 trade-in allowance is received, and the balance is paid in cash. Assume the asset exchange has commercial substance. The machine is traded in for a new machine having a $64,300 cash price. A $17,072 trade-in allowance is received, and the balance is paid in cash. Assume the asset exchange has commercial substance.arrow_forwardOn January 2, Alexander Company paid $21,600 to purchase equipment that has a useful life of 6 years. The equipment will be depreciated equally over the 6- year period as depreciation expense. The cost of $21,600 is divided by the useful life of 6 years to determine the amount of the yearly depreciation expense of $3,600. If the appropriate adjusting entry is not made at the end of the year, what will be the effect on: (a) Income statement accounts (overstated, understated, or no effect)? (b) Net income (overstated, understated, or no effect)? E Aa (c) Balance sheet accounts (overstated, understated, or no effect)? Income Statement Accounts Choose One O Choose One Choose One O Balance Sheet Accounts Ⓒ2022 McGraw Hill LLC. All Rights Reserved. Terms of Use | Privacy Center (3) (1) DII DD F10 F8 Revenue: Expense: Net Income: Assets: Liabilities: Retained Earnings: Explanation :0 F1 Choose One O Choose One C Choose One X Start over do Check F2 ? 80 F3 000 000 F4 F5 MacBook Air F6 A F7 F9…arrow_forwardWillow Creek Company purchased and installed carpet in its new general offices on April 30 for a total cost of $18,000. The carpet is estimated to have a 15-year useful life and no residual value.a. Prepare the journal entry necessary for recording the purchase of the new carpet.b. Record the December 31 adjusting entry for the partial-year depreciation expense for the carpet, assuming that Willow Creek Company uses the straight-line method.arrow_forward

- On December 31, Strike Company sold one of its batting cages for $12,489. The equipment had an initial cost of $427,900 and has accumulated depreciation of $406,505. Depreciation has been recorded up to the end of the year. What is the amount of the gain or loss on this transaction? a.Loss of $12,489 b.Loss of $8,906 c.Gain of $8,906 d.Gain of $12,489arrow_forwardAn asset's book value is $18,700 on December 31, Year 5. The asset has been depreciated at an annual rate of $3,700 on the straight-line method. Assuming the asset is sold on December 31, Year 5 for $15,700, the company should recordarrow_forwardRequired information [The following information applies to the questions displayed below.] a. Depreciation on the company's wind turbine equipment for the year is $5,300. b. The Prepaid Insurance account for the solar panels had a $2,300 debit balance at December 31 before adjusting for the costs of any expired coverage. Analysis of prepaid insurance shows that $750 of unexpired insurance coverage remains at year-end. c. The company received $3,900 cash in advance for sustainability consulting work. As of December 31, one-third of the sustainability consulting work had been performed. d. As of December 31, $1,500 in wages expense for the organic produce workers has been incurred but not yet paid. e. As of December 31, the company has earned, but not yet recorded, $430 of interest revenue from investments in socially responsible bonds. The interest revenue is expected to be received on January 12. or each of the above separate cases, prepare the required December 31 year-end adjusting…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education