FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

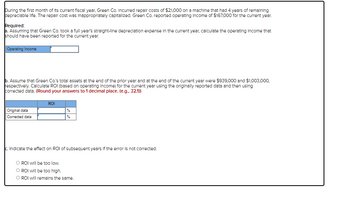

Transcribed Image Text:During the first month of its current fiscal year, Green Co. Incurred repair costs of $21,000 on a machine that had 4 years of remaining

depreciable life. The repair cost was inappropriately capitalized. Green Co. reported operating Income of $167,000 for the current year.

Required:

a. Assuming that Green Co. took a full year's straight-line depreciation expense in the current year, calculate the operating Income that

should have been reported for the current year.

Operating Income

b. Assume that Green Co.'s total assets at the end of the prior year and at the end of the current year were $939,000 and $1,003,000,

respectively. Calculate ROI (based on operating Income) for the current year using the originally reported data and then using

corrected data. (Round your answers to 1 decimal place. (e.g.. 32.1))

Original data

Corrected data

ROI

c. Indicate the effect on ROI of subsequent years if the error is not corrected.

O ROI will be too low.

O ROI will be too high.

O ROI will remains the same.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blue Co. purchased equipment on October 4, 20X1 at a cost of $63,000. The equipment has an estimated useful life of 4 years and an estimated salvage value of $3,000. Blue Co. uses the straight-line depreciation method. Blue Co.’s fiscal year-end is December 31. Assuming Blue Co. uses the half-year convention, what was the accumulated depreciation as of December 31, 20X2? (Round all results to the nearest whole dollar.) a. $30,000 b. $22,500 c. $15,000 d. $7,500arrow_forward> Computer equipment was acquired at the beginning of the year at a cost of $29,375 that has an estimated residual value of $1,800 and an estimated useful life of 5 years. a. Determine the depreciable cost. b. Determine the double-declining-balance rate. % c. Determine the double-declining-balance depreciation for the first year. LA ?arrow_forwardOn January 1, Year 2, Webb Construction Company overhauled four cranes resulting in a slight increase in the life of the cranes. Such overhauls occur regularly at two-year intervals and have been treated as maintenance expense in the past. Management is considering whether to capitalize this year's $28,310 cash cost expense. Assume that the cranes have a remaining useful life of two years and no expected salvage value. Assume straight-line depreciation. the Cranes asset account or to expense it as a maintenance Required a. Determine the amount of additional depreciation expense Webb would recognize in Year 2 and Year 3 if the cost were capitalized in the Cranes account. b. Determine the amount of expense Webb would recognize in Year 2 and Year 3 if the cost were recognized as maintenance expense. c. Determine the effect of the overhaul on cash flow from operating activities for Year 2 and Year 3 if the cost were capitalized and expensed through depreciation charges. (Cash outflows…arrow_forward

- At the beginning of Year 1, Copeland Drugstore purchased a new computer system for $52,000. It is expected to have a five-year life and a $7,000 salvage value. Required a. Compute the depreciation for each of the five years, assuming that the company uses (1) Straight-line depreciation. (2) Double-declining-balance depreciation. b. Record the purchase of the computer system and the depreciation expense for the first year under straight-line and double- declining-balance methods in a financial statements model. Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B Compute the depreciation for each of the five years, assuming that the company uses straight-line depreciation.arrow_forwardA storage tank acquired at the beginning of the fiscal year at a cost of $95,000 has an estimated residual value of $5,000 and an estimated useful life of 25 years. a. Determine the amount of annual depreciation by the straight-line method.$ b. Determine the amount of depreciation for the first and second years computed by the double-declining-balance method. Do not round the double-declining balance rate. If required, round your answers to the nearest dollar. Depreciation Year 1 $ Year 2 $arrow_forwardA Kubota tractor acquired on January 8 at a cost of $54,000 has an estimated useful life of 10 years. Assuming that it will have no residual value. a. Determine the depreciation for each of the first two years by the straight-line method. First Year Second Year $ b. Determine the depreciation for each of the first two years by the double-declining-balance method. Do not round the double-declining balance rate. If required, round your final answers to the nearest dollar. First Year Second Yeararrow_forward

- am. 116.arrow_forward34. Subject : - Accounting In 20X4, Fredup Inc. purchased a piece of equipment for $21,000. The equipment has a 7-year useful life and no residual value. The equipment was erroneously included as an expense in the year. The error was discovered in December 20X8. Required: Prepare the journal entry to record the adjustment in December 20X8. (Assume the company uses straight line depreciation, ignore taxes.)arrow_forwardData, Inc., purchased and placed in service $5,000 of office furniture on August 24, year 3. This is the only asset purchase during the year. Code § 179 expensing and bonus depreciation were not elected. Using the excerpt of the MACRS half-year convention table below, what is the MACRS depreciation in year 3 for the office furniture? Recovery Period 5-Year 7-Year 10-Year 1 20% 14.29% 10% 2 32% 24.49% 18% 3 19.2% 17.49% 14.4% If required, round your answer to the nearest dollar.arrow_forward

- Noah Corp., a calendar year-end company, purchased equipment on 1/1/X1 with the following attributes: Cost $ 25,000 Salvage Value $ 2,000 Useful life 4 years Assuming that Duncan uses the double-declining balance (DDB) depreciation method, answer the following question:Question: How much depreciation expense should be recorded in 20X4 (year four of the asset's life)? Answer- $ ___arrow_forward9. A company purchased and installed equipment on January 1 at a total cost of $72,000. Straight-line depreciation was calculated based on the estimate of a five-year life and no salvage value. The equipment was disposed of on January 1 of the fourth year. The company uses the calendar year. Prepare the general journal entry to record the disposal of the equipment under each of these independent situations: a. The equipment was sold for $29,000 cash. b. The equipment was sold for $21,000 cash.arrow_forwardComputer equipment was acquired at the beginning of the year at a cost of $59,800 that has an estimated residual value of $4,200 and an estimated useful life of five years. Determine the (a) depreciable cost, (b) straight-line rate, and (c) annual straight-line depreciation. a. Depreciable cost $fill in the blank 1 b. Straight-line rate fill in the blank 2 % c. Annual straight-line depreciationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education