FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

A. Cost of goods sold is 48.57% of net sales for 2017

B. Net Sales increased $80 000 or 33.63% during 2017

C. Accounts receivable is 14.89% of total assets for 2016

D. Gross profit is 57.90% of net sales for 2017

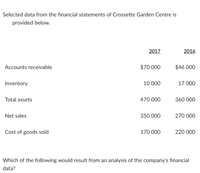

Transcribed Image Text:Selected data from the financial statements of Crossette Garden Centre is

provided below.

2017

2016

Accounts receivable

$70 000

$46 000

Inventory

10 000

17 000

Total assets

470 000

360 000

Net sales

350 000

270 000

Cost of goods sold

170 000

220 000

Which of the following would result from an analysis of the company's financial

data?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1 Condensed financial statements for Games Galore are summarized below: 2 3 Balance Sheet 4 Cash 5 Accounts Receivable, Net 6 Inventory 7 Prepaid Insurance 8 Total Current Assets 9 Property and Equipment, Net 10 Total Assets 11 12 Current Liabilities 13 Long-term Liabilities 14 Total Liabilities 15 Contributed Capital 16 Retained Earnings 17 Total Stockholders' Equity 18 Total Liabilities and Stockholders' Equity 19 20 Income Statement 21 Net Sales (all on account) 22 Cost of Goods Sold 23 Gross Profit 24 Operating Expenses 25 Income from Operations 26 Interest Expense 27 Income before Income Tax Expense 28 Income Tax Expense 29 Net Income 30 READY Attempt(s) Sheet1 $ $ $ $ B $ 2016 185,000 $ 80,000 104,000 11,900 380,900 514,500 895,400 $ 85,300 284,000 369,300 299,000 227,100 526,100 895,400 $ $ 3,031,000 1,949,000 1,082,000 891,400 $ 190,600 14,500 176,100 47,000 129,100 4 C 2015 143,000 59,000 134,000 5,880 341,880 407,000 748,880 96,800 224,000 320,800 299,000 129,080 428,080…arrow_forwardFollowing is an incomplete current-year income statement. Determine Net Sales, Cost of goods sold and Net Income. Additional information follows: Return on total assets is 16% (average total assets is $62,500). Inventory turnover is 5 (average inventory is $7,800). Accounts receivable turnover is 8 (average accounts receivable is $7,700). Income Statement Net Sales Cost of goods sold Selling, general, and administrative expenses 8800 Income tax expenses 3800 Net Incomearrow_forwardComputing and Interpreting Financial Statement Ratios Following are selected ratios of Norfolk Southern for 2018 and 2017. Return on Assets (ROA) Component 2018 2017 Profitability (Net income/Sales) 25.3% 53.2% Productivity (Sales/Average assets) 0.338 0.319 a. Was the company profitable in 2018?Answer b. Was the company more profitable in 2018 or 2017?Answer c. Is the change in productivity a positive or negative development?Answer d. Compute the company’s ROA for 2018 and for 2017. Note: Round answers to one decimal places (example: 10.4%). ROA 2018 Answer 2017 Answer e. From the information provided, which of the following best explains the change in ROA during 2018? Answerarrow_forward

- Suppose the 2022 financial statements of 3M Company report net sales of $23.1 billion. Accounts receivable (net) are $3.2 billion at the beginning of the year and $3.25 billion at the end of the year. Compute 3M’s accounts receivable turnover. - Accounts Recievable turnover ratio=? (times) Compute 3M’s average collection period for accounts receivable in days - Average collection period =? (days)arrow_forwardThe gross profit margin excludes all costs except the cost of goods sold. If Miller Company recorded Net Sales of $17,260 for the month of March 2021, and cost of goods sold of $11,042, what is the company’s gross profit margin for the month of March. 37.4% 36% 39.2% 38.6%arrow_forwardIncome Statement 2009 2010 2011 2012 2013 Revenue 393.3 366.3 428.6 513.7 599.2 Cost of Goods Sold (186.6) (175.8) (205.3) (248.6) (292.6) Gross Profit 206.7 190.5 223.3 265.1 306.6 Sales and Marketing (67.2) (65.8) (82.5) (102.9) (122.5) Administration (59.3) (59.1) (60.2) (67.6) (77.8) Depreciation & Amortization (27.5) (26.7) (36.2) (39.6) (39.2) EBIT 52.7 38.9 44.4 55 67.1 Interest Income (Expense) (34.7) (31.1) (32.9) (38.5) (37.6) Pretax Income 18 7.8 11.5 16.5 29.5 Income Tax (6.3) (2.7) (4.0) (5.8) (10.3) Net Income 11.7 5.1 7.5 10.7 19.2 Shares Outstanding (Millions) 55.5 55.5 55.5 55.5 55.5 Earnings per Share $0.21 $0.09 $0.14 $0.19 $0.35 Balance Sheet 2009 2010 2011 2012 2013 Assets Cash 47.4 66.7 92.8 79.1 89.3 Accounts Receivable…arrow_forward

- The Cullumber Supply Company reported the following information for 2017. Prepare a common-size income statement for the year ended June 30, 2017. (Round answers to 1 decimal place, e.g. 52.7%.) Cullumber Supply CompanyIncome Statement for the Fiscal Year Ended June 30, 2017($ thousands) % of Net Sales Net sales $2,111,000 enter percentages of net sales % Cost of goods sold 1,464,000 enter percentages of net sales % Selling and administrative expenses 312,200 enter percentages of net sales % Nonrecurring expenses 27,600 enter percentages of net sales % Earnings before interest, taxes, depreciation, and amortization (EBITDA) $307,200 enter percentages of net sales % Depreciation 117,000 enter percentages of net sales % Earnings before interest and taxes (EBIT) 190,200 enter percentages of net sales % Interest expense 118,600 enter percentages of net sales % Earnings before taxes (EBT)…arrow_forwardBold Company’s 2016 income statement reported total credit revenue of $250,000. Bold’s accounts receivable balance on January 1, 2016 was $30,000, and its December 31, 2016 accounts receivable balance was $10,000. Bold’s accounts payable balance on January 1, 2016 was $25,000, and its December 31, 2016 accounts payable balance was $35,000. How much did Bold collect from customers during 2016?arrow_forwardIncome Statement 2009 2010 2011 2012 2013 Revenue 393.3 366.3 428.6 513.7 599.2 Cost of Goods Sold (186.6) (175.8) (205.3) (248.6) (292.6) Gross Profit 206.7 190.5 223.3 265.1 306.6 Sales and Marketing (67.2) (65.8) (82.5) (102.9) (122.5) Administration (59.3) (59.1) (60.2) (67.6) (77.8) Depreciation & Amortization (27.5) (26.7) (36.2) (39.6) (39.2) EBIT 52.7 38.9 44.4 55 67.1 Interest Income (Expense) (34.7) (31.1) (32.9) (38.5) (37.6) Pretax Income 18 7.8 11.5 16.5 29.5 Income Tax (6.3) (2.7) (4.0) (5.8) (10.3) Net Income 11.7 5.1 7.5 10.7 19.2 Shares Outstanding (Millions) 55.5 55.5 55.5 55.5 55.5 Earnings per Share $0.21 $0.09 $0.14 $0.19 $0.35 Balance Sheet 2009 2010 2011 2012 2013 Assets Cash 47.4 66.7 92.8 79.1 89.3 Accounts Receivable 87.1 69.6 67.9 76.9 85.2 Inventory 34.7 32.5 28.1 32.8 33.5 Total Current Assets 169.2 168.8 188.8 188.8 208 Net Property, Plant & Equip. 248.8 238.7 312.4 341.9 351.2 Goodwill & Intangibles 358.3 358.3 358.3 358.3 358.3 Total Assets 776.3 765.8…arrow_forward

- Sales Cost of goods sold Accounts receivable Numerator: 2021 $ 446,762 225,881 21,623 Numerator: Compute trend percents for the above accounts, using 2017 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favorable or unfavorable. Numerator: 1 1 1 1 1 1 1 2021: 2020: 2019: 2018: 2017: Is the trend percent for Net Sales favorable or unfavorable? 2020 $ 290,105 146,803 16,913 Trend Percent for Net Sales: 2019 $ 232,084 119,092 15,828 2021: 2020: 2019: 2018: 2017: Is the trend percent for Cost of Goods Sold favorable or unfavorable? Trend Percent for Cost of Goods Sold: 1 Denominator: 7 1 1 1 1 1 I 1 Denominator: Trend Percent for Accounts Receivable: Denominator: 1 1 1 1 2021: 2020: 2019: 2018: 2017: Is the trend percent for Accounts Receivable favorable or unfavorable? 2018 $ 167,570 84,885 9,820 = = = = = = = = = = 2017 $ 128,900 64,450 8,804 = Trend percent Trend percent Trend percent % % % % % % % % % % % % %…arrow_forwardFor 2021, Hamilton Company had Sales of $5,700,000 and Cost of Goods Sold of $3,600,000. For 2020, Hamilton Company had Sales of $4,800,000 and Cost of Goods Sold of $2,900,000. a. What was the Cost of Goods Sold as a percent of Sales for 2021? b. What was the Cost of Goods Sold as a percent of Sales for 2020? c. Did Hamilton show improvement from 2020 to 2021? d. Is this an example of horizontal or vertical analysis?arrow_forwardCalculate average receivable turnoverarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education