FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

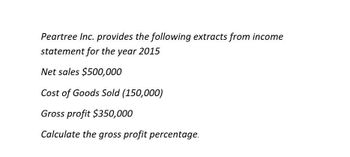

Transcribed Image Text:Peartree Inc. provides the following extracts from income

statement for the year 2015

Net sales $500,000

Cost of Goods Sold (150,000)

Gross profit $350,000

Calculate the gross profit percentage.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- The following information is taken from Allen Corporation's fiscal 2016 annual report. Selected Balance Sheet Data Inventories 2016 $250,000 2015 $200,000 Allen Corporation spent $3,000,000 to purchase and manufacture inventories during its 2016 fiscal year. What is the cost of goods sold for Allen in fiscal year 2016? (Hint: purchase of inventories increase the inventory balance and selling inventories decrease inventory balance).arrow_forwardDetermine the missing data for each letter in the following three income statements for Fulco Company (in thousands): 2014 2013 2012 Sales P 1,144,000 Sales returns and allowances 96,000 76,000 Net sales Q 1,268,000 Merchandise inventory, beginning R 152,000 Purchases 768,000 676,000 Purchases returns and allowances 124,000 68,000 Freight-in Net cost of purchases Cost of goods available for sale Merchandise inventory, ending 116,000 88,000 756,000 K D 888,000 848,000 728,000 156,000 168,000 Cost of goods sold Gross profit 716,000 E 568,000 504,000 Selling expenses 312,000 F General and administrative expenses 156,000 N 132,000 Total operating expenses 520,000 512,000 G Net income V 108,000arrow_forwardUsing the accounts and amounts below, calculate Gross Profit: Account Amount Sales Revenue $124,357 Net Sales 124,835 Sales Returns and Allowances 2,971 Cost of Goods Sold 37,343 Operating Expenses 20,156arrow_forward

- Presented below is selected information for Bramble Company for the month of March 2022. Cost of goods sold $194, 510 Rent expense $32, 720 Freight - out 7,150 Sales discounts 8, 000 Insurance expense 5, 680 Sales returns and allowances 12, 000 Salaries and wages expense 57, 060 Sales revenue 387,000 complete a multistep income statementarrow_forwardFollowing is an incomplete current-year income statement. Determine Net Sales, Cost of goods sold and Net Income. Additional information follows: Return on total assets is 16% (average total assets is $62,500). Inventory turnover is 5 (average inventory is $7,800). Accounts receivable turnover is 8 (average accounts receivable is $7,700). Income Statement Net Sales Cost of goods sold Selling, general, and administrative expenses 8800 Income tax expenses 3800 Net Incomearrow_forwardThe income statement of Sunland Company is shown below. Sunland Company Income Statement For the Year Ended December 31, 2025 Sales revenue $6,930,000 Cost of goods sold Beginning inventory $1,890,000 Purchases 4,410,000 Goods available for sale 6,300,000 Ending inventory 1,590,000 Cost of goods sold 4,710,000 Gross profit 2,220,000 Operating expenses 450,000 Selling expenses 450,000 Administrative expenses 700,000 1,150,000 Net income $1,070,000 1.Accounts receivable decreased $370,000 during the year.2. Prepaid expenses increased $160,000 during the year.3. Accounts payable to suppliers of merchandise decreased $290,000 during the year.4. Accrued expenses payable decreased $90,000 during the year.5. Administrative expenses include depreciation expense of $50,000.Prepare the operating activities section of the statement of cash flows using the direct method.arrow_forward

- A Taste of Akerley has the following financial information. Calculate its gross profit and gross profit margin. 2016 Revenue $500,000 Cost of Sales $350,000arrow_forwardPlease help me with show all calculation thankuarrow_forwardThe following is selected information from Mars Corp. Compute net purchases, and cost of goods sold for the month of March. Inventory, Februray 28, 2018 $450,000 Inventory, March 31, 2018 330,500 Purchase discounts 12,450 Purchase returns and allowances 23,870 sales 276,900 sales discounts 34,660 Gross purchaases 120,400arrow_forward

- Determining Cost of Goods Sold For a recent year, TechMart reported sales of $30,742 million. Its gross profit was $7,071 million. What was the amount of TechMart's cost of goods sold? (Enter answer in millions.)arrow_forwardThe Cullumber Supply Company reported the following information for 2017. Prepare a common-size income statement for the year ended June 30, 2017. (Round answers to 1 decimal place, e.g. 52.7%.) Cullumber Supply CompanyIncome Statement for the Fiscal Year Ended June 30, 2017($ thousands) % of Net Sales Net sales $2,111,000 enter percentages of net sales % Cost of goods sold 1,464,000 enter percentages of net sales % Selling and administrative expenses 312,200 enter percentages of net sales % Nonrecurring expenses 27,600 enter percentages of net sales % Earnings before interest, taxes, depreciation, and amortization (EBITDA) $307,200 enter percentages of net sales % Depreciation 117,000 enter percentages of net sales % Earnings before interest and taxes (EBIT) 190,200 enter percentages of net sales % Interest expense 118,600 enter percentages of net sales % Earnings before taxes (EBT)…arrow_forwardThe income statement of Bob Christiana Company is presented here. BOB CHRISTIANA COMPANY Income Statement For the Year Ended November 30, 2012 Sales revenue $7,700,000 Cost of goods sold Beginning inventory Purchases $1,900,000 4,400,000 Goods available for sale Ending inventory 6,300,000 1,400,000 Total cost of goods sold 4,900,000 Gross profit 2,800,000 Operating expenses 1,150,000 Net income $1,650,000 Additional information: Accounts receivable increased $380,000 during the year, and inventory decreased $250,000. Prepaid expenses increased $170,000 during the year. Accounts payable to suppliers of merchandise decreased $340,000 during the year. Accrued expenses payable decreased $50,000 during the year. Operating expenses include depreciation expense of $110,000. Instructions Prepare the operating activities section of the statement of cash flows for the year ended November 30, 2012, for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education