Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:a.

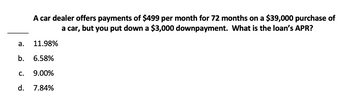

A car dealer offers payments of $499 per month for 72 months on a $39,000 purchase of

a car, but you put down a $3,000 downpayment. What is the loan's APR?

11.98%

b. 6.58%

C. 9.00%

d. 7.84%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Please do not answer this question in excel thank you in advance. A loan of $13,000 at 5.65% annually requires $2,938 interest. For how long is the money borrowed?arrow_forwardBhupatbhaiarrow_forwardTABLE 14.2 Loan amortization table (monthly payment per $1,000 to pay principal and interest on installment loan) Terms in months 6 12 18 24 30 36 42 48 54 60 7.50% $ 170.34 86.76 58.92 45.00 36.66 31.11 27.15 24.18 21.88 20.04 8.00% $ 170.58 86.99 59.15 45.23 36.89 31.34 27.38 24.42 22.12 20.28 8.50% 9.00% $ 170.83 $ 171.20 87.22 87.46 59.37 59.60 45.46 45.69 37.12 37.35 31.57 31.80 27.62 27.85 24.65 24.77 22.36 22.59 20.52 20.76 10.00% $ 171.56 87.92 60.06 46.14 37.81 32.27 28.32 25.36 23.07 21.25 10.50% $ 171.81 88.15 60.29 46.38 38.04 32.50 28.55 25.60 23.32 21.49 11.00% $ 172.05 88.38 60.52 46.61 38.28 32.74 28.79 25.85 23.56 21.74 11.50% $ 172.30 88.62 60.75 46.84 38.51 32.98 29.03 26.09 23.81 21.99 12.00% $ 172.55 88.85 60.98 47.07 38.75 33.21 29.28 26.33 24.06 22.24 12.50% $ 172.80 89.08 61.21 47.31 38.98 33.45 29.52 26.58 24.31 22.50 13.00% $ 173.04 89.32 61.45 47.54 39.22 33.69 29.76 26.83 24.56 22.75 13.50% $ 173.29 89.55 61.68 47.78 39.46 33.94 30.01 27.08 24.81 23.01…arrow_forward

- Loan 1: $200,000 at 4.5% for 30 years, monthly payments, and no origination cost. APR = 4.80% Loan 2: $200,000 at 4.25% for 30 years, monthly payments, and no origination cost. What is the discount point charged on Loan 1 assuming there is no cost associated with the origination? How many points must be charged on the 2nd loan to equalize the APR on the two loans? Please show how to solve using an excel spreadsheetarrow_forwardYou buy a used car for $6,000, taxes included. The dealership offers financing at 6% annual interest, compounded monthly, over 4 years. If your down payment is $1,000, determine your monthly payments.arrow_forwardwhats the answer for 5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education