Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Answer all the 4 requirement, please answer complete otherwise skip it

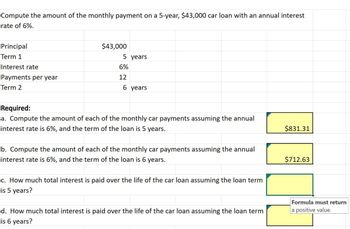

Transcribed Image Text:Compute the amount of the monthly payment on a 5-year, $43,000 car loan with an annual interest

rate of 6%.

Principal

Term 1

Interest rate

Payments per year

Term 2

$43,000

5 years

6%

12

6 years

Required:

a. Compute the amount of each of the monthly car payments assuming the annual

interest rate is 6%, and the term of the loan is 5 years.

b. Compute the amount of each of the monthly car payments assuming the annual

interest rate is 6%, and the term of the loan is 6 years.

c. How much total interest is paid over the life of the car loan assuming the loan term

is 5 years?

d. How much total interest is paid over the life of the car loan assuming the loan term

is 6 years?

$831.31

$712.63

Formula must return

a positive value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Not a previously submitted question. Thank youarrow_forwardPlease answer questions correctlyarrow_forwardAutoSave Off H Document2 - Word P Search (Alt+Q) Sign in File Design References Mailings Review View Help Grammarly Picture Format P Comments A Share Home Insert Draw Layout P Find - - A A Aa v A = - E - E G Times New Roman v 12 Normal No Spacing Heading 1 Replace = = 1E v Editor Open Grammarly Paste BIU I U v - 2. A - ab x, x' A . A Select v Undo Clipboard a Font Paragraph Styles Editing Editor Grammarly a. At the beginning of the year, Addison Company's assets are $200,000 and its equity is $150,000. During the year, assets increase $80,000 and liabilities increase $46,000. What is the equity at year-end? Assets Liabilities Equity Beginning $ 200,000 = 150,000 Change 80,000 = 46,000 + Ending Page 1 of 1 O words Text Predictions: On * Accessibility: Good to go O Focus 110% 9:58 PM P Type here to search 49°F 3/20/2022 近arrow_forward

- How would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardThis question has not been submitted previously. Thank youarrow_forwardred Question 11 4) Listen Use the graphs below to categorize the statements to describe either Graph A or Graph B. 3 Graph A Graph B 0 #12 " 3/2 2x 0 */2 3/2 2 -1 T graph a graph b Add an answer item! Add an answer item! Answer Bank amplitude = 1 midline is y=3 f(x)= cos(x)+3 amplitude =3 f(x)=3sin(x)+1 midline is y=1 All Changearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education