FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

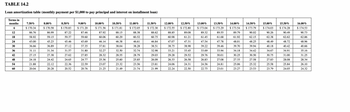

Transcribed Image Text:**TABLE 14.2**

**Loan Amortization Table (Monthly Payment per $1,000 to Pay Principal and Interest on Installment Loan)**

| Terms in Months | 7.50% | 8.00% | 8.50% | 9.00% | 10.00% | 10.50% | 11.00% | 11.50% | 12.00% | 12.50% | 13.00% | 13.50% | 14.00% | 14.50% | 15.00% | 15.50% | 16.00% |

|-----------------|---------|---------|---------|---------|---------|---------|---------|---------|---------|---------|---------|---------|---------|---------|---------|---------|---------|

| 6 | $170.34 | $170.58 | $170.83 | $171.20 | $171.56 | $171.81 | $172.05 | $172.30 | $172.55 | $172.80 | $173.04 | $173.29 | $173.54 | $173.79 | $174.03 | $174.28 | $174.53 |

| 12 | $86.76 | $86.99 | $87.22 | $87.46 | $87.92 | $88.15 | $88.38 | $88.62 | $88.85 | $89.10 | $89.32 | $89.57 | $89.79 | $90.02 | $90.26 | $90.49 | $90.73 |

| 18 | $58.92 | $59.15 | $59.37 | $59.60 | $60.06 | $60.29 | $60.52 | $60.75 | $60.98 | $61.21 | $61.45 | $61.68 | $61.91 | $62.15 | $62.38 | $62.62 | $62.86 |

| 24

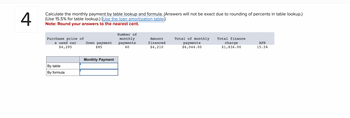

Transcribed Image Text:### Problem 4: Monthly Payment Calculation

Calculate the monthly payment by table lookup and formula. (Answers will not be exact due to rounding of percents in table lookup.)

**Instructions:**

- Use a 15.5% rate for table lookup.

- Utilize the loan amortization table.

- Note: Round your answers to the nearest cent.

#### Given Information:

- **Purchase price of a used car**: $4,295

- **Down payment**: $85

- **Number of monthly payments**: 60

- **Amount financed**: $4,210

- **Total of monthly payments**: $6,044.00

- **Total finance charge**: $1,834.00

- **APR**: 15.5%

#### Monthly Payment Calculation:

| Method | Monthly Payment |

|-----------|-----------------|

| By table | |

| By formula| |

#### Diagram Explanation:

The table demonstrates how to determine the monthly payment using two methods:

1. **By Table**: Using the amortization table at a 15.5% rate.

2. **By Formula**: Using the standard loan payment calculation formula.

Ensure to fill in the empty fields with the correct monthly payment values from your calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- W - 2... History S Bookmarks Window Help SA D21 5.3 Amortized Loans... What will the monthly payment be? Sarah negotiated a price of $25,590.00 for a new Toyota Camry Hybrid Sedan. She is prepared to give a down payment of 17%. Her credit union offered her a 6-year amortized loan for the remaining amount at a rate of 1.8%. How much money will be paid in interest? How much will the car cost, in total? $ D21 Chapter 5.3 - 21516... www d2l.pima.edu CHECK ANSWER LG My Courses - Lookin... If she got a simple interest loan at the same interest rate and time, how much would she pay in interest? LG Academics - Looking...arrow_forwardFor the Questions 3-5 assume you want to finance (borrow) $12,000 for your next car and your interest rate will be 6%. 3. What will be your monthly payment and the total amount paid over the life of the loan if you finance for 48 months? Provide the car payment and the TVM inputs you used to calculate the payment. Рayment Total of all payments PV FV RATE/INTEREST PERIODS/N (See next page for Questions 4 and 5)arrow_forwardGmail News Translate Post Attendee - Zo... A new car costing $28,000 can be financed with a four-year loan at 6.12%. A three-year-old model of the same car costs $16,000 and is financed with a four-year loan at 6.86% with monthly payments of $382.10. Use the present value of an annuity formula to find the difference in monthly payments between financing the new car and the used car. Rund to the nearest cent. ni pmt 1 P- $ 282.58 O$ 277.02 O$ 382.10 O$ 166.11arrow_forward

- Calculate the principal portion of the second payment on the required on an amortized loan annual interest rate of 8.25% for 20 years. finance the purchase of a new home priced at $99,757.57 assuming the O A. $165.30 O B. $174.17 OC. $175.30 O D. $164.17 Click to select your answer. tUs /- MacBook Air 888 F4 14 F7 F1 F3 FS F6 II 4) F9 F10 F11 @ 2$ 4 23 & 2 6. 0. R Y P. S D F H. J K B alt command +arrow_forwardAnswer all the 4 requirement, please answer complete otherwise skip itarrow_forwardCompute the monthly payment and the total amount spent for a vehicle that costs $24,000 if you finance the entire purchase over 5 years at an annual rate of 8 25 percent. Calculate the payment if you finance the car for only four years. Finally, calculate the payment for three years. What do you notice about the payment under the different time assumptions? Note: Round intermediate computations to at least five (5) decimal places Click on the table icon to view the MILPF table The monthly payment, PMT, on the 5-year auto loan is $ (Round to the nearest cent.) The total amount spent if you financed $24,000 for 5 years at 8 25 percent per year is $ (Round to the nearest cent.) The monthly payment, PMT, on the 4-year auto loan is $ (Round to the nearest cent.) Finally, the monthly payment, PMT, on the 3-year auto loan is $ (Round to the nearest cent.) What do you notice about the payment under the different time assumptions? (Select the best choice below.) OA. As the number of payments…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education