ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

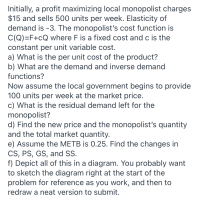

Transcribed Image Text:a) What is the per unit cost of the product?

b) What are the demand and inverse demand

functions?

Now assume the local government begins to provide

100 units per week at the market price.

c) What is the residual demand left for the

monopolist?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A monopolist can produce at constant average and marginal costs of AC = MC = 5. The firm faces a market demand curve given by Q = 53 - P. The monopolist’s marginal revenue curve is given by MR = 53 – 2Q a. Calculate the profit-maximizing price-quantity combination for the monopolist. Also calculate the monopolist’s profits and consumer surplus. b. What output level would be produced by this industry under perfect competition (where price = marginal cost) ? c. Calculate the consumer surplus obtained by consumers in part b. Show that this exceeds the sum of the monopolist’s profits and consumer surplus received in part a. What is the value of the “deadweight loss” from monopolization?arrow_forwardInitially, a profit maximizing local monopolist charges $15 and sells 500 units per week. Per unit variable cost is $10. Now assume the local government begins to provide 100 units per week at the market price. As a result, the market price falls to $13 and the quantity sold by the monopolist falls to 430. a) Find the changes in Consumer surplus , Producer surplus , and Government surplus created by the monopoly. b) Assume the METB (marginal excess tax burden)is 0.25. Find the changes in SS. c) Depict all of this in a diagram.arrow_forwardThe following is information for a perfectly price discriminating monopolist. Demand: P = 87 - 0.021Q %3D Marginal cost = 10 + 0.029Q Calculate the producer surplus for the monopolist at their optimal quantity. Answer: 59290arrow_forward

- You own a road resurfacing business called Dahyun Bricks services located in Seoul. You are the only reservicing business in South Korea. Therefore, you have a local monopoly. Your experience running the company for many years has taught you that market demand for your service can be described by the demand function: p = 20 - Q. The cost function is c =q². Therefore, marginal cost equals 2q. Quantity refersto square metre of road resurfacing. Note the Q denotes aggregate market demand and q denotes your production. Of course, if you are the only supplier than q = Q. a) Compute profit maximising price and output. Compute profits. b) The monopoly profit that you have been earning has attracted attention from another firm that will set up operations in South Koreaand compete for market share. You are concerned with losing market share and profit. So, you offer the potential entrant the following deal. Both firms agree to maximise industry profits (joint profits). The potential entrant…arrow_forwardA firm is originally operating as a single-price monopolist that faces a market demand curve P(Q) = 198 –0 and total cost curve equal to TC (q) = 10, 500 + 32Q, with constant MC equal to MC(Q) = 32 for all units produced. Part (a): How much output does the firm produce and at what price is each unit sold for? Part (b): Calculate the firm's profit. The firm now realizes there are actually two distinct groups of consumers that purchase their product, with the following demand functions: P(q1) = 242 – qı P(q2) = 176 – 92 Their total and marginal cost curves have not changed. If the firm wanted to successfully practice third-degree price discrimination: Part (c): How many units of output would they sell to group 1 and how much will each consumer in group 1 pay? Part (d): How many units of output would they sell to group 2 and how much will each consumer in group 2 pay? Part (e): How much profit is earned by the firm when they practice third-degree price discrimination? Part (f): How much…arrow_forwardQuestion 2. A monopolist sells the same product at the same price into two different markets. The demand for the product in market #1 is denoted D₁ (p) = 30 - 2p where p is the unit price. The demand for the product in market #2 is given by D₂ (p) = 80 - 3p. (a) If the monopolist sets a price of $20 per unit, what is the total demand? (b) Explain why elasticity of total demand is not defined at a unit price of $15.arrow_forward

- A monopolist faces an inverse demand curve P(q) = 28 – 3q. The cost curve is C(q) = 10q. What is deadweight loss in this market? (a) DWL = 3 (b) DWL = 27/2 (c) DWL = 19 (d) DWL = 27 (e) None of the above.arrow_forwardPlease answer question d, e and farrow_forwardQUESTION 3 A monopolist has a cost function of c(x) = x so that its marginal cost is constant at $1 per unit. It faces the following demand curve: D(p) = {100/p 100/p if p > 20 if p ≤ 20 A. What is the profit-maximizing choice of output/price for the monopolist? Graphically represent the monopoly market. B. If the government sets a price ceiling on the monopolist in order to force it to act as a competitor, what price should the government set? C. What output would the monopolist produce if forced to behave as a competitor? D. Based on the information in parts A - C, find the consumer-, producer-, and social surpluses before and after the government intervention.arrow_forward

- (a) A monopolist has discovered that the inverse demand function of a person with income Y for the monopolist’s product is P = 0.002Y-Q where P is the price, Y the income, and Q is the output. The monopolist can observe the incomes of its consumers and hence vary its price accordingly. The monopolist has a total cost function C(Q) = 100Q. Calculate the profit maximising price as a function of the consumer’s income Y carefully explaining all the steps in the derivation of the formula. (b) A monopolist has a constant marginal cost of £2 per unit and no fixed costs. He faces two separate markets in the United States and in the UK. The goods sold in one market are never resold in the other. He sets one price P1 for the US market and another price P2 for the UK market (both measured in £). The demand in the United States is given by Q1=7,000-700P1 and the demand in the UK is given by Q2=1,200-200P1. Calculate the profit maximising output produced and price charged in each country by the…arrow_forwarda) Find and highlight the consumer surplus in the monopoly in the diagram.b) Draw a possible marginal cost curve for the monopolist into the diagram that is consistentwith all the other curves that are already given. c) Based on the marginal cost curve that you constructed in part (b), find and highlight themonopolist’s total costs at the monopoly price in the diagram. d) Briefly (200 words max) explain the shape of the marginal revenue curve as compared tothe demand curve in the diagram.arrow_forwardSubpart 7arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education