Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General accounting

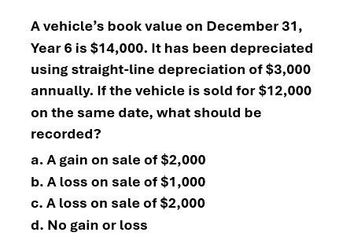

Transcribed Image Text:A vehicle's book value on December 31,

Year 6 is $14,000. It has been depreciated

using straight-line depreciation of $3,000

annually. If the vehicle is sold for $12,000

on the same date, what should be

recorded?

a. A gain on sale of $2,000

b. A loss on sale of $1,000

c. A loss on sale of $2,000

d. No gain or loss

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Albany Corporation purchased equipment at the beginning of Year 1 for 75,000. The asset does not have a residual value and is estimated to be in service for 8 years. Calculate the depreciation expense for Years 1 and 2 using the double-declining-balance method. Round to the nearest dollar.arrow_forwardWhich of the following is not true about the MACRS depreciation system: A salvage value must be determined before depreciation percentages are applied to depreciable real estate. Residential rental buildings are depreciated over 27.5 years straight-line. Commercial real estate buildings are depreciated over 39 years straight-line. No matter when during the month depreciable real estate is purchased, it is considered to have been placed in service at mid-month for MACRS depreciation purposes.arrow_forwardAn asset's book value is $18,000 on December 31, Year 5. The asset has been depreciated at an annual rate of $3,000 on the straight-line method. Assuming the asset is sold on December 31, Year 5 for $15,000, the company should record: A. A loss on sale of $12,000. B. A gain on sale of $12,000. C. Neither a gain nor a loss is recognized on this transaction. D. A gain on sale of $3,000. E. A loss on sale of $3,000.arrow_forward

- An asset's book value is $18,200 on December 31, Year 5. The asset has been depreciated at an annual rate of $3,200 on the straight-line method. Assuming the asset is sold on December 31, Year 5 for $15,200, the company should record: A). A loss on sale of $1,800. B). A loss on sale of $3,000. C). A gain on sale of $1,800. D). A gain on sale of $3,000. E). Neither a gain nor a loss is recognized on this type of transaction.arrow_forwardCan you please give true answer?arrow_forwardHawthorn Company purchased a piece of equipment for $25,000 and has accumulated depreciation of $20,000 at the end of the current year. The company decides to discard the equipment at the end of the current year. What is the journal entry for the disposal? A. Accumulated Depreciation - Equipment Gain on Disposal 30,000 Truck 25,000 B. Equipment Gain on Disposal 25,000 Accumulated Depreciation - Equipment 5,000 20,000 C. Accumulated Depreciation - Equipment 5,000 20, 000 Loss on Disposal 25,000 D. Accumulated Depreciation - Equipment 20, 000 Loss on Disposal 5, 000 Equipment 25, 000arrow_forward

- Equipment was acquired at the beginning of the year at a cost of $78,840. The equipment was depreciated using the straight-line method based upon an estimated useful life of 6 years and an estimated residual value of $7,860. a. What was the depreciation expense for the first year?$fill in the blank 4b6aeefb5057020_1 b. Assuming the equipment was sold at the end of the second year for $59,600, determine the gain or loss on sale of the equipment.$fill in the blank 4b6aeefb5057020_2 c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank or enter "0". - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select -arrow_forwardAn asset's book value is $19,000 on December 31, Year 5. The asset has been depreciated at an annual rate of $4,000 on the straight-line method. Assuming the asset is sold on December 31, Year 5 for $16,000, the company should record: a. A loss on sale of $3,000. b. Neither a gain nor a loss is recognized in this type of transaction. c. A gain on sale of $3,000. d. A gain on sale of $3,000. e. A loss on sale of $3,000.arrow_forwardBeck man Enterprise purchased a depreciable asset on October 1, Year 1 at the cost of $152,000. The asset is expected to have a salvage value of $16300 at the end of its five-year useful life. If the asset is depreciated on the double-declining-balance method, the assets book value on December 31,year 2 will be?arrow_forward

- KHS&R's Construction bought a truck on 1/1/ at a cost of $31,000, an estimated salvage (residual) value of $3,000, and an estimated useful life of 4 years. The truck is being depreciated on a straight-line basis. At the end of year 3, what amount will be reported for accumulated depreciation? Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc., just enter the raw number. Webcourses will add commas to your answer automatically. For example, if you calculated the answer to be $24,123, you would only input: 24123 ASUS f4 f5 f6 X f7 f8 f9 f10 f11 4. 5 C R Y 60 08 图arrow_forwardNeed answer pleasearrow_forward> Equipment was acquired at the beginning of the year at a cost of $77,880. The equipment was depreciated using the straight-line method based upon an estimated useful life of 6 years and an estimated residual value of $7,500. a. What was the depreciation expense for the first year? b. Assuming the equipment was sold at the end of the second year for $58,800, determine the gain or loss on the sale of the equipment. c. Journalize the entry for the sale. If an amount box does not require an entry, leave it blank. ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning