SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

What is amount of the gain to be allocated to duvall on these accounting question?

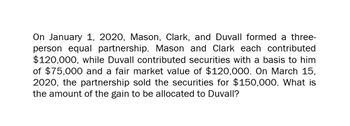

Transcribed Image Text:On January 1, 2020, Mason, Clark, and Duvall formed a three-

person equal partnership. Mason and Clark each contributed

$120,000, while Duvall contributed securities with a basis to him

of $75,000 and a fair market value of $120,000. On March 15,

2020, the partnership sold the securities for $150,000. What is

the amount of the gain to be allocated to Duvall?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 1. On May 1, 2019, Gonzaga and Balace formed a partnership and agreed to share profits and losses in the ratio of 3:7, respectively. Gonzaga contributed a parcel of land that cost P10,000. Balace contributed P40,000 cash. The land was sold for P18,000 on May 1,2019, immediately after formation of the partnership. What amount should be recorded in Gonzaga's capital account on formation of the partnership? a. P15,000 b. P17,400 C. P10,000 d. P18,000arrow_forwardOn May 1, 2021, Cobb and Mott formed a partnership and agreed to share profits and losses in the ratio for 3:7, respectively. Cobb contributed a parcel of land that cost him P 10,000. Mott contributed P 40,000 cash. The land was sold for P 18,000 on May 1, 2021, immediately after formation of the partnership. What amount should be recorded in Cobb's capital account on formation of the partnership? A 10,000 В 18,000 C 15,000 17,400arrow_forward1. On December 1, 2020, Antipolo and Bunao formed a partnership, agreeing to share for profits and losses in the ratio of 2:3, respectively. Antipolo invested a parcel of land that cost him P134,375. Bunao invested P161,250 cash. The land was s old for P268,750 on the same date, three hours after formation of the partnership. How much should be the capital balance of Antipolo right after formation? a. P134,375 b. P161,250 C. P322,500 d. P268,750arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT