FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

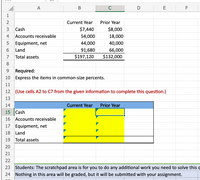

Transcribed Image Text:A

В

E

F

1

2

Current Year

Prior Year

Cash

$7,440

$8,000

4

Accounts receivable

54,000

18,000

Equipment, net

44,000

40,000

91,680

$197,120

6.

Land

66,000

$132,000

7

Total assets

8.

Required:

10 Express the items in common-size percents.

9.

11

12 (Use cells A2 to C7 from the given information to complete this question.)

13

14

Current Year

Prior Year

15

Cash

16 Accounts receivable

17 Equipment, net

18

Land

19

Total assets

20

21

22

23

Students: The scratchpad area is for you to do any additional work you need to solve this q

24 Nothing in this area will be graded, but it will be submitted with your assignment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- K L C D E Statement of Financial Postionas at December 31 (in millions of Canadian dollars) A В G H J P Q R V Y AA AB AC AD AE AF AG AH Statement ofComprhensive Income for Year Ended Dec. 31 (in millions of Canadian dollars) 20x3 20x2 20x1 20x3 20x2 20x1 7 Cash and cash equivalents 293 398 762 Totalnet sales 4360 4346 2715 Accounts receivable e Inventory O Prepaid Expenses Total Operating expenses Operating costs Distribution costs 572 522 309 493 699 312 1682 1754 942 85 27 17 403 402 318 1400 Royalty costs Depreciation Totaloperating costs (COGS) Profit from mining operations Other expenses General and Administrative 1443 1646 265 291 232 2 Property, plant and equipment 3 Mineral property costs 4 Total Assets 5 Liabilities 6 Accounts payable and accrued liabilities 7 Taxes payable 8 Total Current Liabilities 9 Long-term debt 0 Deferred income taxes E1 Asset retirement obligations 2 Totalliabiltiies Shareholders Equity 4 Share capital -5 Retained Earnings -6 Total shareholder's equity…arrow_forwardInstructions This assignment is designed for practicing both the retailer/merchandiser accounting cycle and your basic excel skills. Below are select sales transactions for two companies. You will need to enter the missing pieces of each transaction on the journal entry tab. Each missing piece of information is highlighted in yellow. The only cell where an actual number is to be input is on the journal entries worksheet. Please note: not every yellow cell requires input (it could be left blank if appropriate). After completing the journal entries, you must then complete the missing pieces of the T accounts, trial balance, and statements highlighted in yellow. Only excel functions may be used to calculate the appropriate cell value on these pages. DO NOT INPUT THE ACTUAL NUMBER INTO THE T ACCOUNTS, TRIAL BALANCE, OR STATEMENTS. Use excel functions (such as making a cell equal another from the journal entry page, summing numbers together, or using the plus or minus symbols to help you…arrow_forwardCash $59,000 $23,500 Accounts receivable 43,000 25,500 Inventory 50,000 29,500 Prepaid expenses 18,500 34,000 Long-term investments 0 42,000 Equipment 97,500 45,500 Accumulated depreciation—equipment (45,000) (27,500) Total assets $223,000 $172,500 Liabilities and Stockholder's Equity Accounts payable $42,000 $19,500 Bonds payable 48,500 70,000 Common stock 65,000 35,500 Retained earnings 67,500 47,500 Total liabilities and stockholders' equity $223,000 $172,500 Additional information: 1. Net income for the year ending December 31, 2022 was $47,500. 2. Cash dividends of $27,500 were declared and paid during the year. 3. Long-term investments that had a cost of $42,000 were sold for $26,500.…arrow_forward

- E Balance Sheet Murawski Company Balance Sheet December 31 Current Assets Cash and cash equivalents $330 $360 Accounts receivable (net) 470 400 Inventory 460 390 120 160 Prepaid expenses Total current assets 1.380 1.310 investments 10 10 Property, plant, and equipment 420 380 Intangibles and other assets 530 510 Total assets $2.340 $2.210 Current liabilities $900 $790 410 380 Long term liabilities. Stockholder's equity common 1.030 1,040 Total liabilities and stockholder's equity $2.340 $2.210 Income Statement Murawski Company Income Statement For the Years Ended December 31 2022 2021 $3.460 Sales Revenue Costs and expenses Cost of goods sold 890 Selling and Administrative expens 7.310 interest expense 20 Total costs and expenses 3,240 income before income taxes 220 income tax expense 60 Net Income $134 C 22 V 2022 $3,800 955 7,400 25 3,380 420 126 5294 2021 W Calculate the 2021 Inventory Turnover ratio. Use whole numbers rounded to 2 decimal places, if needed, as seen in the example…arrow_forwardBalance Sheet for Bearcat Hathaway, 2022 2021 2022 Cash Accounts. Receivable $5,268,485 $10,268,485 Inventory $529,062 $696,685 Current Assets $8,371,777 $13,279,842 Less $2,574,230 $2,314,672 Gross Fixed Assets $16,251,665 $20,567,330 Accum.Depreciation Total Assets $7,460,897 $10,117,819 Accounts Payable Notes. Payable Current Liabilities Calculate the net working capital in 2022. Long Termi Debt Total Liabilities, None of these options are correct $10,572,740 $5,664,675 $8,854,338 $3,946,273 Total $17,162,545 $23,729,353 Liabilities and Equity Capital Surplus Retained. Earnings 2021 2022 $1,673,992 $2,438,271 Common Net Fixed Assets $8,790,768 $10,449,511 Stock ($0.50 $1,300,000 $1,600,000 par) $1,033,110 $1,987,233 $2,707,102 $4,425,504 $9,242,830 $11,468,302 $11,949,932 $15,893,806 $1,148,120 $1,800,969 $2,764,493 $4,434,578 $17,162,545 $23,729,353arrow_forwardssarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education