FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:18

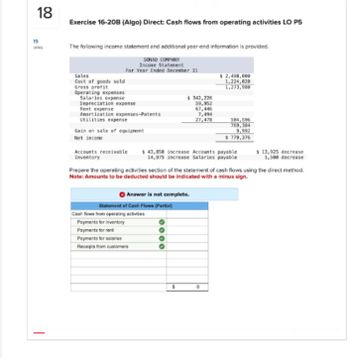

Exercise 16-20B (Algo) Direct: Cash flows from operating activities LO P5

19

The following income statement and additional year-end information is provided.

SONAD COMPANY

Income Staterent

-

For Year Ended December 31

Sales

Cost of goods sold

Gross profit

Operating expenses

Salaries expense

Depreciation expense

Rent expense

Amortization expenses-Patents

Utilities expense

$ 342,226

$ 2,498,000

1,224,020

1,273,980

59,952

67,446

7,494

27,478

584,596

Gain on sale of equipment

Net income

769,384

9,992

$779,376

Accounts receivable $ 43,850 increase Accounts payable

Inventory

14,975 increase Salaries payable

$ 13,925 decrease

1,500 decrease

Prepare the operating activities section of the statement of cash flows using the direct method.

Note: Amounts to be deducted should be indicated with a minus sign.

Answer is not complete.

Statement of Cash Flows (Partial)

Cash flows from operating activities

Payments for inventory

Payments for rent

Payments for salaries

Receipts from customers

$

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Exercise 21-24 (Static) Cash flows from operating activities (indirect method) [LO21-4] Portions of the financial statements for Myriad Products are provided below: MYRIAD PRODUCTS COMPANY Income Statement For the Year Ended December 31, 2024 ($ in millions) Sales $ 660 Cost of goods sold 250 Gross margin 410 Salaries expense $ 110 Depreciation expense 90 Amortization expense 5 Interest expense 20 Loss on sale of land 3 228 Income before taxes 182 Income tax expense 91 Net Income $ 91 MYRIAD PRODUCTS COMPANY Selected Accounts from Comparative Balance Sheets December 31, 2024 and 2023 ($ in millions) Year Change 2024 2023 Cash $ 102 $ 100 $ 2 Accounts receivable 220 232 (12) Inventory 440 450 (10) Accounts payable 140 134 6 Salaries payable 80 86 (6) Interest payable 25 20 5 Income tax payable 15 10 5 Required: Prepare the cash flows from the operating activities section of the statement of cash flows…arrow_forwardA6arrow_forwardNonearrow_forward

- Question 13 The extract disclosed below relates to JohNicho Limited for the year ended December 31, 2021 JohNicho Limited Statement of Comprehensive Income for the year ended 31st December: Net Sales Cost of goods sold SG&A Other costs Operating Income (EBIT) Interest Extraordinary income EBT Taxes Net Income Non-current assets Property, Plant & Equipment Motor vehicles Furniture Total non-current assets Current assets Trade Receivables Other Current Assets Inventories Total Current Assets Total assets Current liabilities Accounts payable Other current liabilities Total Current Liabilities JohLex Limited Statement of Financial Position as at 31st December: 2020 GHC Long-term Debt Debenture Total non-current liabilities 10 Shareholders' equity Total Liabilities and Equity GHC 6,386 18,472 6,759 8,461 25,265 19,811 20,753 Required to calculate: (a) Inventory turnover period (in days) (b) Receivable collection period (in days) (c) Payable collection period (in days) (d) Working capital…arrow_forwardDo not give image formatarrow_forwardExercise 13-2 Net Cash Provided by Operating Activities [LO13-2] For the just completed year, Hanna Company had net income of $55,500. Balances in the company’s current asset and current liability accounts at the beginning and end of the year were as follows: December 31 End of Year Beginning of Year Current assets: Cash and cash equivalents $ 64,000 $ 78,000 Accounts receivable $ 158,000 $ 184,000 Inventory $ 445,000 $ 367,000 Prepaid expenses $ 12,000 $ 13,000 Current liabilities: Accounts payable $ 350,000 $ 380,000 Accrued liabilities $ 7,500 $ 12,000 Income taxes payable $ 36,000 $ 25,000 The Accumulated Depreciation account had total credits of $52,000 during the year. Hanna Company did not record any gains or losses during the year. Required: Using the indirect method, determine the net cash provided by operating activities for the year. (List any deduction in cash and cash outflows as negative amounts.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education