FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Net

Transcribed Image Text:8 2

la

$10

9 30 1/4

P

K

M

O

L

9-

AltCar

V

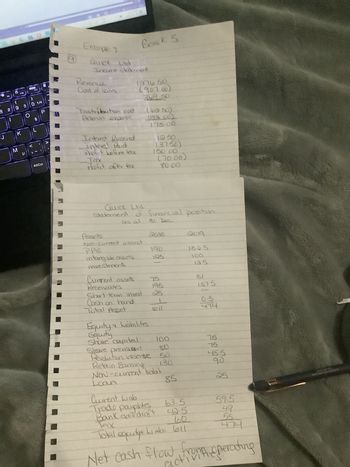

Example 1

Quick Ltd

Income skaitment

Revenue

Cost of sales

Distribution cost

Admin expense

Book S

Interest Receved

-Interal Paid

Profit before tax

Tax

Profit after tax

1.376 50

(90700)

369.50

Assets

Non-current assest

PPE

intangible assets

Investments

(68 50)

(13200)

175.00

Current assets

Receivables

Short-term invest

Cash on hand

Total Asset

12 50

(37.50)

Quick Ltd

statement of financial position

as al

81 Dec

Equity a hiabilities

Equity

Share capital

Share premiam

150:00

(20:00)

80.00

2030

190

195

75

195

25

L

loll

100

80

130

2019

85

100

la 5

51

1575

474

75

4.5.5

90.

Revolution reserve

Relain Earning

Now-current liabl

Loan

Current Liab

Trade payables

63.5

Bank dverdraft 42.5

Tax

60

Total equityt Liabi 611

Net cash flow from operating

25

59.5

49

55

474

VACA CEP COR

350

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The primary formula for calculating operating cash flow is?arrow_forwardDetermine cash flows from operating activities by the direct method.arrow_forwardWhen using the indirect method of determining net cash flows from operating activities, how are revenues and expenses reported on the statement of cash flows if their cash effects are identical to the amounts reported in the income statement?arrow_forward

- What are the major advantages of the indirect method of reporting cash flows from operating activities?arrow_forwardThe two approaches to reporting cash flows provided by operating activities are the a. the liquidity and profitability methods. b. the basic and standard methods. c. direct and indirect methods. d. the gross margin and contribution margin methods.arrow_forwardRECONCILIATION OF NET INCOME TO NET CASH FLOWS FROM OPERATING ACTIVITIES Cash flows from operating activities: Adjustments for noncash effects: Changes in operating assets and liabilities: Net cash flows from operating activitiesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education