Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't used hand raiting

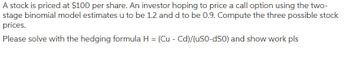

Transcribed Image Text:A stock is priced at $100 per share. An investor hoping to price a call option using the two-

stage binomial model estimates u to be 1.2 and d to be 0.9. Compute the three possible stock

prices.

Please solve with the hedging formula H = (Cu - Cd)/(US0-dS0) and show work pls

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume that there are three different put options on a stock available and that all of them have the same expiration date. These three options have the following market prices $6, $3, and $1, and strike prices $40, $35, and $30, respectively. Construct a butterfly spread and show the relevant profits and losses. The use of graph is essential.arrow_forwardSuppose that three stocks (A, B, and C} and two common risk factors (1 and 2) have the following relationship: E(RA) = (1.1)A1 + (0.8)A2 E(RB) = (0.7)A1 + (0.6)A2 E(RC) = (0.3)A1 + (0.4)A2 a. If A1 = 4 percent and A2 = 2 percent, what are the prices expected next year for each of the stocks? Assume that all three stocks currently sell for $30 and will not pay a dividend in the next year. b. Suppose that you know that next year the prices for Stocks A, B, and C will actually be $31.50, $35.00, and $30.50. Create and demonstrate a riskless, arbitrage investment to take advantage of these mispriced securities. What is the profit from your investment? You may assume that you can use the proceeds from any necessary short sale. Problems 13 and 14 refer to the data contained in Exhibit 7.23, which lists 30 monthly excess returns to two different actively managed stock portfolios (A and B) and three different common risk factors (1, 2, and 3). {Note: You may find it…arrow_forwardYou are facing three stock investment alternatives, Stock A, Stock B and Stock C. Given the following information, please indicate which stock is (are) overvalued, which stock is (are) undervalued, and which stock is (are) correctly priced based on the required returns calculation using the Capital Asset Pricing Model (CAPM or Security Market Line=SML). The risk free rate is 3% and the risk premium for the market index return is 5%. Please Show Work Expected Stocks Returns BETA A 14% 1.2 B 8% 0.67 C 20% 2.5arrow_forward

- Given the returns and probabilities for the three possible states listed below, calculate the covariance between the returns of Stock A and Stock B. For convenience, assume that the expected returns of Stock A and Stock B are 8.10 percent and 11.60 percent, respectively. (Round answer to 4 decimal places, e.g. 0.0768.) Good OK Poor Covariance Probability 0.22 0.60 0.18 Return on Stock A 0.30 0.10 -0.25 Return on Stock B 0.50 0.10 -0.30arrow_forwardYou want to estimate the monthly alpha and beta of AXON stock, using the index model. Suppose AXON has a beta of 0.95 and a monthly alpha of 0.5 (representing half a percent). If you set up the regression model correctly, the index model equation should be (remember in index model formulas, we use R instead of r to denote excess returns): Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. b с d Rmarket = Rmarket = 0.5 x Rstock +0.95 Raxon 0.95 x Rstock +0.5 = 0.5 x Rmarket +0.95 Raxon = 0.95 x Rmarket +0.5arrow_forwardAssume the following data for a stock: Risk - free rate market) == 1.5; beta (size) = 0.3; beta (book-to-market) = 5 percent; beta ( = - 1.1; market risk premium 1 7 percent; size risk premium 3.7 percent; and book - to - market risk premium = 5.2 percent. Calculate the expected return on the stock using the Fama - French three-factor model.arrow_forward

- Suppose you have the following information concerning a particular options.Stock price, S = RM 21Exercise price, K = RM 20Interest rate, r = 0.08Maturity, T = 180 days = 0.5Standard deviation,= 0.5 a. What is correct of the call options using Black-Scholes model? * Look for N(d1) and N(d2) from the cumulative standard normal distribution table:arrow_forwardFor the next question, consider the two stocks, A and B, in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. P0 Q0 P1 Q1 A 50 100 45 100 B 30 200 34 200 Calculate the rate of return on a price-weighted index of the two stocks for between t = 0 and t = 1. Assume the divisor value is 2. Enter your answer as a decimal, rounded to four decimal places (e.g, 0.0123).arrow_forwardThe risk-free rate is 1.13% and the market risk premium is 6.26%. A stock with a β of 0.84 will have an expected return of ____%. Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924))arrow_forward

- Suppose that put options on a stock with strike prices $18 and $20 cost $2 and $3.50, respectively. How can the options be used to create a bull spread? Construct atable that shows the profit and payoff for the spread.arrow_forward1. Consider a one period binomial model. Suppose So = 1 att = To; and Su = 2 and Sd = ½ at time T₁. If we assume the risk free rate R is 1.2, compute the current value of a European put with strike K = 1. Please round your answer to 2 decimals. Enter answer here 2. Compute the number of units of stock we need to short in order to replicate the option in the previous question. Please round your answer to 2 decimals. Enter answer here 3. Use Black-Scholes Formula to calculate the call price of a European call option with: So = 20, K = 20, r = 5%, c = 0,0 = 40%, T = 5; (round to two decimal digits).arrow_forwardYou are long both a call and a put on the same share of stock with the sameexercise date. The exercise price of the call is $40 and the exercise price of the put is$45. Plot the value of this combination as a function of the stock price on the exercisedate (draw a payoff diagram)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning