Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need help with this question solution general accounting

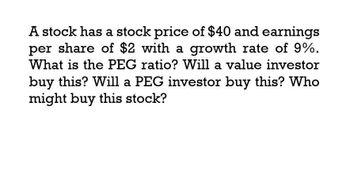

Transcribed Image Text:A stock has a stock price of $40 and earnings

per share of $2 with a growth rate of 9%.

What is the PEG ratio? Will a value investor

buy this? Will a PEG investor buy this? Who

might buy this stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The dividend-growth model may be used to value a stock: Round your answers to the nearest cent. a. What is the value of a stock if: Do = $2.30 k = 8% 9 = 5% V = Do(1+g) k-9 $ b. What is the value of this stock if the dividend is increased to $4.30 and the other variables remain constant? $ c. What is the value of this stock if the required return declines to 6 percent and the other variables remain constant? $ d. What is the value of this stock if the growth rate declines to 3 percent and the other variables remain constant? $ e. What is the value of this stock if the dividend is increased to $2.90, the growth rate declines to 3 percent, and the required return remains 8 percent? $arrow_forwardA stock has a stock price of $40 and earnings per share this question solutionarrow_forwardThe dividend-growth model may be used to value a stock: Do(1+9) V = k - g Round your answers to the nearest cent. a. What is the value of a stock if: Do = $3.10 k = 12% 9 = 8% b. What is the value of this stock if the dividend is increased to $4.30 and the other variables remain constant? $ c. What is the value of this stock if the required return declines to 9 percent and the other variables remain constant? d. What is the value of this stock if the growth rate declines to 5 percent and the other variables remain constant? e. What is the value of this stock if the dividend is increased to $3.70, the growth rate declines to 5 percent, and the required return remains 12 percent? $arrow_forward

- What is the solution and the workingarrow_forwardConsider a stock with a current dividend D0=$4 and a required rate of return R=12%. The stock trades at a price P0=$40. What dividend growth rate g must investors expect for this price to reflect the stock's fundamental value? g = _ % (answer a number with 1 decimal, e.g., 1.2)arrow_forwardAn investor buys a stock if price rises 5% from the 250-day low and shorts a stock if price falls 5% from the 250-day high. What is this strategy called? Will it work if the market is efficient? Explain whyarrow_forward

- Provide this question solution general accountingarrow_forwardI need answer of this accounting questionsarrow_forwardThe rate of return on the market stock index is 13 percent. The rate of return on a risk-freebank account is 1%. The B (beta) of stock XYZ is 1.5. Use the data to answer the questionsbelow.a. What is the market risk premium? Show your work.b. What is the cost of equity for XYZ? Show your work.c. What is the stock XYZ risk premium? Show your work.d. Draw the graph of the Security Market Line and show the stock of XYZ on the graph.The end-of-year dividend on stock ABC is expected to be $0.8. The growth rate of dividend isexpected to be 5 percent for ever. The current price of the ABC stock is $10. Use the data toanswer the questions below.e. What is the cost of equity for stock ABC? Show your work.f. Suppose stock KLM has the same end-of-year dividend, dividend growth rate andprice as stock ABC, but the risk of KLM stock is much greater than of the ABC stock.What is your estimate of the cost of equity of stock KLM using the method at part e?Do you agree with the valuation of the cost of…arrow_forward

- What is the required return on preferred stock, rPS, if the stock has an annual dividend of $9 and a price of $100?arrow_forwardPlease respond to both. You buy a stock when you expect that its price will rise, you short a stock when you expect that its price will fall. True or False. A stock has an expected dividend of $7 and a current price of $74. The required return on the stock is 14%, what is the stock’s capital gain’s yield?arrow_forwardContinue considering Firm XYZ. If the dividends for Firm XYZ are the same for common and preferred stock, and the price for common stock is $50. What would be the cost of equity?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT