Economics (MindTap Course List)

13th Edition

ISBN: 9781337617383

Author: Roger A. Arnold

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

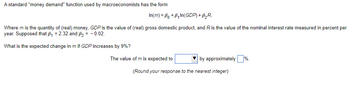

Transcribed Image Text:A standard "money demand" function used by macroeconomists has the form

In(m) = Po + B₁In(GDP) + B₂R,

Where m is the quantity of (real) money, GDP is the value of (real) gross domestic product, and R is the value of the nominal interest rate measured in percent per

year. Supposed that B₁ = 2.32 and B₂ = -0.02.

What is the expected change in m if GDP increases by 9%?

The value of m is expected to

by approximately %.

(Round your response to the nearest integer)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

Recommended textbooks for you

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning