Essentials of Economics (MindTap Course List)

8th Edition

ISBN: 9781337091992

Author: N. Gregory Mankiw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

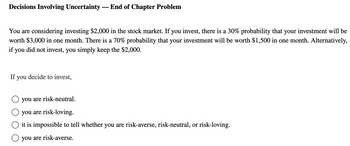

Transcribed Image Text:Decisions Involving Uncertainty - End of Chapter Problem

You are considering investing $2,000 in the stock market. If you invest, there is a 30% probability that your investment will be

worth $3,000 in one month. There is a 70% probability that your investment will be worth $1,500 in one month. Alternatively,

if you did not invest, you simply keep the $2,000.

If you decide to invest,

☐ you are risk-neutral.

you are risk-loving.

it is impossible to tell whether you are risk-averse, risk-neutral, or risk-loving.

☐ you are risk-averse.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You and your friend have opened an account on E-Trade and have each decided to select five similar companies in which to invest. You are diligent in monitoring your selections, tracking prices, current events, and actions the company has taken. Your friend chooses his companies randomly, pays no attention to the financial news, and spends his leisure time focused on everything besides his investments. Explain what might be the performance for each of your portfolios at the end of the year.arrow_forwardWhat are some reasons why the investment strategy of a 30-year-old might differ flow the investment strategy of a 65-year-old?arrow_forwardWhat is an insurance premium?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...

Economics

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning