ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

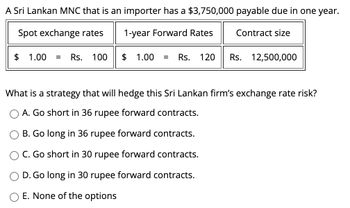

Transcribed Image Text:A Sri Lankan MNC that is an importer has a $3,750,000 payable due in one year.

Spot exchange rates

1-year Forward Rates

Contract size

$ 1.00

Rs. 100

$ 1.00 = Rs. 120 Rs. 12,500,000

What is a strategy that will hedge this Sri Lankan firm's exchange rate risk?

A. Go short in 36 rupee forward contracts.

B. Go long in 36 rupee forward contracts.

C. Go short in 30 rupee forward contracts.

D. Go long in 30 rupee forward contracts.

E. None of the options

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- a) Using the following information, determine each one of the theoretical Exchange Rates (E.R.) according to International Fisher Effect. b) Show how Money Market Arbitrage could be done assuming that the loan is 1,000 units of the currency of the country where the loan is contracted. Determine the profit in the currency in which the loan was contracted. ΜARKET ΜARKET E.R. E.R. COUNTRY CURRENCY INTEREST Dec-01 Dec-02 Dec-02 Mexico MXP 12 % 19.56 20.15 Turkey TRY (Lira) 6 % 5.9419 6.07673 Australia AUD 4 % 1.7759 1.81183 Jаpan JPY 8 % 105.866 113.978 United GBP 5 % 0.5991 0.617849 Kingdom (UK) South Korea KRW (Won) 9% 1,658.62 1,793.37 Canada CAD 5 % 1.3736 1.4942 U.S.A.. USD 3%arrow_forwardUrgent!!arrow_forwardA Japanese tourist rents a hotel room in London. The impact on BOP will be debit for Japan current account (-) and a credit for UK current account (+). True or False?arrow_forward

- Explain partially convertible currencyarrow_forwardThe forward rate of exchange is 2 , the spot rate of exchange is 1.75. The US has a bond of 9% interest and Canada has a bond for 5% interest. What is the amount you can collect in US dollars for the Canada bond on an investment of $10,000? Group of answer choices $10,937.50 and the Canadian investment is worse than the US investment $10,900 and the Canadian investment is better than the US investment $10,900 and the Canadian investment is worse than the US investment $10,937.50 and the Canadian investment is better than the US investmentarrow_forwardHow would each of these events affect the supply or demand for Japanese yen? A) Stronger U.S. economic growth. B) A decline in Japanese interest rates. C) Higher inflation in the United States.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education