ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

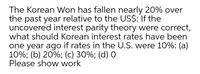

Transcribed Image Text:The Korean Won has fallen nearly 20% over

the past year relative to the US$: If the

uncovered interest parity theory were correct,

what should Korean interest rates have been

one year ago if rates in the U.S. were 10%: (a)

10%; (b) 20%; (c) 30%; (d) 0

Please show work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A UK-manufactured car sells for GBP 14.000. A french-manufactured car sells for EUR 15.750. If the EUR/GBP exchange rate changes from 1.17 to 1.09, what is the percentage change in the price of the french car in GBP? a. -6.8% b. -7.3% c. 6.8% d. 7.3%arrow_forwardThe equation S = I + NCO describes the savings market for an entire national economy engaged in foreign trade. What role does currency exchange play in this savings equation and which of the 2 variables is MOST affected by appreciation or depreciation of a nation's currency?arrow_forwardJanice is a U.S. citizen traveling to Mexico with $5,000. She should be exchange her dollars for ____ pesos at an exchange rate of U.S. dollars to Mexican pesos of 0.06. (Note: Round to the nearest one in foreign currency.) a) 52,457 Ob) 91,760 O c) 83,333 d) 74,242 Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- S1 Relative PPP: So (2) - (H 1+ Th One of the less restrictive form of the law of one price is known as relative purchasing power parity. Using the equation given in section 6-7b, calculate the expected spot rate for currency B using the relative purchasing power parity with the information provided below: If country A prices are expected to rise by 3.3 percent over the coming year, whereas prices in country B are expected to rise by 2.8 percent, and if the current spot exchange rate is $1.32 of currency A / $1 of currency B, then relative purchasing power parity implies the expected spot rate for the currency B in one year will be:arrow_forward13- You are a U.S. importer who buys goods from many different countries. How many U.S. dollars do you need to settle each of the following invoices? 1,000,000 Australian dollars for wool blankets (exchange rate: A$1 = $0.769) 500,000 British pounds for dishes (exchange rate: £1 = $1.5855) 100,000 Indian rupees for baskets (exchange rate: Rs1 = $0.0602) 350 million Japanese yen for stereo components (exchange rate: ¥1 = $0.0069) 825,000 euro for German wine (exchange rate: €1 = $1.05) 14- What is the dollar value of the invoices in exercise 13 if the dollar: Depreciates 10 percent against the Australian dollar Appreciates 10 percent against the British pound Depreciates 10 percent against the Indian rupee Appreciates 20 percent against the Japanese yen Depreciates 100 percent against the euroarrow_forwardDetermine for each, whether the interest parity condition holds or not, if Ese = 1.10 Interest Rate for the Dollar R$ 0.07 0.08 0.09 0.1 0.12 Page 9 of 11 Interest Rate for the Euro Re 0.02 0.08 0.04 0 0.04 Expected Rate of Dollar Depreciation Against Euro (Ese-Este)/Ese 0.11 0.16 0.05 0.11 0.16 Interest Parity Condition Holds? (YES/NO)arrow_forward

- esources Assume the following: (1) the interest rate on six-month treasury bills is 8 percent per annum in the United Kingdom and 4 percent per annum in the United States; (2) today's spot price of the pound is $1.50, while the six-month forward price of the pound is $1.485. If the price of the six-month forward pound were to then U.S. investors would no longer earn an extra return by shifting funds to the United Kingdom. O rise to $1.52 O rise to $1.55 O fall to $1.40 O fall to $1.47arrow_forwardA UK-manufactured car sells for GBP 14.000. A french-manufactured car sells for EUR 15.750. If the EUR/GBP exchange rate is 1.09, how much does the french-made car cost in GBP? a. 17,162 b. 14,450 c. 13,462 d. 18,427arrow_forwardOtondo , a currency trader in East African Community, has ksh 400,000. He wishes to assess his triangular arbitrage by moving to Uganda, and Tanzania. The exchange rate quotes from the currency convertor was: 32TZ/1 KES 20UGH/IKES Agreed exchange rate between Uganda shillings and Tanzania shilling was 1.5 UGH /1TZ Compute the results. Explain your resultsarrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardA U.S. MNC has subsidiaries in Britain and Japan. Assume the revenue in both subsidiaries in local currency remains the same. British WOS WOS Revenue £100M ¥10 Bn exchange $1.7/£ rate to $1.6/£ Japanese ¥ 85.12/$ to ¥ 77.12/$ What will be the impact on the $ amounts from each WOS? O Increase from British WOS; Increase from Japanese WOS O decrease from British WOS; decrease from Japanese WOS O Increase from British WOS; decrease from Japanese WOS O decrease from British WOS; Increase from Japanese WOSarrow_forwardGiven the following data R = $1/¥105 F = $1/¥140 i(u.s.) = 10% What is the interest rates in Japan if the interest parity condition holdsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education