EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

None

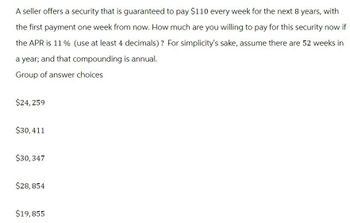

Transcribed Image Text:A seller offers a security that is guaranteed to pay $110 every week for the next 8 years, with

the first payment one week from now. How much are you willing to pay for this security now if

the APR is 11% (use at least 4 decimals)? For simplicity's sake, assume there are 52 weeks in

a year; and that compounding is annual.

Group of answer choices

$24,259

$30,411

$30,347

$28,854

$19,855

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- An investor will receive equal payments of $700 for four years, and the first payment will be received one year from now. What is the present value of these payments if the interest rate is 9%? (Round your answer to two decimal places.) Multiple choice question. $2,267.80 $2,081.50 $763.45 $2,379.87arrow_forwardA bank is offering to pay you $1000 at the beginning of each month for the next 10 years. The interest rate is 6% compounded monthly. How much would you pay to buy this investment? Group of answer choices $ 7,360.09 $90, 073.45 $7,801.69 $90, 523.82arrow_forwardYou purchase an annuity that will pay you $100 every three months for five years. The first $100 payment will be made as soon as you purchases the investment. If your required rate of return is 9% , how much should you be willing to pay for this investment? Group of answer choices $1,596.82 $1,632.29 $1,759.34 $1,510.46arrow_forward

- You are trying to value the following investment opportunity: The investment will cost you $22151 today. In exchange for your investment you will receive monthly cash payments of $5195 for 9 months. The first payment will occur at the end of the first month. The applicable effective annual interest rate for this investment opportunity is 7%. Calculate the NPV of this investment opportunity. Round to two decimals (do not include the $-sign in your answer).arrow_forwardIf the interest rate is 15%, what is the present valueLOADING... of a security that pays you $1100 next year, $1230 the year after, and $1330 the year after that? Present value is $ enter your response here. ( Round your response to the nearest penny.)arrow_forwardPeter Lynchpin wants to sell you an investment contract that pays equal $12,600 amounts at the end of each of the next 18 years. If you require an effective annual return of 7 percent on this investment, how much will you pay for the contract today? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Value todayarrow_forward

- You are considering purchasing an investment contract that will eventually pay you $4,000 per year at the end of each year for seven years. The appropriate interest rate for the risks involved is 6.4% The first payment begins in 6 years. What price should you pay today to purchase this contract (rounded to nearest dollar) ? (Do not round interim calculations)arrow_forwardSuppose you are buying your first home for $144,000, and you have $17,000 for your down payment. You have arranged to finance the remainder with a 30-year, monthly payment, amortized mortgage at a 6.40% nominal interest rate, with the first payment due in one month. What will your monthly payments be? Group of answer choices $831.93 $857.64 $753.30 $714.27 $794.39arrow_forwardDon Draper has signed a contract that will pay him $50,000 at the end of each year for the next 8 years, plus an additional $150,000 at the end of year 8. If 7 percent is the appropriate discount rate, what is the present value of this contract? Question content area bottom Part 1 The present value of the contract is $ enter your response here . (Round to the nearest cent.)arrow_forward

- You are considering purchasing an investment contract that will eventually pay you $4000 per year at the end of each year for seven years. The appropriate interest rate for the risks involved is 6.4% The first payment begins in 6 years. What price should you pay today to purchase this contract (rounded to nearest dollar) ?arrow_forwardYour insurance agent is trying to sell you an annuity that costs $55,000 today. By buying this annuity, your agent promises that you receive payments of $285 per month for 30 years. What is the rate of return expressed as an APR on this investment? Multiple Choice O 3.91% 4.33% willarrow_forwardImagine you have a credit card balance of $1,000 that you would like to pay off within one year. The annual interest rate on that credit card is 16%, but interest compounds monthly, and you are required to make a payment each month. What amount would you have to pay monthly to pay off this balance within one year? Question options: a $90.71 b $80.66 c $83.33 d $99.12arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT