Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

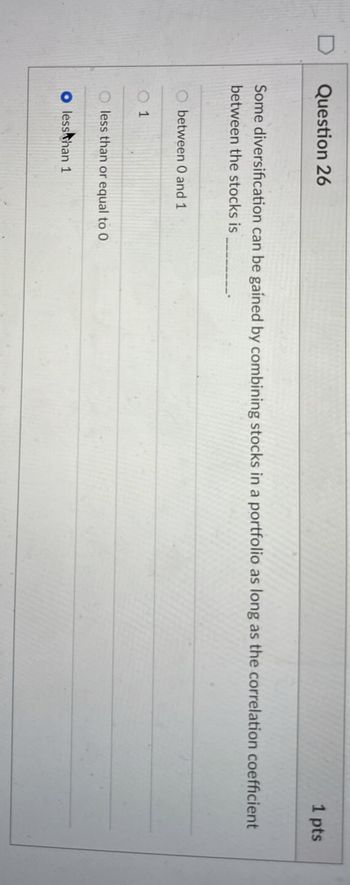

Transcribed Image Text:Question 26

1 pts

Some diversification can be gained by combining stocks in a portfolio as long as the correlation coefficient

between the stocks is

between 0 and 1

1

O less than or equal to 0

O less than 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Question 6?arrow_forward24 - Stock A's beta is 1.7 and Stock B's beta is 0.7. Which of the following statements must be true about these securities? (Assume both stocks are at their market equilibriums.) Stock B must be a more desirable addition to a portfolio than A. Stock A must be a more desirable addition to a portfolio than B. The expected return on Stock A should be greater than that on B. The expected return on Stock B should be greater than that on A. When held in isolation, Stock A has more risk than Stock B.arrow_forward5arrow_forward

- Question 5 a) “If markets are semistrong-form efficient, investors would only adopt passive investment strategies and buy into an index fund, rather than active strategies where they would have a portfolio manager select the components of their portfolios and seek for mispriced equities.” Explain if you agree with this statement, in no more than 150 words.arrow_forwardQuestion 13 RWJ 13-6 TF In the Capital Asset Pricing Model, the slope of the SML is also the reward-to-risk ratio. Group of answer choices True False Question 14 RWJ 13 - Evaluate the correctness of the following statements concerning risk. I. The risk premium increases as diversifiable risk increases. II. Diversifiable risks are risks investors cannot avoid. Group of answer choices II is correct. Both are WRONG. I is Correct. I and II are correct.arrow_forward1.3 Problem 1: Answer with a clear true/false, and provide a detailed explanation to substantiate your answer: As more and more assets are added to a portfolio, its total risk would typically fall at a decreasing rate.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education