Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

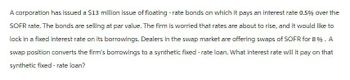

Transcribed Image Text:A corporation has issued a $13 million issue of floating-rate bonds on which it pays an interest rate 0.5% over the

SOFR rate. The bonds are selling at par value. The firm is worried that rates are about to rise, and it would like to

lock in a fixed interest rate on its borrowings. Dealers in the swap market are offering swaps of SOFR for 8%. A

swap position converts the firm's borrowings to a synthetic fixed-rate loan. What interest rate will it pay on that

synthetic fixed-rate loan?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consider a CDS on Lehman Brothers default event. Given today’s market conditions you know that the present value of expected premium payments 6.0250*s, the present value of expected accrual payments is 0.0515*s and the present value of expected payoff is 0.1325. All measured per $1 of notional principal. You also know that Argo hedge fund bought this CDS on Lehman Brothers default from AIG one week ago with contractual rate of X basis points per year. Given this information the breakeven spread (i.e. the value of s) is _________ and today’s value of the CDS contract to AIG is positive if the value of s is _______ than X. a. 222 basis points;greater b. 218 basis points; smaller c. 218 basis points, greater d. 222 basis points; smaller e. 84 basis points; greater Please help and explainarrow_forwardSambuka, Inc. can issue annual coupon bonds in either U.S. dollars or in Euros that mature in threeyears. Dollar-denominated bonds would have a coupon rate of 5 percent; Euro-denominated bonds would have a coupon rate of 4 percent. Assuming that Sambuka can issue bonds worth $10,000,000 in US dollars or 8 million Euros, given that the current exchange rate is $1.25/1 Euro. If the forecasted exchange rate for the Euro is $1.21for each of the next three years what is the annual cost of financing for the Euro-denominated bonds? Which type of bond should Sambuka issue?arrow_forwardAn investor has two alternatives: AAA-rated corporate bond or Turkish Government Treasury bond. But the investor is not sure what rate of interest these two bonds should pay. Assume that the real risk-free rate of interest is 1.5%; inflation is expected to be 2.5%; the maturity risk premium is 3.5%; and, the default risk premium for AAA rated corporate bonds is 5.5%. a) What is the "Rate of interest for the AAA-rated corporate bond" ? b) What is the "Rate of interest for the Turkish Government Treasury bond"?arrow_forward

- The time from acceptance to maturity on a $1,000,000 banker's acceptance is 120 days. The importer's bank's acceptance commission is 1.75 percent and the market rate for 120-day B/As is 5.75 percent. What amount will the exporter receive if he holds the B/A until maturity? If he discounts the B/A with the importer's bank? Also determine the bond equivalent yield the importer's bank will earn from discounting the B/A with the exporter. If the exporter's opportunity cost of capital is 11 percent, should he discount the B/A or hold it to maturity? (Do not round intermediate calculations. Round "Maturity value" to 2 decimal places. Round "Bond equivalent yield" as a percent rounded to 2 decimal places.) Amount the exporter will receive at maturity Amount the exporter will receive if discounted Bond equivalent yield Should he discount the B/A or hold it to maturity? Discount the B/A %arrow_forwardEven though most corporate bonds in the United States make coupon payments semiannually, bonds issued elsewhere often have annual coupon payments. Suppose a German company issues a bond with a par value of €1,000, 10 years to maturity, and a coupon rate of 8.7 percent paid annually. If the YTM is 10.7 percent, what is the current bond price in euros? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Current bond pricearrow_forwardBaghibenarrow_forward

- New Hampshire Corp. has decided to issue three-year bonds denominated in 10 million Chinese yuan at par. The bonds have a coupon rate of 14 percent. If the yuan is expected to appreciate from its current level of $0.15 to $0.156, $0.164, and $0.173 in years 1, 2, and 3, respectively, what is the financing cost of these bonds?arrow_forwardSuppose the Federal Reserve sells a $3000 bond, and the reserve ratio maintained by all private banks is 20%. Assume that all loans are fully redeposited (zero “cash drains”) and that all deposits are checkable deposits. Determine the effect of the bond sale on total loans and deposits in the private banks. Explain in detail how these changes would occur. Illustrate the total result of the effects in part (1) using balance sheets for the consolidated private banks and the Federal Reserve, respectively. Discuss how the effects in part (1) would be different if: (i) the reserve ratio was 25% instead of 20%; (ii) a certain portion of loans were held as cash outside banks instead of being redeposited in the banks.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education