Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

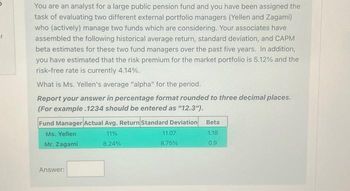

Transcribed Image Text:You are an analyst for a large public pension fund and you have been assigned the

task of evaluating two different external portfolio managers (Yellen and Zagami)

who (actively) manage two funds which are considering. Your associates have

assembled the following historical average return, standard deviation, and CAPM

beta estimates for these two fund managers over the past five years. In addition,

you have estimated that the risk premium for the market portfolio is 5.12% and the

risk-free rate is currently 4.14%.

What is Ms. Yellen's average "alpha" for the period.

Report your answer in percentage format rounded to three decimal places.

(For example.1234 should be entered as "12.3").

Fund Manager Actual Avg. Return Standard Deviation

Ms. Yellen

11%

Mr. Zagami

8.24%

Answer:

11.07

8.75%

Beta

1.18

0.9

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is 0.97. Year 2018 2019 2020 2021 2022 Fund -15,2% 25.1 12.4 6.2 -1.2 Sharpe ratio Treynor ratio Market -24.5% 19.5 9.4 7.6 -2.2 Risk-Free 1% 3 2 4 2 What are the Sharpe and Treynor ratios for the fund? Note: Do not round intermediate calculations. Round your answers to 4 decimal places.arrow_forwardPlease answer these twoarrow_forwardIn a recent 5-year period, mutual fund manager Diana Sauros produced the following percentage rates of return for the Mesozoic Fund. Rates of return on the market index are given for comparison. Fund Market index a. 1 -1.2 -0.9 b. 2 +24.8 +16.0 a. Calculate (a) the average return on both the Fund and the index, and (b) the standard deviation of the returns on each. (Do not round intermediate calculations. Round your answers to 2 decimal places.) b. Did Ms. Sauros do better or worse than the market index on these measures? Average return Standard deviation Did Ms. Sauros do better or worse than the market index on these measures? 3 +40.7 +31.7 Mesozoic Fund Return Better 4 +11.1 +10.9 15.06 16.04 Market Portfolio Return 5 +0.3 -0.7 10.70 11.76arrow_forward

- You have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is 0.97. Year 2018 2019 2020 2021 2022 Fund -14.85% 25.1 12.9 7.2 -1.5 Market -29.5% 20.0 10.9 8.0 -3.2 Risk-Free 3% 5 2 5 What are the Sharpe and Treynor ratios for the fund? Note: Do not round intermediate calculations. Round your answers to 4 decimal places. Answer is complete but not entirely correct. Sharpe ratio Treynor ratio 0.1613 2.8377arrow_forwardYou have been given the following return information for a mutual fund, the market index, and the risk-free rate. You also know that the return correlation between the fund and the market is .97. Year 2015 2016 2017 2018 2019 Fund -17.0% Sharpe ratio Treynor ratio 25.1 13.3 6.4 -1.74 Market -33.5% 20.4 12.1 8.0 -3.2 Risk-Free 2% 6 2 5 3 What are the Sharpe and Treynor ratios for the fund? (Do not round intermediate calculations. Round your answers to 4 decimal places.)arrow_forwardSuppose you are a fund manager, managing an active fund with an expected return of 14% and a standard deviation of 20%. The risk-free rate is 2%. You are advising a risk averse client who has mean-variance preferences and would like to invest in a combination of the risk-free asset and your active fund. They currently have a passive portfolio with an expected return of 8% and a standard deviation of 12%. The sharpe ratios for the active fund and passive portfolio are 0.6 and 0.5 respectively. Could you answer this question in excel and explain how you did it: Draw the capital allocation line (CAL) of your active fund on an expected return-standard deviation diagram. Clearly indicate the position of your active fund and your client’s current passive portfolio in the figure.arrow_forward

- Mr. Ota is an analyst for a large pension fund and he has been assigned the task of evaluating two different external portfolio managers (K and C). He considers the following historical average return, standard deviation, and CAPM beta estimates for these two managers over the past five years: Actual Average Standard deviation Portfolio Beta Return Manager K Manager C 7.80% 10.05% 0.75 12.0% 15.50% 1.45 Additionally, Mr. Ota estimate for the risk premium for the market portfolio is 5.40% and the risk-free rate is currently 2.50%. a. For both Managers K and C, calculate the expected return using the CAPM. Express your answers to the nearest basis point (i.e., xX.XX%)arrow_forwardYou already submitted an Investment Proposal. The second part of your Investment Project is a follow-up of your Investment Proposal, with a short reflection essay about the securities you recommended in your Investment proposal. You have to provide an updated Table showing your portfolio. Make sure to include the gain or losses of each individual securities, your total holding-period return, and the effective annual rate (EAR). You should include in the analysis at least one of the securities you recommended to buy in your first report. How did it go? Did it go as planned? Why do you think it did not go as planned? You may also analyze some of your winners and losers in your portfolio (they could be others than the ones you justified in the first report). Any regrets? What would you have done differently after what you have learned in this course? There is no unique way to do a reflection essay. What are in your opinion the essential lessons from this course? The length of the…arrow_forwardConsider a client with a 10% return objective. A financial adviser creates a policy statement for that client, identifies relevant financial securities that fit the risk return profile for this client, and drafts an optimal asset allocation using specialized optimization techniques. After one year, the financial adviser's recommendations produce a return of 10%. Question: Is this client satisfied with the performance of the portfolio?arrow_forward

- You work as an economic analyst for an investment firm. You believe there are four possible states for the economy over the next year: Boom, Good, Poor, Bust. Your colleague Tosha has estimated the returns for three stocks based on those four scenarios. One of your clients has a portfolio that is 20.00% invested in Stock A and 30.00% invested in Stock C. The rest of your client's portfolio is invested in Stock B. Use the information below to calculate the expected return, variance, and standard deviation on your client's portfolio. 1. First fill in the missing probability and portfolio weight (cells D19 and F22). 2. Calculate the actual return for the portfolio in each state. 3. Use those portfolio returns and the probabilities to calulcate the portfolio's expected return using the SUMPRODUCT function. 4. Calculate the squared deviation from the mean for each state of the economy. 5. Use the SUMPRODUCT function to get the variance (the probability weighted average of the squared…arrow_forwardYou will receive $8,000 in five years. When you receive it, you will invest it for 8 more years at an annual rate of 6%. How much money will you have 13 years from now? Question 7 options: 16,453 14,680 17,063 12,751 15,121arrow_forward17. Average Return and Standard Deviation. In a recent five-year period, mutual fund manager Diana Sauros produced the following percentage rates of return for the Mesozoic Fund. Rates of return on the market index are given for comparison. Calculate (a) the average return on both the fund and the index and (b) the standard deviation of the returns on each. Did Ms. Sauros do better or worse than the market index on these measures? (LO11-3) Fund Market index 1 -1.2 -0.9 2 +24.8 +16.0 3 +40.7 +31.7 4 +11.1 +10.9 5 +0.3 -0.7arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education