Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

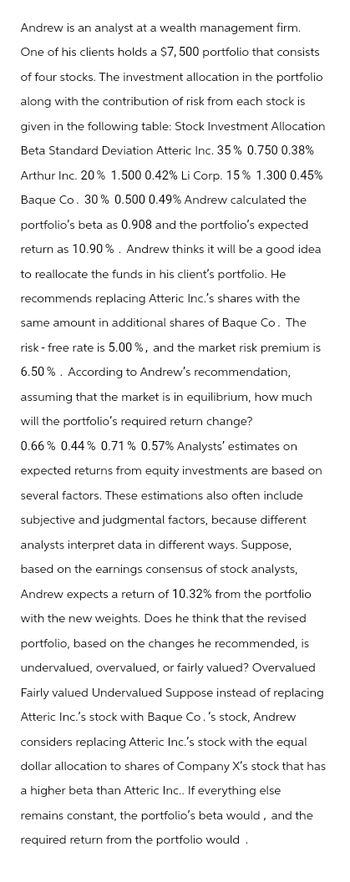

Transcribed Image Text:Andrew is an analyst at a wealth management firm.

One of his clients holds a $7,500 portfolio that consists

of four stocks. The investment allocation in the portfolio

along with the contribution of risk from each stock is

given in the following table: Stock Investment Allocation

Beta Standard Deviation Atteric Inc. 35% 0.750 0.38%

Arthur Inc. 20% 1.500 0.42% Li Corp. 15% 1.300 0.45%

Baque Co. 30% 0.500 0.49% Andrew calculated the

portfolio's beta as 0.908 and the portfolio's expected

return as 10.90%. Andrew thinks it will be a good idea

to reallocate the funds in his client's portfolio. He

recommends replacing Atteric Inc.'s shares with the

same amount in additional shares of Baque Co. The

risk-free rate is 5.00%, and the market risk premium is

6.50%. According to Andrew's recommendation,

assuming that the market is in equilibrium, how much

will the portfolio's required return change?

0.66% 0.44% 0.71% 0.57% Analysts' estimates on

expected returns from equity investments are based on

several factors. These estimations also often include

subjective and judgmental factors, because different

analysts interpret data in different ways. Suppose,

based on the earnings consensus of stock analysts,

Andrew expects a return of 10.32% from the portfolio

with the new weights. Does he think that the revised

portfolio, based on the changes he recommended, is

undervalued, overvalued, or fairly valued? Overvalued

Fairly valued Undervalued Suppose instead of replacing

Atteric Inc.'s stock with Baque Co.'s stock, Andrew

considers replacing Atteric Inc.'s stock with the equal

dollar allocation to shares of Company X's stock that has

a higher beta than Atteric Inc.. If everything else

remains constant, the portfolio's beta would, and the

required return from the portfolio would.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please help answer this question.arrow_forwardMr. Buffett’s entire portfolio contains shares of Apple (15%), Kraft (36%), and Verizon. Using the information in the table below, the standard deviation of Mr. Buffett’s portfolio is ____________. (See table) a. 2.20% b. 4.69% c. 5.86% d. 6.83% e. 1.65%arrow_forwardPenny inherited a $200,000 portfolio of investments from her grandparents when she turned 21. The portfolio is comprised of treasury bills and stock in Ford and Harley Davidson as follows. Based on the current portfolio composition and the expected returns, what is the expected rate of return for Penny's portfolio? a. 7.8% b. 8.7% c. 7.0% d. 8.0% a.. b.. C. d.. Treasury Bills Ford Harley Davidson Expected Return 4.5% 8.0% 12.0% $ A A A $ $ $ Value 80,000.00 60,000.00 60,000.00arrow_forward

- Neha is an analyst at a wealth management firm. One of her clients holds a $7,500 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Stock Investment Allocation Beta Standard Deviation Atteric Inc. 35% 0.750 0.53% Arthur Inc. 20% 1.400 0.57% Li Corp. 15% 1.300 0.60% Transfer Fuels Co. 30% 0.300 0.64% Neha calculated the portfolio’s beta as 0.828 and the portfolio’s expected return as 8.55%. Neha thinks it will be a good idea to reallocate the funds in her client’s portfolio. She recommends replacing Atteric Inc.’s shares with the same amount in additional shares of Transfer Fuels Co. The risk-free rate is 4.00%, and the market risk premium is 5.50%. 1. According to Neha’s recommendation, assuming that the market is in equilibrium, how much will the portfolio’s required return change? 0.86% 0.67% 1.07% 0.99%…arrow_forwardMr. Jones has a 2-stock portfolio with a total value of $540,000. $195,000 is invested in Stock A and the remainder is invested in Stock B. If standard deviation of Stock A is 16.60%, Stock B is 12.40%, and correlation between Stock A and Stock B is –0.40, what would be the expected risk on Mr. Jones’ portfolio (standard deviation of the portfolio return)?arrow_forwardMr. Ota is an analyst for a large pension fund and he has been assigned the task of evaluating two different external portfolio managers (K and C). He considers the following historical average return, standard deviation, and CAPM beta estimates for these two managers over the past five years: Actual Average Standard deviation Portfolio Beta Return Manager K Manager C 7.80% 10.05% 0.75 12.0% 15.50% 1.45 Additionally, Mr. Ota estimate for the risk premium for the market portfolio is 5.40% and the risk-free rate is currently 2.50%. a. For both Managers K and C, calculate the expected return using the CAPM. Express your answers to the nearest basis point (i.e., xX.XX%)arrow_forward

- quiz 8-20arrow_forwardyou have invested in two shares, Tinkle.com and Circumbendibus Wheels. Tinkle.com has volatility 38.20%, while Circumbendibus Wheels has volatility 35.90%. The correlation between the two shares' returns is 0.44. You have allocated 50.00% of your money to Tinkle.com. What is the volatility of your portfolio?arrow_forwardThe following table lists stock price data for four companies held in a mutual fund's portfolio: 52 WEEK HI LO +11.5 29.79 25.00 +15.9 55.55 40.04 +17.8 40.20 30.03 +6.9 38.60 23.17 YTD % CHG STOCK Habib Corp. Marston Tech Chemla Inc. Vistou Co. YLD DIV % 1.50 5.3 2.00 4.9 1.20 3.2 0.50 1.4 Use the preceding data to answer the following question: VOL P/E 100s CLOSE 4001 28.47 5 34201 41.10 -0.15 17 2033 37.67 +0.17 15 15770 34.87 -0.28 NET CHG +0.08 Which of the stocks in the table had the highest earnings per share (EPS) in the past year?arrow_forward

- Analyze the following three years of data relating to the MoMoney Mutual Fund, . It should report the amount of dividend income and capital gains distributed to the shareholders, along with any other changes in the fund's net asset value (b = 0.5). (Click the icon here ☐ in order to copy the contents of the data table below into a spreadsheet.) 2019 2018 NAV (beginning of period) ? ? 2017 $35.56 Net investment income 0.64 0.74 0.56 Net gains on securities 5.48 4.52 - 3.41 Dividends from net investment income 0.64 0.56 Distributions from realized gains 1.61 1.96 0.51 1.44 a. What is the total income from the investment operations? b. What are the total distributions from the investment operations? a. The total income from investment operations in 2019 is $ The total income from investment operations in 2018 is $ (Round to the nearest cent.) (Round to the nearest cent.) (Round to the nearest cent.) The total income from investment operations in 2017 is $ b. The total distributions from…arrow_forwardRichard owns the following portfolio of securities. What is the beta for the portfolio?CompanyBetaPercent of PortfolioApple2.5015%Wells Fargo0.6550%Ebay1.7035%arrow_forward8. Portfolio risk and return Ariel holds a $10,000 portfolio that consists of four stocks. Her investment in each stock, as well as each stock's beta, is listed in the following table: Stock Andalusian Limited (AL) Zaxatti Enterprises (ZE) Three Waters Co. (TWC) Flitcom Corp. (FC) Suppose all stocks in Ariel's portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? O Flitcom Corp. O Three Waters Co. O Andalusian Limited O Zaxatti Enterprises O Zaxatti Enterprises O Three Waters Co. O Andalusian Limited O Flitcom Corp. Investment Beta Standard Deviation $3,500 1.00 $2,000 1.30 $1,500 1.20 $3,000 0.30 Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of stand-alone risk? Ariel's portfolio 9.00% 12.00% 20.00% 19.50% If the risk-free rate is 4% and the market risk premium is 5.5%, what is Ariel's portfolio's beta and required return? Fill in the following table: Beta Required…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education