Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

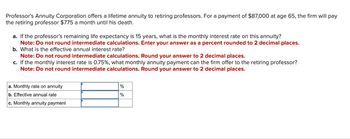

Transcribed Image Text:Professor's Annuity Corporation offers a lifetime annuity to retiring professors. For a payment of $87,000 at age 65, the firm will pay

the retiring professor $775 a month until his death.

a. If the professor's remaining life expectancy is 15 years, what is the monthly interest rate on this annuity?

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.

b. What is the effective annual interest rate?

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

c. If the monthly interest rate is 0.75%, what monthly annuity payment can the firm offer to the retiring professor?

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

a. Monthly rate on annuity

b. Effective annual rate

c. Monthly annuity payment

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A perpetuity of $1 each year, with the first payment due immediately, has a present value of $25 at an annual effective rate of i%. The owner exchanges it for another perpetuity with the first payment due immediately and subsequent payments due at two year intervals. What should the payment of the second perpetuity be, in order to keep the same interest rate, i%, and the same present value? A B с D E Less than $1.90 At least $1.90, but less than $1.94 At least $1.94, but less than $1.98 At least $1.98, but less than $2.02 $2.02 or morearrow_forwardYou deposit $11,600 annually into a life insurance fund for the next 10 years, at which time you plan to retire. Instead of a lump sum, you wish to receive annuities for the next 20 years. What is the annual payment you expect to receive beginning in year 11 if you assume an interest rate of 8 percent for the whole time period? (Do not round Intermediate calculations. Round your answer to 2 decimal places. (e.g., 32.16)) Annuities per year over the next twenty yearsarrow_forwardWhat's the future value of a 3-year $500 ordinary annuity, if the quoted interest rate is 11.35%, compounded semiannually? Note that the annuity payments are annual but that the compounding is semiannual. Round your final answer to 2 decimal places. $1,729.62 O $1.757.72 $1,888.60 O $1,777.10 O $1.676.69arrow_forward

- > An ordinary annuity that earns 7.3% compounded monthly has a current balance of $600,000. The owner of the account is about to retire and has to decide how much to withdraw from the account each month. Find the number of withdrawals under each of the following options. (A) $5000 monthly (B) $4000 monthly (C) $3000 monthly (A) Select the correct choice below, and, if necessary, fill in the answer box t OA. The total number of withdrawals of $5000 will be OB. The withdrawals of $5000 continue forever. Help me solve this View an example complete your choice. Get more help. Clear all Check answer rect: 0arrow_forwardFind the amount accumulated FV in the given annuity account. (Assume end-of-period deposits and compounding at the same intervals as deposits. Round your answer to the nearest cent.) $170 deposited monthly for 20 years at 3% per year in an account containing $11,000 at the start Find the periodic payments PMT necessary to accumulate the given amount in an annuity account. (Assume end-of-period deposits and compounding at the same intervals as deposits. Round your answer to the nearest cent.) $90,000 in a fund paying 6% per year, with monthly payments for 5 yearsarrow_forwardA 6-year term insurance policy has an annual premium of $500, and at the end of 6 years, all payments and interest are refunded. What lump-sum deposit is necessary to equal this amount if you assume an interest rate of 2.5% compounded annually? (a) State the type. future value present value of an annuity sinking fund amortization ordinary annuity (b) Answer the question. (Round your answer to the nearest cent.) $arrow_forward

- Find the future value of an annuity due of $1,500 semiannually for six years at 7% annual interest compounded semiannually. What is the total investment? What is the interest? E Click the icon to view the Future Value of $1.00 Ordinary Annuity table. The future value is $. (Round to the nearest cent as needed.)arrow_forwardYou have your choice of two investment accounts. Investment A is a 7-year annuity that features end-of-month $2,900 payments and has an APR of 6 percent compounded monthly. Investment B is an annually compounded lump-sum investment with an APR of 6 percent, also good for 7 years. How much money would you need to invest in B today for it to be worth as much as Investment A 7 years from now? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Present valuearrow_forwardA company needs to buy an annuity package that will provide a future income to an individual over a 33-year period at the following levels: £4421 paid at the beginning of each year for the first 13 years followed by £3318 paid at the beginning of each year up until year 33 (inclusive). Calculate in £s, to 2 decimal places, the price of this investment in order to assure the required payments, given that the rate of interest during this period is: 4.0% pa effective for the first 20 years and then 7.1% pa effective thereafter. (no tables, only formulas, please)arrow_forward

- Your company’s pension plan earns 4.3 % interest per year, compounded quarterly. a) You would like to receive payments of $40,000 quarterly while retired. If you would like these payments paid out over 25 years, what amount of money will you need in your pension fund at the beginning of your retirement years? Give the answer correctly to 2 decimal places, and do not use the $ sign in the answer box. The money you will need at the beginning of your retirement years is Blank 1. Calculate the answer by read surrounding text. dollars. b) Use your answer from part a to help you to determine how much you should put into your pension fund quarterly during your working years to reach your retirement goals. Assume you are planning to work for 30 years. Give the answer correctly to 2 decimal places, and do not use the $ sign in the answer box. The amount you should deposit quarterly during your working years is Blank 2. Calculate the answer by read surrounding text.…arrow_forwardProfessor’s Annuity Corp. offers a lifetime annuity to retiring professors. For a payment of $350,000 at age 65, the firm will pay the retiring professor $2,800 a month until death. If the professor’s remaining life expectancy is 30 years, what is the monthly rate on this annuity? What is the effective annual rate?arrow_forwardplease show the step by step solution. Do not skips steps. Explain your steps Please write on paperarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education