FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

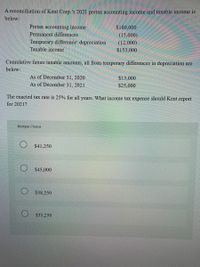

Transcribed Image Text:A reconciliation of Kent Corp.'s 2021 pretax accounting income and taxable income is

below:

Pretax accounting income

$180,000

Permanent differences

(15,000)

Temporary difference: depreciation

(12,000)

Taxable income

$153,000

Cumulative future taxable amounts, all from temporary differences in depreciation are

below:

As of December 31, 2020

As of December 31, 2021

$13,000

$25,000

The enacted tax rate is 25% for all years. What income tax expense should Kent report

for 2021?

Multiple Choice

$41,250

$45,000

$38,250

$35,250

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2022, NB, Incorporated's federal taxable income was $242,000. Compute the required installment payments of 2023 tax in each of the following cases: Required: a. NB's 2023 taxable income is $593,000. b. NB's 2023 taxable income is $950,000. c. NB's 2023 taxable income is $1,400,000. a. Total installment payments b. Total installment payments c. Total installment payments Amountarrow_forwardGreene Co. has pretax book income for the year ended December 31, 2022 in the amount of $315,000 and has a tax rate of 30%. Depreciation for tax purposes exceeded book depreciation by $10,500.What should Greene Co. record as its deferred tax liability for 2022? Group of answer choices $94,500 $0 $91,350 $3150arrow_forwardCarla Corporation has a cumulative temporary difference related to depreciation of $556,000 at December 31, 2025. This difference will reverse as follows: 2026, $39.000; 2027, $226.000; and 2028, $291,000. Enacted tax rates are 17% for 2026 and 2027, and 20% for 2028. Compute the amount Carla should report as a deferred tax liability at December 31, 2025. Deferred tax liability at December 31, 2025 $arrow_forward

- The information that follows pertains to Esther Food Products: a. At December 31, 2024, temporary differences were associated with the following future taxable (deductible) amounts: Depreciation Prepaid expenses Warranty expenses b. No temporary differences existed at the beginning of 2024. c. Pretax accounting income was $46,000 and taxable income was $9,000 for the year ended December 31, 2024. d. The tax rate is 25%. Required: Complete the following table given below and prepare the appropriate journal entry to record income taxes for 2024. Complete this question by entering your answers in the tabs below. Calculation General Journal $ 32,000 11,000 (6,000) Complete the following table given below to record income taxes for 2024. Note: Amounts to be deducted should be entered with a minus sign. Description Pretax accounting income Permanent differences Income subject to taxation Temporary Differences Income taxable in current year $ Amount 46,000 X Tax Rate = x X Recorded as:arrow_forwardAt December 31, 2022, Ivanhoe Corporation had a temporary difference (related to pensions) and reported a related deferred tax asset of $32,700 on its balance sheet. At December 31, 2023, Ivanhoe has five temporary differences. An analysis reveals the following: Future (Taxable) Deductible Amounts emporary Difference oks; deductible when funded for tax purposes 2024 2025 2026 $32,700 $22,700 $10,000 earned for accounting purposes and when received for tax purposes 76,000 accounting purposes and recognized for tax purposes when paid alment sales when sold for book purposes, and as collected for tax purposes 24,000 (36,300) (36,300) (36,300) iting purposes, and CCA for tax purposes (90,300) (50,000) (40,000) $6,100 ($63,600) ($66,300) The enacted tax rate has been 30% for many years. In November 2023, the rate was changed to 28% for all periods after January 1, 2025. Assume that the company has income tax due of $180,000 on the 2023 tax return and that Ivanhoe follows IFRS. (a) Indicate…arrow_forwardWildhorse Company has the following two temporary differences between its income tax expense and income taxes payable. 2025 2026 2027 Pretax financial income $820,000 $927,000 $912,000 Excess depreciation expense on tax return (28,700) (42,000) (9,700) Excess warranty expense in financial income Taxable income 20,100 10,400 7,800 $811,400 $895,400 $910,100 The income tax rate for all years is 20%. (a) Your answer is partially correct. Assuming there were no temporary differences prior to 2025, prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2025, 2026, and 2027. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.)arrow_forward

- PT BCD has a deferred tax asset account with a balance of Rp300.000 at the end of 2018 due to a single cumulative temporary difference of Rp750.000. At the end of 2019, this same temporary difference has increased to a cumulative amount of Rp1.000.000. Taxable income for 2019 is Rp1.700.000. The tax rate is 40% for all years. Assuming it’s probable that 70% of the deferred tax asset will be realized, what amount will be reported on ABC’s statement of financial position for the deferred tax asset at December 31, 2019?arrow_forwardConcord Construction Company changed from the completed-contract to the percentage-of-completion method of accounting for long-term construction contracts during 2021. For tax purposes, the company employs the completed-contract method and will continue this approach in the future. (Hint: Adjust all tax consequences through the Deferred Tax Liability account.) The appropriate information related to this change is as follows. Pretax Income from: Percentage-of-Completion Completed-Contract Difference 2020 $747,000 $539,000 $208,000 2021 673,000 468,000 205,000 (a) Assuming that the tax rate is 30%, what is the amount of net income that would be reported in 2021?arrow_forwardAt the end of 2020, Payne Industries had a deferred tax asset account with a balance of $125 million attributable to a temporary book-tax difference of $500 million in a liability for estimated expenses. At the end of 2021, the temporary difference is $384 million. Payne has no other temporary differences and no valuation allowance for the deferred tax asset. Taxable income for 2021 is $900 million and the tax rate is 25%. Required:1. Prepare the journal entry(s) to record Payne’s income taxes for 2021, assuming it is more likely than not that the deferred tax asset will be realized.2. Prepare the journal entry(s) to record Payne’s income taxes for 2021, assuming it is more likely than not that only one-fourth of the deferred tax asset ultimately will be realized.arrow_forward

- At the end of 2020, Payne Industries had a deferred tax asset account with a balance of $100 million attributable to a temporary book- tax difference of $400 million in a liability for estimated expenses. At the end of 2021, the temporary difference is $304 million. Payne has no other temporary differences and no valuation allowance for the deferred tax asset. Taxable income for 2021 is $720 million and the tax rate is 25%. Required: 1. Prepare the journal entry(s) to record Payne's income taxes for 2021, assuming it is more likely than not that the deferred tax asset will be realized in full. 2. Prepare the journal entry(s) to record Payne's income taxes for 2021, assuming it is more likely than not that only one-fourth of the deferred tax asset ultimately will be realized. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry(s) to record Payne's income taxes for 2021, assuming it is more likely than not that the deferred…arrow_forwardTroy Ltd., at the end of 2023, its first year of operations, prepared a reconciliation between pre- tax accounting income and taxable income as follows: Pre-tax accounting income $300,000 Excess CCA claimed for tax purposes ... (600, 000) Estimated expenses deductible when paid $200,000 Use of the depreciable assets will result in taxable 500,000 Taxable income ... amounts of $200,000 in each of the next three years. The estimated expenses of $500,000 will be deductible in 2026 when settlement is expected to be made. The enacted tax rate is 25% and is to increase to 30%, starting in 2024. Instructions a) Prepare a schedule of the deferred taxable and deductible amounts. b) Prepare the required adjusting entries to record income taxes for 2023arrow_forward1. Pretax accounting income was S70 million and taxable income was $8 million for the year ended December 31, 2021. 2. The difference was due to three items: a. Tax depreciation exceeds book depreciation by $60 million in 2021 for the business complex acquired that year. This amount is scheduled to be $80 million in 2022 and to reverse as ($70 million) and ($70 million) in 2023 and 2024, respectively. b Insurance of $8 millian was paid in 2021 for 2022 coverage C. A $6 million loss contingency was accrued in 2021, to be paid in 2023. 3. No temporary differences existed at the beginning of 2021. 4. The tax rate is 25% Required: 1. Determine the amounts necessary to record income taxes for 2021, and prepare the appropriate journal entry 2. Assume the enacted federal income tax law specifies that the tax rate will change from 25% ta 20% in 2023. When scheduling the reversal of the depreciation difference, you were uncertain as to how to deal with the fact that the difference will continue…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education