FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

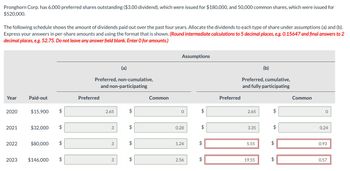

Transcribed Image Text:Pronghorn Corp. has 6,000 preferred shares outstanding ($3.00 dividend), which were issued for $180,000, and 50,000 common shares, which were issued for

$520,000.

The following schedule shows the amount of dividends paid out over the past four years. Allocate the dividends to each type of share under assumptions (a) and (b).

Express your answers in per-share amounts and using the format that is shown. (Round intermediate calculations to 5 decimal places, e.g. 0.15647 and final answers to 2

decimal places, e.g. 52.75. Do not leave any answer field blank. Enter O for amounts.)

(a)

Preferred, non-cumulative,

and non-participating

Year

Paid-out

Preferred

2020

$15,900 $

2.65

2021

$32,000 $

3

2022

$80,000 $

3

2023 $146,000

$

3

+A

+A

+A

Common

Assumptions

0

(b)

Preferred, cumulative,

and fully participating

Preferred

Common

SA

$

2.65

0.28

$

3.35

1.24

+A

$

2.56

+A

SA

5.55

$

+A

19.55

SA

$

0.24

0.93

0.57

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps with 2 images

Knowledge Booster

Similar questions

- Kk. 243.arrow_forwardTop Dog, Inc. has 13,000 shares of $1 par value common stock outstanding. Top Dog, Inc. distributes a 15% stock dividend when the market value of its stock is $18 per share. Read the requirements. Requirement 1. Journalize Top Dog, Inc.'s declaration of the stock dividend on May 15 and distribution on May 31. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Start by journalizing the declaration of the stock dividend on May 15. Ad punts and Explanation Date May. 15 Requirements Debit 1. Journalize Top Dog, Inc.'s declaration of the stock dividend on May 15 and distribution on May 31. 2. What is the overall effect of the stock dividend on Top Dog, Inc.'s total assets? 3. What is the overall effect on total stockholders' equity? Credit Xarrow_forwardA company had stock outstanding as follows during each of its first 3 years of operations: 1,000 shares of 9%, $100 par, cumulative preferred stock and 32,000 shares of $10 par common stock. The amounts distributed as dividends are presented in the following schedule. Determine the total and per-share dividends for each class of stock for each year by completing the schedule. If necessary, round dividends per share to the nearest cent. If your answer is zero, please enter "0". Year 1 2 3 Dividends $6,750 9,000 25,580 Preferred Total Preferred Per Share Common Total Common Per Sharearrow_forward

- Kingbird Company has outstanding 2,700 shares of $100 par, 6% preferred stock and 14,300 shares of $10 par value common. The following schedule shows the amount of dividends paid out over the last 4 years. Allocate the dividends to each type of stock under assumptions (a) and (b). Express your answers in per share amounts using the format shown below. (Round the rate of participation to 4 decimal places, e.g.1.4278%. Round answers to 2 decimal places, e.g. 6.85.) Paid- out $11,900 $ $25,800 $ $51,900 $ $69,400 $ (a) Preferred, noncumulative, and nonparticipating Preferred LA LA $ Common Assumptions LA LA LA $ (b) Preferred, cumulative, and fully participating Preferred LA LA $ Commonarrow_forwardJunkyard Arts, Inc., had earnings of $543,200 for the year. The company had 48,000 shares of common stock outstanding during the year and issued 4,300 shares of $100 par value preferred stock. The preferred stock has a dividend of $8 per share. There were no transactions in either common or preferred stock during the year. Determine the basic earnings per share for Junkyard Arts for the year. Round answer to two decimal places.arrow_forwardPlease answer competelyarrow_forward

- A corporation's relevant range of activity is 3,000 units to 7,000 units. When it produces and sells 5,000 units, its average costs per unit are as follows Average Cost Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense per Unit $5.20 Multiple Choice $3.75 $1.65 $2.60 $0.50 $0.40 $1.50 $0.50 If 5,500 units are produced, the total amount of direct manufacturing cost incurred is closest to:arrow_forwardYour answer is partially correct. Try again. The stockholders' equity section of Bonita Corporation consists of common stock ($10 par) $2,400,000 and retained earnings $527,000. A 10% stock dividend (24,000 shares) is declared when the market price per share is $14. Show the before-and-after effects of the dividend on the following. (a) The components of stockholders' equity. (b) Shares outstanding. (c) Par value per share. Stockholders' equity Outstanding shares. Par value per share x ✓ Before Dividend 2927000 After Dividendarrow_forwardA company had stock outstanding as follows during each of its first 3 years of operations: 2,500 shares of 10%, $100 par, cumulative preferred stock and 50,000 shares of $10 par common stock. The amounts distributed as dividends are presented in the following schedule. Determine the total and per-share dividends for each class of stock for each year by completing the schedule. If necessary, round dividends per share to the nearest cent. If your answer is zero, please enter "0". Year 1 2 3 Dividends $10,000 25,000 60,000 Preferred Total Preferred Per Share Common Total Common Per Sharearrow_forward

- Barbur, Incorporated reported net income of $12.5625 million. During the year the average number of common shares outstanding was 3.35 million. The price of a share of common stock at the end of the year was $5. There were 540,000 shares of preferred stock outstanding on average and no dividends were declared and the preferred stock is noncumulative. The EPS is: Multiple Choice O C O $0.27. $3.51. $3.61. $3.75.arrow_forwardFor the purpose of calculating earnings per share (EPS), the denominator is:Select one:a. Outstanding ordinary shares at balance date.b. Weighted-average number of the sum fully paid ordinary shares and partly paid equivalents.c. Outstanding ordinary shares at balance date and weighted-average number of fully paid ordinary shares.d. Weighted-average number of fully paid ordinary shares.arrow_forwardSeacrest Company has 15,000 shares of cumulative preferred 2% stock, $50 par and 50,000 shares of $30 par common stock. The following amounts were distributed as dividends: Year 1- $22,500 Year 2- $7,500 Year 3- $45,000 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If answer is 0, enter 0. For each year I have to figure out the preferred stock, and common stock for each year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education