FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

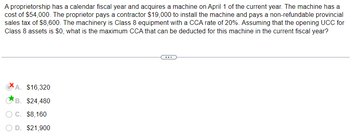

Transcribed Image Text:A proprietorship has a calendar fiscal year and acquires a machine on April 1 of the current year. The machine has a

cost of $54,000. The proprietor pays a contractor $19,000 to install the machine and pays a non-refundable provincial

sales tax of $8,600. The machinery is Class 8 equipment with a CCA rate of 20%. Assuming that the opening UCC for

Class 8 assets is $0, what is the maximum CCA that can be deducted for this machine in the current fiscal year?

A. $16,320

B. $24,480

O C. $8,160

D. $21,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Corazon Company purchased an asset with a list price of $17,600. Corazon paid $1,400 of transportation-in cost, $1,700 to train an employee to operate the equipment, and $1,100 to insure the asset against theft after it has been set up in the factory. The asset was purchased under terms 1/20, n/30 and Corazon paid for the asset within the discount period. Based on this information, Corazon would capitalize the asset on its books at: Multiple Choice O O O $19,124. $17,600. $19,300. $20,524.arrow_forwardCrane Co. purchases land and constructs a service station and car wash for a total of $532500. At January 2, 2021, when construction is completed, the facility and land on which it was constructed are sold to a major oil company for $590000 and immediately leased from the oil company by Crane. Fair value of the land at time of the sale was $58500. The lease is a 10-year, noncancelable lease. Crane uses straight-line depreciation for its other various business holdings. The economic life of the facility is 15 years with zero salvage value. Title to the facility and land will pass to Crane at termination of the lease. A partial amortization schedule for this lease is as follows: Payments Interest Amortization Balance Jan. 2, 2021 $590000.00 Dec. 31, 2021 $96019.78 $59000.00 $37019.78 552980.22 Dec. 31, 2022 96019.78 55298.02 40721.76 512258.46 Dec. 31, 2023 96019.78 51225.85 44793.93 467464.53 What is the amount of the…arrow_forwardatent purchased this year from Miller Co. on January 1 for a cash cost of $5.600. When purchased, the patent had of 8 years. rademark was registered with the federal government for $12,500. Management estimated that the trademark coue ich as $290,000 because it has an indefinite life. mputer licensing rights were purchased this year on January 1 for $48.000. The rights are expected to have a four-y the company. alred: ompute the acquisition cost of each intangiblo 20arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education