FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

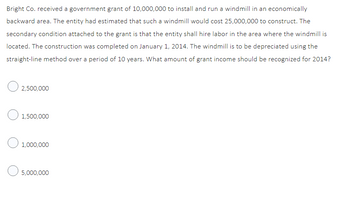

Transcribed Image Text:Bright Co. received a government grant of 10,000,000 to install and run a windmill in an economically

backward area. The entity had estimated that such a windmill would cost 25,000,000 to construct. The

secondary condition attached to the grant is that the entity shall hire labor in the area where the windmill is

located. The construction was completed on January 1, 2014. The windmill is to be depreciated using the

straight-line method over a period of 10 years. What amount of grant income should be recognized for 2014?

O2,500,000

1,500,000

O 1,000,000

5,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cimi Manufacturing had the following transactions related to the purchase of long-term assets. During 2025, purchased land for $380,000 with plans to build a new facility. The company pays $23,500 to demolish a building that was on the land and an additional $17,000 to grade the land in preparation for the new building. Construction cost of the new building was $$2,100,000. The parking lot and related lighting cost $41,000. Cimi's employee wages during this time of construction were $214,000. On Nov 5, 2025, Cimi purchased machinery to be install in the new facility. the machine had a price of $28,000 with term 2/10, n/30, and FOB shipping point. Cimi always pays within the discount period. Transporation cost of $680 wer paid. Additionally, the following costs related to installation of the machine were incurred: installation cost $7,600 of which $5,000 of this was parts, testing costs of $900. During installation, damage to a neighboring company's warehouse occured, costing…arrow_forwardCrane Corporation acquires a coal mine at a cost of $404,000. Intangible development costs total $101,000. After extraction has occurred, Crane must restore the property (estimated fair value of the obligation is $80,800), after which it can be sold for $161,600. Crane estimates that 4,040 tons of coal can be extracted.If 707 tons are extracted the first year, prepare the journal entry to record depletion. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amountarrow_forwardAt the beginning of 2024, Terra Lumber Company purchased a timber tract from Boise Cantor for $3,730,000. After the timber is cleared, the land will have a residual value of $760,000. Roads to enable logging operations were constructed and completed on March 30, 2024. The cost of the roads, which have no residual value and no alternative use after the tract is cleared, was $297,000. During 2024, Terra logged 660,000 of the estimated 6.6 million board feet of timber. Required: Calculate the 2024 depletion of the timber tract and depreciation of the logging roads, assuming the units-of-production method is used for both assets. Note: Do not round intermediate calculations. Enter values in whole dollars. Depletion of the timber tract Depreciation of the logging roadsarrow_forward

- Pineapple Ltd applied for a government grant of $1,000,000 on 5 January 2017 to cover part of the cost of a new machine. The grant was approved on 1 February 2017 and the government released the fund on 1 April 2017. Pineapple purchased the machine for $5,000,000 with cash on 1 June 2017 and the machine was used for production The machine was depreciated over its estimated useful life of 10 years on method and depreciation was calculated monthly. Pineapple Ltd prepared statements at 31 December each year. (a) On which date should Pineapple Ltd recognize the government grant? Explain. (b) Assume Pineapple Ltd recognized the government grant as deferred income. Prepare the extracts of statement of financial position and the statement of profit or loss for the year ended 31 December 2017. Show your workings. (c) The life of a business is divided into specific time periods, usually a year, to measure results of operations for each such time period and to portray financial…arrow_forwardOn January 4, 2015, a research project undertaken by Nasja Ltd. was completed and a patent was approved. The research phase of the project incurred costs of $150,000, and legal costs incurred to obtain the patent approval were $20,000. The patent is assessed to have a useful life to 2025, or for ten years. Early in 2016, Nasja successfully defended the patent against a competitor, incurring a legal cost of $22,000. This set a precedent for Nasja who was able to reassess the patent’s useful life to 2030. During 2017, Nasja was able to create a product design that was feasible for commercialization, but no more certainty was known at that time. Costs to get the product design to this stage were $250,000. Additional engineering and consulting fees of $50,000 were incurred to advance the design to the manufacturing stage. Nasja follows IFRS. Required: a. Prepare all the relevant journal entries for the project for 2015 to 2017, inclusive. b. What is the accounting treatment for the…arrow_forwardDuring the reporting period ending 30 June 2014, Sara Limited erected an oil rig in Noosa River. The cost of the rig and associated technology amounted to $99 000 000. The oil rig commenced production on 1 July 2014. At the end of the rig’s useful life, which is expected to be five (5) years, Sara Limited is required by its resource consent to dismantle the oil rig, remove it, and return the site to its original condition. After consulting its own engineers and environmentalists, Sara Limited estimates that if such work was required to be done at the present time it would cost $14 999 995. If we accept that the rate on 5-year government bonds reflects the relevant time value of money, and if the rate is 4 per cent annually, calculate the present value of the restoration provision which would be today.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education