FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

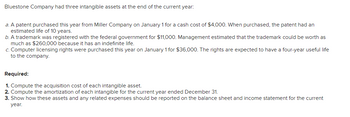

Transcribed Image Text:Bluestone Company had three intangible assets at the end of the current year:

a. A patent purchased this year from Miller Company on January 1 for a cash cost of $4,000. When purchased, the patent had an estimated life of 10 years.

b. A trademark was registered with the federal government for $11,000. Management estimated that the trademark could be worth as much as $260,000 because it has an indefinite life.

c. Computer licensing rights were purchased this year on January 1 for $36,000. The rights are expected to have a four-year useful life to the company.

**Required:**

1. Compute the acquisition cost of each intangible asset.

2. Compute the amortization of each intangible for the current year ended December 31.

3. Show how these assets and any related expenses should be reported on the balance sheet and income statement for the current year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the beginning of the year, a company purchases a patent for $1504000. The remaining legal life of the patent is 10 years, but management estimates that the patent will generate additional revenue for the next 16 years because there are currently no known competitors. What amount of amortization on the patent will be recorded for the asset at the end of the first year, assuming that the straight-line method is used and that the asset was purchased at the beginning of the year? O $-0- $150400 $94000 $188000arrow_forwardOn January 2, 2022, Lauren Corporation purchased factory equipment for $850,000. In addition, it paid $82,000 in sales tax and $7,000 in installation charges. Shipping costs to ship the equipment to the factory were $2,500 and were paid by Lauren. Lauren paid $300,000 in cash and signed a two-year note for the balance. Required: Prepare the journal entry to record the acquisition of this equipment. Assuming straight-line depreciation, an estimated residual value of $75,000 and an estimated life of 10 years, prepare the journal entry for the depreciation expense for 2021.arrow_forwardJanes Company provided the following information on intangible assets: A patent was purchased from the Lou Company for $1,400,000 on January 1, 2022. Janes estimated the remaining useful life of the patent to be 10 years. The patent was carried on Lou’s accounting records at a net book value of $490,000 when Lou sold it to Janes. During 2024, a franchise was purchased from the Rink Company for $640,000. The contractual life of the franchise is 10 years and Janes records a full year of amortization in the year of purchase. Janes incurred research and development costs in 2024 as follows: Materials and supplies $ 154,000 Personnel 194,000 Indirect costs 74,000 Total $ 422,000 Effective January 1, 2024, based on new events that have occurred, Janes estimates that the remaining life of the patent purchased from Lou is only five more years. Required: Prepare the entries necessary for years 2022 through 2024 to reflect the above information. Prepare a schedule showing the…arrow_forward

- Wember Company acquired a subsidiary company on December 31, 2015, and recorded the cost of the intangible assets it acquired as follows: Patent $100,000 Trade name 80,000 Goodwill 150,000 The patent is being amortized by the straight-line method over an expected life of 10 years with no residual value. Amortization has been recorded for the current year. The trade name was considered to have an indefinite life. Because of the success of the subsidiary in the past, Wember has not previously considered any of the intangible assets to be impaired. However, in 2019, because of a current recession and technological changes in the subsidiary’s industry, Wember decides to review all of its intangible assets for impairment and record any adjustments at December 31, 2019. Wember estimates that the fair value of the patent is $42,000. The company estimates the fair value of the trade name to be $90,000 but decides that it now has a limited life of 5 years. The subsidiary company,…arrow_forwardWember Company acquired a subsidiary company on December 31, 2015, and recorded the cost of the intangible assets it acquired as follows: Patent $80,000 Trade name 100,000 Goodwill 250,000 The patent is being amortized by the straight-line method over an expected life of 10 years with no residual value. Amortization has been recorded for the current year. The trade name was considered to have an indefinite life. Because of the success of the subsidiary in the past, Wember has not previously considered any of the intangible assets to be impaired. However, in 2019, because of a current recession and technological changes in the subsidiary’s industry, Wember decides to review all of its intangible assets for impairment and record any adjustments at December 31, 2019. Wember estimates that the fair value of the patent is $42,000. The company estimates the fair value of the trade name to be $120,000 but decides that it now has a limited life of 6 years. The subsidiary…arrow_forwardAt the beginning of the year, Big Time Tires acquired a patent for $730,000, and a trademark for $260,000. Big Time Tire's policy is to amortize intangible assets with finite useful lives using the straight-line method, no residual value, and a five-year service life. What is the total amount of amortization expense that would appear in Big Time Tire's income statement for the first year related to these items? Amortization expensearrow_forward

- Powerglide Company, organized in 2011, has set up a single account for all intangible assets. The following summary discloses the debit entries that have been recorded during 2012. 1/2/12 Purchased patent (8-year life) $ 380,000 4/1/12 Goodwill (indefinite life) 360,000 7/1/12 Purchased franchise with 10-year life; expiration date 7/1/22 450,000 8/1/12 Payment of copyright (5-year life) 156,000 9/1/12 Research and development costs 215,000 $1,561,000 InstructionsPrepare the necessary entries to clear the Intangible Assets account and to set up…arrow_forwardOn January 1, Year 1, Lowing Company acquired a patent from Generics Research Corporation for $3 million. The legal life of the patent is 20 years, but Lowing expects to use it for 5 years. Pawson Company has committed to purchase the patent from Lowing for $500,000 at the end of that 5-year period. Lowing uses the straight-line method to amortize intangible assets with finite useful lives. What is the amount of amortization expense each year?arrow_forwardRoller Inc. purchased a plant and the land on which the plant was located for a total of $300,000 cash. Roller hired an independent appraiser who gave the estimated market values: plant, $220,000; land, $110,000. a. Complete the entry to record the acquisition (show computation). b. Calculate the depreciation expense recorded at the end of the first year for the plant, if Roller uses the straight-line method, and the plant has a useful life of 10 years and $5000 residual value.arrow_forward

- Information concerning Taylor Corporation’s intangible assets follows: 1. Taylor incurred $70,000 of experimental and development costs in its laboratory to develop a patent which was granted on January 2, 2025. Legal fees associated with the registration of the patent totaled $20,000. Taylor estimates that the useful life of the patent will be 10 years; the legal life of the patent is 20 years. The company uses the straight-line method of amortization for this asset. 2. On January 1, 2025, Taylor signed an agreement to operate as a franchisee of Dairy King, Inc. for an initial franchise fee of $150,000. The agreement provides that the fee is not refundable and no future services are required of the franchisor. Taylor estimates the useful life of the franchise to be 15 years and uses the straight-line method of amortization. 3. A trade name was purchased from Stine Company for $80,000 on May 1, 2023. Expenditures for successful litigation in defense of the trade name totaling…arrow_forwardRobotix Company purchases a patent for $21,000 on January 1. The patent is good for 18 years, after which anyone can use the patent technology. However, Robotix plans to sell products using that patent technology for only 5 years. Prepare the intangible asset section of the year end balance sheet after amortization expense for the year is recorded.arrow_forwardPinky and the Brain Ltd acquired an item of plan at a gross cost of $680,000 on October 20X2. The plant has an estimated life of 10 years with residual value equal to 15% of its gross cost. The company uses straight line depreciation charge on a time-apportioned basis. The company received a government grant of 30% of its cost price at the time of its purchase. The terms of the grant are that if the company retains the asset for four years or more, then no repayment liability will be incurred. If the plant is sold within four years a repayment on a sliding scale would be applicable. The repayment is 75% if sold within the first year of purchase and this amount decreases by 25% per annum. Pinky and the Brain Ltd has no intention to sell the plant within the first four years. The company's accounting policy for capital based government grants is to treat them as deferred credits and release them to income over the life of the asset to which they relate. Required: a. Discuss whether the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education